Abasto Magazine: July / August 2025 - ENGLISH

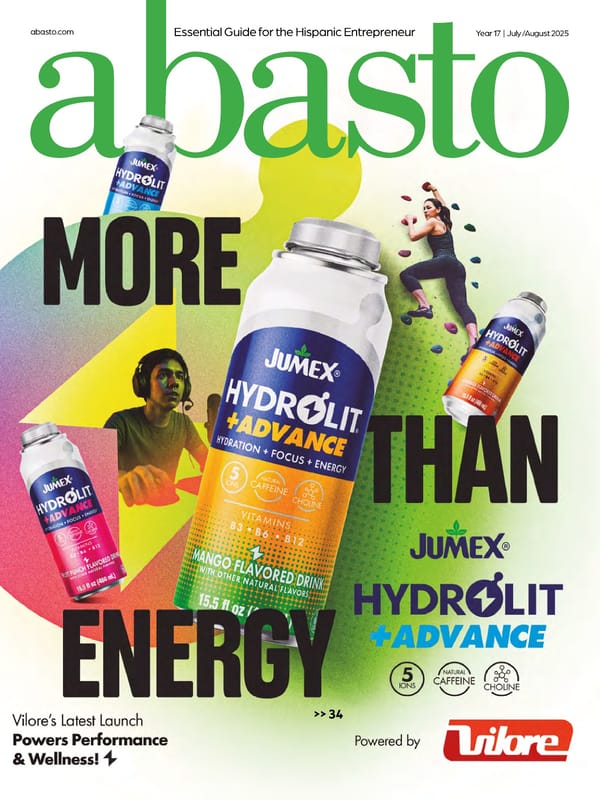

This issue highlights Vilore's latest product launch, Jumex Hydrolit +Advance, emphasizing enhanced performance and wellness benefits.

>> 34 Essential Guide for the Hispanic Entrepreneur abasto.com Year 17 | July /August 2025

Category (Green) Gold. La Costeña® Guacamole Salsa is where creamy meets spicy a bold blend of real avocado and heat that delivers flavor in every pour. Perfect for retail or foodservice. No chopping, no mashing – Just open, pour and serve. Creamy. Spicy. vilore.com Sales@vilore.com

/MINSA minsa.com.mx C o r n M a s a F l o u r f o r : T o r ti ll a s , C h i p s a n d S n a c k s Organic Corn Masa NON GMO Corn Masa Conventional Corn Masa

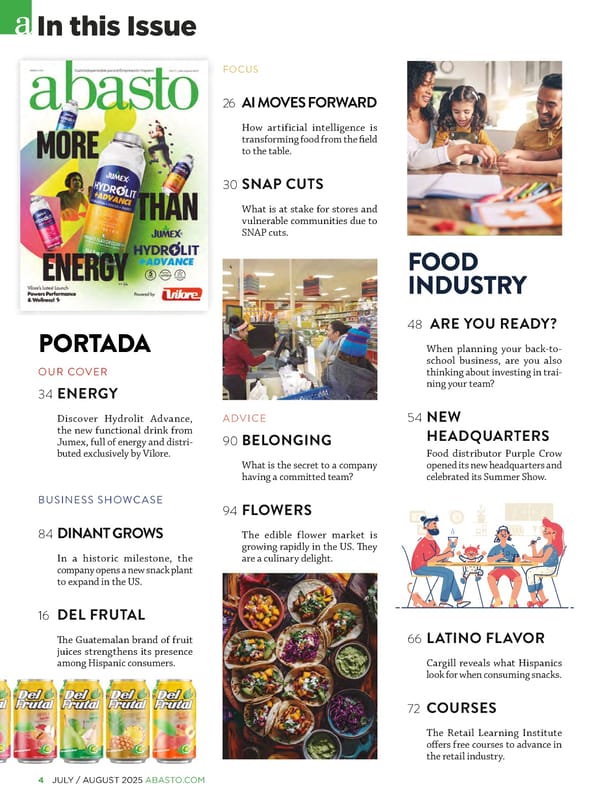

4 JULY / AUGUST 2025 ABASTO.COM ADVICE OUR COVER 34 ENERGY Discover Hydrolit Advance, the new functional drink from Jumex, full of energy and distri- buted exclusively by Vilore. In this Issue FOCUS FOOD INDUSTRY PORTADA BUSINESS SHOWCASE 16 DEL FRUTAL The Guatemalan brand of fruit juices strengthens its presence among Hispanic consumers. 30 SNAP CUTS What is at stake for stores and vulnerable communities due to SNAP cuts. 54 NEW HEADQUARTERS Food distributor Purple Crow opened its new headquarters and celebrated its Summer Show. 72 COURSES The Retail Learning Institute offers free courses to advance in the retail industry. 94 FLOWERS The edible flower market is growing rapidly in the US. They are a culinary delight. 84 DINANT GROWS In a historic milestone, the company opens a new snack plant to expand in the US. 26 AI MOVES FORWARD How artificial intelligence is transforming food from the field to the table. 48 ARE YOU READY? When planning your back-to- school business, are you also thinking about investing in trai- ning your team? 66 LATINO FLAVOR Cargill reveals what Hispanics look for when consuming snacks. 90 BELONGING What is the secret to a company having a committed team?

6 JULY / AUGUST 2025 ABASTO.COM 6 JULIO / AGOSTO 2025 ABASTO.COM EDITORIAL DIRECTOR With this July/August 2025 issue of Abasto Magazine in your hands, you now have direct access to the stories, trends, and key players that are setting the pace for the food and beverage industry in the United States, especially for Hispanic supermarkets. We begin with our cover story: Hydrolit Advance, Jumex's new functional beverage that responds to the growing demand for healthy products with real benefits for hydration and daily energy. An innovative propo- sal that reflects how Hispanic consumers are evolving and demanding more value with every purchase. In our Technology Focus section, we open the conversation on the impact of artificial intelligence and biotechnology on the future of food. How are these technologies transforming food production, distribu- tion, and consumption? Find out on pages 24 and 26, where we analyze what's coming for retail and manufacturing. Over the past few months, Abasto has been present at the most important trade shows in the sector: Sweet & Snacks Expo in Indianapolis, IDDBA in New Orleans, and the National Restaurant Association Show in Chicago. We share a visual and editorial summary that not only highlights the latest products and trends, but also many of our Hispanic customers who are making a difference on these platforms. In preparation for the back-to-school season, our contributor Ramón Portilla invites us to reflect on a strategic investment: employee training. In a highly competitive environment, offering training can become the engine of growth for Latino businesses. In addition, in an exclusive conversation with Abasto, Janna Mauck, senior director of snacks and cereals marketing at Cargill, reveals the latest findings on snacking habits among Hispanics: flavor, conve- nience, and emotional connection to their roots set the tone. And don't miss the full coverage of the grand opening of Purple Crow's new headquarters in Winston-Salem. Its modern 900,000-square-foot logistics center is already boosting distribution efficiency and streng- thening its relationship with hundreds of Hispanic retailers across the country. This issue is full of content that informs, connects, and inspires. Whether you're looking for strategies for your store, ideas for new products, or inspiration to strengthen your business, Abasto is your trusted ally in the world of Hispanic business in the United States. Exploring new industry trends with Abasto

8 JULY / AUGUST 2025 ABASTO.COM Our Collaborators Abasto es una revista bimestral de circulación nacional publicada por Hispanic Marketing Consultants, Inc. P.O. Box 20577 Winston-Salem, NC 27101. Todos los derechos reservados. Prohibida la reproducción parcial o total de su contenido sin previa autorización del Editor. Abasto investiga la seriedad de sus anunciantes, pero no se hace responsable del contenido de las ofertas. Las opiniones expresadas por los autores y contribuyentes que colaboran en esta revista no son necesariamente compartidas por los editores o representantes de HMC (Hispanic Marketing Consultants) Abasto Media. BUENOS CONSEJOS. BUENOS NEGOCIOS. ABASTO MEDIA IS ACCREDITED / ACTIVELY INVOLVED WITH THE FOLLOWING ASSOCIATIONS: RAMÓN PORTILLA Founder HumanX Insights. Visionary leader in customer insights. Passionate about CX. Innovator in Insights technology JESÚS DÍAZ Chef Yisus Diaz is a fusion chef. He has won two Emmy Awards and has a new culinary project with Televisa, Univision, and Vix RICARDO GAITÁN Branding specialist. Master in Marketing Management Universidad San Plablo. Author of the book: "101 useful branding tips" JAY GARCÍA Specialist in high performance sales and professional promotion. Speaker and trainer of sales strategies. MARCELA PRIMO Talent management strategist with more than 20 years of experience, she is the founder and general director of LEEM PRO STAFFING. Gerente General / General Manager GUSTAVO CALABRO gcalabro@abasto.com 336.724.9718 x.204 Diseño Gráfico / Graphic Design ORLANDO RIVERA orlando.rivera@abasto.com 336.724.9718 x.201 Departamento Editorial / Editorial Department HERNANDO RAMÍREZ-SANTOS hramirezsantos@abasto.com 336.724.9718 x.205 VIOLETA MONTES DE OCA vmontesdeoca@abasto.com 336.724.9718 x.203 Cuentas Nacionales / National Accounts ELIANA LANKERD elankerd@abasto.com 336.724.9718 x.202 Administración & Eventos / Administration & Events FERNANDA P. WALKER fernanda.pineros@abasto.com 336.724.9718 x.213 Redes Sociales / Social Media DANNA GUEVARA dannag@abasto.com Ventas México-Latam / Sales Representative LATAM MARCELA CHAVES dianac@abasto.com 336.724.9718 x.206 XOCHITL OLIVA xoliva@abasto.com • 713.363.0385 JUAN PABLO MADERO jpmadero@abasto.com • 52.1.333.167. 8502 Publicidad / Advertising advertising@abasto.com 336.486.2424 Suscripciones / Suscriptions info@abasto.com MARY COPPOLA HESLEP Creative Director of Ten Acre Marketing. Former vice president of marketing for United Fresh Produce Association. RON MARGULIS Director de RAM Communications, LLC. He is a journa- list specializing in the food industry. JULIO IBÁÑEZ Retail Executive, International. CEO of Aurora Grocery Group and President of the Hispanic Retail Chamber of Commerce. ANA MARÍA TRIANA Psychologist & Business Consultant. She is Marketing Director of AnaBella Dried Food.

ABASTO.COM JULY / AUGUST 2025 9 TAPATIO FOODS, LLC 4685 District Blvd. Vernon, CA 90058 Ph: (323) 587-8933 | Fax: (323) 587-5266 E-mail: info@TapatioHotSauce.com ©2025 TAPATIO FOODS, LLC. Tapatio is a registered trademark of TAPATIO FOODS, LLC Join us on:

Rediscover the perfect flavor Rediscover your favorite breading, LISTTO, which now has a new look. Your LISTTO breading mix has been revamped, but it still has the same perfect, crispy, and delicious flavor in your meals. Surprise everyone with deliciously breaded chicken, meat, or fish that you can prepare in minutes. Cook exquisitely, cook with LISTTO! WWW.ALIMENTOSLISTTO.COM Lago de Chapala Chili Crisp and Chamoy from Lago de Chapala take your meals to the next level. Enjoy the perfect blend of crunch and spice with Chili Crisp in Original, Seeds, and Cranberry, or the irresistible sweet and sour touch of our Chamoy. Add more flavor to every bite! HTTPS://CHAPALAHOTSAUCE.COM/ES/ PRODUCT SHOWCASE 10 JULIO / AGOSTO 2025 ABASTO.COM PEPITO USA All the flavor of Pepito Products will be present at CONFITEXPO, the largest candy and snack trade show in Latin America, from July 29 to 31 in Guadalajara, Jalisco. WWW.CONFIEXPO.COM FLAVOR AND FUN IN A BIG WAY! Product Showcase

Contact your GOYA representative or email salesinfo@goya.com | GoyaTrade.com © 2025 GOYA FOODS INC.

La Moderna Your food can now speak sign language! Did you know? Two to three out of every 1,000 children are born with hearing loss. One in eight people over the age of 12 has hearing loss in both ears. And more than 90% of deaf children have hearing parents. At La Moderna®, we have created a unique pasta that not only lets you cook, but also communicate. In partnership with Texas Hands and Voices, we donate a portion of each purchase to support families of deaf people. WWW.LAMODERNAUSA.COM | TEL: +1 (817) 506-3535 La Costeña Fancy an authentic flavor? Take your taste buds on a trip to Mexico with Esquites La Costeña! Enjoy the authentic street- style corn experience in a handy bag, perfect for enjoying anytime. VILORE FOODS - WWW.VILORE.COM (210) 509-9496 | SALES@VILORE.COM PRODUCT SHOWCASE 12 JULIO / AGOSTO 2025 ABASTO.COM Spice up your Back to School! Spice up your favorite food, add Salsa Huichol Negra to everything, and enjoy this summer to the fullest. Give your favorite dishes the true Mexican flavor during this Back-to-School season. Follow us and tag us on our social media. SALSA HUICHOL HOT SAUCE Sigma FUD The taste of summer is here with FUD! Enjoy practical recipes full of flavor. With FUD, every dish is the perfect excuse to get together with family and friends. Make this summer a season full of flavor, sunshine, and good times! BAR-S FOODS – A SIGMA COMPANY WWW.FUDUSA.COM | 1-800-699-4115

14 JULY / AUGUST 2025 ABASTO.COM 14 JULIO / AGOSTO 2025 ABASTO.COM Mega Chili Powder Introducing Mega Chili Powder, the bold new twist you've been waiting for! The latest addition to the Mega Toppings family, home to Chamoy Mega, the #1 chamoy in Mexico and the US, adds a unique spicy and tangy kick to fruits, snacks, drinks, or any craving that needs an extra burst of flavor. MEGA FOODS | WWW.MEGA-FOODS.COM| 972 482 708 Sal La Fina Sal La Fina has been bringing flavor to the tables of Mexican families for over 50 years. La Fina was crea- ted out of the need for a product that would meet everything a homemaker looks for in salt: quality, fresh- ness, whiteness, flavor, and purity. CUSTOMERSERVICE@SISAMEXINC.COM | OFC:(214) 575-9813 PRODUCT SHOWCASE Frijoles volteados de La Preferida A staple of Central American cuisine, refried beans are traditionally prepared with slow-cooked beans, mashed to be a perfect creamy consistency, and sautéed to highlight their intense earthy flavor. La Preferida’s refried beans are an ideal side dish for breakfast, lunch or dinner. Try them today! WWW.LAPREFERIDA.COM TEL: 1 (800) 621-5422 | INFO@LAPREFERIDA.COM Prisma Luxus LLC You know that Tamborines and Zandi-itas are the perfect pair! Delicious tamarind and watermelon-flavored snacks that melt in your mouth, releasing their unique blend of salty, sweet, and spicy flavors. Perfect for sharing, they are a must-have classic in your confectionery catalog. REQUEST INFORMATION BY WRITING TO: FANNY@PRISMAMEXICO.COM

16 JULY / AUGUST 2025 ABASTO.COM Guatemalan Pride Guatemalan Pride in Every Can in Every Can The Guatemalan Nectar brand strengthens its presence among Hispanic consumers in the US. 16 JULIO / AGOSTO 2025 Distribute Del Frutal and Follow Us on Social Media Del Frutal is proud to be the favo- rite nectar of many Latinos in the United States. The company wants you to join its team as a distributor to bring its delicious nectars to more cities. Contact us by sending an email to customer. experience@edtexport.com and follow us on social media by clic- king on the QR code: Successful Entry into the US Market In 2002, Del Frutal began its foray into the United States with a clear objective: to reach Guatemalans living in the North American country. Although the size and diver- sity of the market presented challenges, the company opted for strategic alliances and local distributors to address these challenges. Thanks to this approach, its products are now available in multiple states and Hispanic communities. FRUIT FRUIT Leadership in Guatemala and Regional Expansion Headquartered in Guatemala, Del Frutal has maintained a dominant position in its home country. Over the past four decades, it has become the most widely consumed nectar brand in both Guatemala and Central America. Growth has been steady, with the launch of different flavors and formats, including the country's first canned product. This combination of tradition and innovation facilita- ted its international expansion. Each nectar contains approximately Closeness to Hispanic Consumers The target audience in the US includes first-, second-, and third-generation Guatemalans, as well as other Central American communities. The brand participa- tes in Hispanic festivals and events, celebrating cultural pride and winning over new consumers. What sets Del Frutal apart in a saturated beverage market is its commitment to quality. They only use fruit that meets the brand's standards, ensuring authentic and consistent flavor. Del Frutal is committed to continued growth while maintaining its roots. sugar cane sweetens with Since its founding in 1984, Del Frutal has represented the best of Guatemala in the beverage world. Born under the renowned Alimentos Maravilla company, the brand emer- ged with a clear mission: to offer a natural, refreshing, and nutritious product made with fruit concentrate. The name “Del Frutal” was not chosen at random. From the outset, the aim was to emphasize its connection with nature and diffe- rentiate it from other sugary drinks. “The difference between drinking something and nourishing your- self,” says its slogan in Guatemala. In the United States, the message is adapted to “The taste of natural,” capturing the nutritional value of its nectars, which contain high levels of fruit, vitamin C, and sugarcane. By Hernando Ramírez-Santos Flavors that Evoke Roots Del Frutal markets seven flavors in the US, the most popular being pineapple, apple, and peach. Each nectar includes about 25% fruit and sweetens with cane sugar. The company guarantees quality through internationally certified processes. It also offers formats desig- ned for Hispanic consumers: 11.14 fl oz cans, 1-liter tetra packs, and indivi- dual 200 ml servings in packs of three. BUSINESS SHOWCASE

18 JULY / AUGUST 2025 ABASTO.COM LA COCINA SERVES READY-MADE MEALS Time-pressed shoppers grab carnitas tacos, chicken mole or Salvadoran pupusas prepared in La Cocina. Seating along the front windows invites guests to enjoy hot dishes before tackling the rest of their list. By Hernando Ramírez-Santos V allarta Supermarkets Colton store opens June 4, marking the Latino-owned chain’s 60th California location and under- scoring fast regional growth. Vallarta will cut the ribbon at 8:15 a.m. at 1250 Washington St., welcoming Colton residents with music, giveaways and a $7,500 donation to local schools and charities. Company marketing director Lizette Gomez called the milestone “a reflection of our deep commitment to the communities we serve.” MODERN DESIGN HONORS LATINO HERITAGE Spanning 43,931 square feet, the super- market blends contemporary lighting and signage with vivid murals and traditional tilework. Shoppers will find wide aisles, clear bilingual navigation and self-checkout stations that speed transactions while preserving Vallarta’s hallmark warm service. FRESH PRODUCE HEADLINES THE OFFERINGS The produce department displays seaso- nal staples, exotic tropical fruit and certified organic vegetables sourced from California fields and premium interna- tional farms. Staff rotate stock hourly, ensuring crisp lettuce, ripe mangoes and aromatic herbs stay at peak freshness. CARNICERÍA ANCHORS | THE SALES FLOOR Vallarta Supermarkets Colton dedicates a full wall to its Carnicería, branded “Home of the Original Carne Asada.” Skilled butchers hand-trim ranchera flank steak, marinate cuts in signature spice blends and grind beef to order. Clear pricing boards highlight specials and encourage meal planning. VALLARTA SUPERMARKETS COLTON STORE GRAND OPENING SET FOR JUNE 4 EXPANDS LATINO GROCERY FOOTPRINT PANADERÍA AND TORTILLERÍA DELIVER DAILY AROMAS Bakers start mixing dough at 3 a.m., filling the air with the scent of conchas and boli- llos. Nearby, machines press and cook corn and flour tortillas from nixtamalized masa ground on volcanic stone, demons- trating authenticity and transparency. DULCERÍA, CREMERÍA AND FLORERÍA ROUND OUT SELECTION Rows of tamarind candies and piñatas brighten the Dulcería, while the Cremería stocks queso Oaxaca and crema fresca for regional recipes. The Florería offers bouquets from Inland Empire growers and potted succulents that suit local patios. VALLARTA SUPERMARKETS COLTON CREATES JOBS, FUELS EXPANSION STRATEGY The new Vallarta Supermarkets Colton branch adds roughly 150 positions, brin- ging the company workforce past 8,000. The chain opened 59 stores over four decades, mainly in Los Angeles and San Bernardino counties. Executives plan additional Inland Empire sites as popu- lation growth and Latino purchasing power climb. FOCUS ON CULTURE DRIVES LOYALTY Industry analysts credit Vallarta’s success to curated departments reflecting Latin American tastes and community involve- ment through scholarships, food drives and disaster aid. By fusing tradition with modern convenience, the grocer retains multigenerational shoppers and attracts newcomers seeking authentic flavors. LOOKING AHEAD The supermarket chain will follow the Vallarta Supermarkets Colton model for its upcoming projects: medium-sized stores, cultural details, and services that differentiate the brand in a highly compe- titive market. As Gómez pointed out, “We are celebrating 40 years of sharing food that tastes like home; Colton is the next chapter.” IN THE NEWS SPECIALTY STATIONS ADD FLAVOR VARIETY Guacamole Station: Associates mash Hass avocados and mix pico de gallo to each guest’s heat preference. Sushi Bar: Trained chefs roll California, spicy tuna and vegetarian options on site, replacing trays every four hours. Juice Bar: Vitroleros brim with horchata, jamaica and strawberry agua fresca, while blenders whir with carrot-ginger wellness shots.

WALMART WARNS HIGH TARIFFS WILL PUSH CONSUMER PRICES HIGHER By Hernando Ramírez-Santos W almart warned that rising tariffs under President Trump’s trade policies will lead to higher consumer prices, espe- cially for imported food and general merchandise, despite the retailer’s efforts to shield shoppers. The caution came during the company’s first-quarter earnings call for fiscal year 2026. CEO Doug McMillon and CFO John David Rainey described a strong quarter, but emphasized growing concern over cost pressures linked to U.S. tariffs, especially those targeting Chinese goods and Latin American produce. TARIFFS ARE RAISING COSTS “Even at the reduced levels announced this week, we aren’t able to absorb all the pressure,” McMillon said. “Given the reality of narrow retail margins, higher tariffs will result in higher prices.” He pointed to the resurgence of tariffs on goods from China—where Walmart sources many electronics and toys—as particularly impact- ful. Tariffs on agricultural products from Costa Rica, Peru, and Colombia are also driving up costs for bananas, avocados, coffee, and roses. Although Walmart sources two-thirds of its U.S. assortment domestically, McMillon said the share of imports, especially from China, remains significant in certain categories. MANAGING INVENTORY AND MITIGATING IMPACTS Walmart is adjusting inventory flows and working with suppliers to switch from tariff-affected materials—like aluminum—to alternatives such as fiberglass. The company also aims to manage costs by absorbing some tariff impacts within product cate- gories, rather than applying the full increase item by item. “We can adjust the forecast and partner with our suppliers over time,” McMillon said. “It’s helpful that our inventory is well-managed going into Q2.” Walmart is leveraging its growth in eCommerce, advertising, and memberships—businesses with higher margins—to offset cost increa- ses and limit the impact on Walmart consumer prices. SOLID FIRST QUARTER RESULTS Despite tariff concerns, Walmart reported strong first-quarter perfor- mance. Companywide sales grew 4%, with profits up 3% in constant currency. U.S. comparable sales rose 4.5% for Walmart and 6.7% for Sam’s Club, excluding fuel. eCommerce sales jumped 22% globally. McMillon credited these results to Walmart’s broad, replenishable product assortment and impro- ving profitability in newer business segments. “We delivered a good first quarter,” McMillon said. “Our strategy and omnichannel capabilities are strong. We’ll keep getting better in terms of assortment, delivery speed, and scaling our newer businesses.” CFO FLAGS UNCERTAINTY IN FORECASTS CFO John David Rainey echoed McMillon’s cautious optimism, but said that trade policy unpredictability adds risk to the company’s financial outlook. “The range of possible outcomes is much greater than when we originally provided our annual guidance,” Rainey said. He warned that if higher tariffs are restored, they could jeopardize Walmart’s ability to grow earnings year over year. Nonetheless, Rainey said Walmart remains confident it can meet full- year guidance under most scenarios the company has modeled, including those that assume bilateral agree- ments will reduce tariff burdens. “We’re not fully immune, but we’ve modeled various outcomes and still see a path to achieving our goals,” Rainey said. POSITIONED TO ABSORB PRESSURE —BUT NOT ALL OF IT Both executives stressed that Walmart’s scale, domestic sourcing, and diversified revenue streams give it an edge in managing rising costs. But McMillon acknowledged limits. “We're positioned to manage the cost pressure from tariffs as well or better than anyone,” he said. “But even at the reduced levels, the higher tariffs will result in higher prices.” As the second quarter progresses and more tariff-affected inventory hits stores, customers may begin to feel the effects—especially in general merchandise. Walmart pledged to keep food prices as low as possible, even if that means sacrificing margin in other areas. However, the longer tariffs remain elevated, the more pressure builds. SEO FOCUS KEYWORD: WALMART CONSUMER PRICES SEO Metadata: • Title Tag: Walmart Warns Tariffs Will Raise Consumer Prices Despite Mitigation Efforts • Meta Description: Walmart execu- tives warned during the Q1 FY2026 earnings call that U.S. tariffs— especially on Chinese and Latin American imports—will push Walmart consumer prices higher. 20 JULY / AUGUST 2025 ABASTO.COM IN THE NEWS

iami is once again getting ready to be the epicenter of the conti- nent's food and beverage trade with the 2025 edition of the Americas Food and Beverage Show and Conference, happening September 10-12. Organized by the World Trade Center Miami, this event has become a key platform for small and medium-sized businesses (SMBs) to connect with crucial buyers and explore the dynamics of a globalized market. Expectations are high for this year, with 12,000 buyers, nearly 1,000 stands, and at least 25 countries anticipated in the pavilions of the Miami Beach Convention Center. This significant growth, shown by the expansion from two to three pavi- lions compared to last year, highlights the event's increasing importance. The sessions cover everything from regulatory requirements to logistics for getting products into the United States and strategies for exporting outside the country. Plus, they offer reverse sessions and market trend analyses across various sectors. By Violeta Montes de Oca 29th Edition 3 days: September 10-12 3 halls at the Miami Beach Convention Center 800 companies will attend 1,000 stands across approximtely 250,000 square feet of exhibition space 12,000 buyers 25 country pavilions A large part of the conference agenda focuses on helping exhibitors export and import their products. We have sessions on FDA and USDA requirements, but also sessions with distributors”, Alice Ancona / Chief Operating Officer of the World Trade Center Miami. STRATEGIC CONNECTIONS AND RESULTS The World Trade Center Miami's vision for the Americas Food and Beverage Show goes beyond just being a trade fair. The event's organizers emphasize that the main goal is to generate tangible results for exhibitors. This means facilitating contact with distributors, importers, and other key players who can boost their businesses. Stories of filled containers and success- ful exports after the fair are a source of pride and demonstrate the event's real impact on the growth of participating companies. A distinctive aspect of the trade fair is its focus on SMBs, highlights Ivan Barrios, President and CEO of the World Trade Center Miami. Unlike other events that prioritize large corporations, the Americas Food and Beverage Show provi- des a platform for smaller businesses to showcase their products and forge valua- ble connections. A Bridge of Opportunities in Miami THE AMERICAS FOOD AND BEVERAGE SHOW 2025: IN THE NEWS 22 JULY / AUGUST 2025 ABASTO.COM HISPANIC MARKET Additionally, recognizing the importance of the Hispanic American market, efforts are made to ensure the event is bilingual, offering conferences and educational cycles in Spanish. This inclusive approach resonates especially in a market like the United States, where the purchasing power and influence of the Latino community are increasingly significant. The Americas Food and Beverage Show experience goes beyond the days of the fair. Tours of Hispanic supermarkets in Miami are organized so international exhibitors can observe product placement strategies and the dynamics of the local market. .

24 JULY / AUGUST 2025 ABASTO.COM CONVENIENCE BRIEFS QuikTrip celebrated its expansion into Indiana by opening a new travel center in Daleville at 15101 W. Commerce Rd., located along Interstate 69 at Exit 234. With this location, QuikTrip now opera- tes more than 1,100 stores in 20 states. Members of the Daleville Town Council and other community leaders were on hand to help cut the ribbon at the new site. McLane and Wawa Expand Collaboration Seven & i Holdings and Alimentation Couche-Tard (ACT) Sign Agreement Seven & i Holdings and Alimentation Couche-Tard (ACT) have signed a non-disclosure agreement (NDA) to facilitate discussions regarding a potential transaction. Seven & i's inde- pendent Special Committee (SC) stated that this NDA will grant ACT access to additional information beyond what other potential buyers of the divest- ment package are already receiving. ACT confirmed the signing of the NDA to advance transaction discus- sions, due diligence, and regulatory engagement plans. However, they cautioned that there is no guarantee these discussions will lead to a tran- saction. ACT President and CEO, Alex Miller, expressed gratitude for the SC's involvement and access to due diligence, affirming their commitment to collaborative work in the interest of all stakeholders. Nouria Unveils New Store in Raynham, MA Nouria, a premier provider of convenience and travel essentials, recently opened a new location in Raynham, Massachusetts. This facility is designed to serve the commu- nity with convenience items, premium fuel, and Nouria's Kitchen, featuring Italian dishes from Amato's. QuikTrip opens first Indiana location McLane Company, Inc., one of the largest distributors in the United States, and Wawa, a leading conve- nience store chain, have expanded their partnership to support Wawa's continued growth. McLane and Wawa have a successful history of working together for over 20 years, with McLane now servicing more than 1,100 Wawa stores from distribution centers in Kentucky, Virginia, New Jersey, and Florida. +1,100 tiendas en 20 estados IN THE NEWS

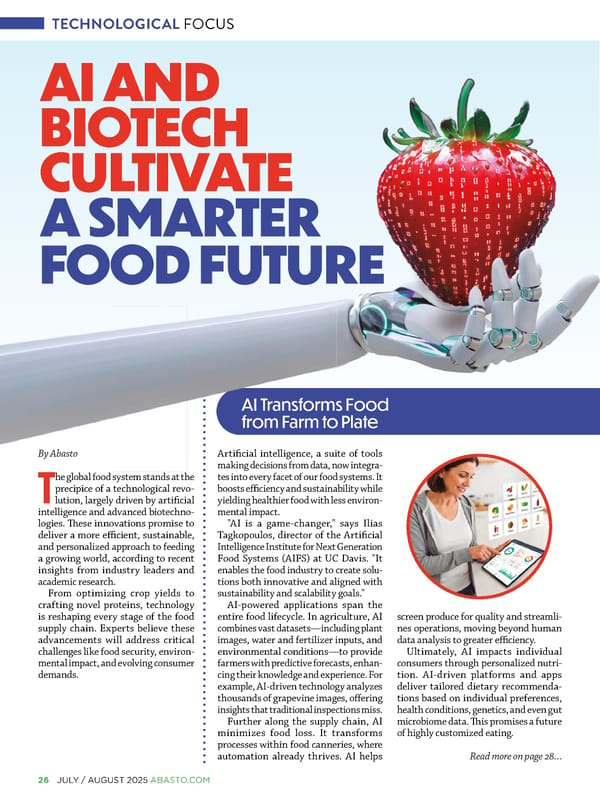

6 PACKS 12FL OZ

TECHNOLOGICAL FOCUS 26 JULY / AUGUST 2025 ABASTO.COM Artificial intelligence, a suite of tools making decisions from data, now integra- tes into every facet of our food systems. It boosts efficiency and sustainability while yielding healthier food with less environ- mental impact. "AI is a game-changer," says Ilias Tagkopoulos, director of the Artificial Intelligence Institute for Next Generation Food Systems (AIFS) at UC Davis. "It enables the food industry to create solu- tions both innovative and aligned with sustainability and scalability goals." AI-powered applications span the entire food lifecycle. In agriculture, AI combines vast datasets—including plant images, water and fertilizer inputs, and environmental conditions—to provide farmers with predictive forecasts, enhan- cing their knowledge and experience. For example, AI-driven technology analyzes thousands of grapevine images, offering insights that traditional inspections miss. Further along the supply chain, AI minimizes food loss. It transforms processes within food canneries, where automation already thrives. AI helps screen produce for quality and streamli- nes operations, moving beyond human data analysis to greater efficiency. Ultimately, AI impacts individual consumers through personalized nutri- tion. AI-driven platforms and apps deliver tailored dietary recommenda- tions based on individual preferences, health conditions, genetics, and even gut microbiome data. This promises a future of highly customized eating. AI Transforms Food from Farm to Plate Read more on page 28… AI AND BIOTECH CULTIVATE A SMARTER FOOD FUTURE By Abasto T he global food system stands at the precipice of a technological revo- lution, largely driven by artificial intelligence and advanced biotechno- logies. These innovations promise to deliver a more efficient, sustainable, and personalized approach to feeding a growing world, according to recent insights from industry leaders and academic research. From optimizing crop yields to crafting novel proteins, technology is reshaping every stage of the food supply chain. Experts believe these advancements will address critical challenges like food security, environ- mental impact, and evolving consumer demands.

ABASTO.COM JULY / AUGUST 2025 27 C M Y CM MY CY CMY K Pauta INNERCIA.pdf 1 11/06/25 12:33 p.m.

28 JULY / AUGUST 2025 ABASTO.COM Alongside AI, biotechnology spear- heads significant innovation in food. Precision fermentation, a cutting-edge approach, produces specific ingredients like proteins, enzymes, and fats with unprecedented precision and efficiency. This revolutionary technology uses microorganisms in controlled environ- ments, paving the way for sustainable food innovation and efficiently meeting the demands of a growing global population. Cultivated meat, also known as lab-grown meat, offers a compelling alternative to traditional livestock farming. Produced from animal cells, this technology addresses environmental and ethical concerns. Hadar Sutovsky, VP Corporate Investments at ICL Group, notes, "Cultivated meat holds great potential, but the path to mainstream acceptance involves overcoming challenges in cost, regulatory approval, and consumer perception." Achieving the right taste, texture, and aroma remains crucial for widespread adoption. Beyond cultivated meat, the industry explores a broader range of alternative proteins. While plant-based options continue to evolve, the focus expands to Biotech Innovates Protein and Production include mushroom-based proteins and innovative seafood alternatives. Developers actively work to improve the sensory experience, ensuring these new products truly satisfy consumer expectations. The drive for sustainability underpins many of these technological advance- ments. Carbon utilization, for example, explores innovative methods to convert carbon dioxide into valuable food ingre- dients. Similarly, regenerative agriculture, which restores soil health and enhances ecosystem resilience, moves from niche interest to a mainstream strategy within the food system. Controlled Environment Agriculture (CEA), including hydroponics and aero- ponics, optimizes growing conditions for higher yields with significantly less water. This facilitates the expansion of urban and vertical farming, which reduces "food miles" and enhances local food security. Furthermore, the industry increa- singly demands sustainable packaging solutions to combat plastic waste, while upcycled ingredients play a larger role in reducing overall food waste. The integration of blockchain tech- nology also boosts transparency and traceability throughout the supply chain. This real-time tracking helps combat food fraud and builds greater trust between producers and consumers. A Future of Healthier, Smarter Food These trends collectively paint a picture of a food future that is healthier, more sustainable, and more accessible. By harnessing the power of artificial intelligence and advanced biotech- nologies, the food industry moves towards scalable, climate-friendly solutions for a growing global population. This innovative trajectory promises not only to revolutionize how we produce and consume food but also to address some of humanity's most pressing challenges. Sustainable Practices Gain Momentum …Continued from page 26

ENFOQUE ECONÓMICO By Hernando Ramírez-Santos T he National Grocers Association (NGA) is mobilizing independent grocers across the country to oppose cuts to the Supplemental Nutrition Assistance Program (SNAP) that would reduce funding for the program by 20 percent. NGA President and CEO Greg Ferrara warned that the drastic changes to SNAP funding introduced in the reconciliation bill, which has already passed the House of Representatives, are very concerning. “As the reconciliation process moves to the Senate, we look forward to working with lawmakers to protect the most vulnerable communities and strengthen SNAP Cuts: Threat to Vulnerable Communities and Independent Stores this critical program, ensuring it is adequately funded and efficiently imple- mented while addressing unacceptable levels of error and fraud,” Ferrara said. NGA pushes Congress against SNAP cuts NGA representatives met with advisers to Senate Majority Leader Chuck Schumer, House Democratic Leader Hakeem Jeffries, Senator Amy Klobuchar, and Congresswoman Angie Craig. The shopkeepers delivered a clear message: cuts to SNAP will hurt vulnerable families and the small businesses that serve them. ECONOMY FOCUS What’s at stake The bill threatens more than 42 million Americans who rely on SNAP, including 14 million chil- dren and more than 6.5 million older adults. According to the Congressional Budget Office (CBO), Congress’ budget proposal would cut funding for SNAP by $285.7 billion over the 2025-2034 period: • States would have to cut or eliminate SNAP bene- fits for approximately 1.3 million people per month, on average. • Expanding the work requi- rement would reduce SNAP by about $90 billion through 2034. • It would eliminate food assis- tance for 3.2 million people in a typical month, including 1 million older adults, 800,000 parents of school-age chil- dren, and 1.4 million adults between the ages of 18 and 54 living in areas with higher unemployment. Read more on page 32… 30 JULY / AUGUST 2025 ABASTO.COM

Instant Bubble Tea Kit Instant Bubble Tea Kit Instant Bubble Tea Kit Instant Bubble Tea Kit TA I W AN C L A SS IC � � � � � �� � � � � � � � � � � � � More size options for your store! New! 350 mL 500 mL, 1L New! 350 mL 500 mL, 1L New!

A new economic analysis from the NGA indicates that SNAP funds support approximately 388,000 jobs and more than $20 billion in direct wages, which translates to more than $4.5 billion in state and federal tax revenue. “At the heart of every independent grocer in the country is a firm belief: no American should go hungry,” said Stephanie Johnson, RDN, NGA’s vice president of government relations. “With that core value, we urge Congress to limit cuts to SNAP funding during the recon- ciliation process.” The impact on grocers According to an NGA technical report, every dollar invested in SNAP generates $1.79 in economic activity, demonstrating its efficiency. Johnson emphasized that cuts to SNAP would affect not only fami- lies but also small businesses in rural and underserved communities. “Independent grocers are essential partners in delivering SNAP benefits. Reducing SNAP would hurt the most vulnerable Americans and jeopardize the viability of community stores that sustain local economies.” Stephanie Johnson, RDN, NGA’s vice president of government relations. …Continued from page 30 Independent grocers are pillars of their communities, ensuring access to healthy food and local employment opportuni- ties. The NGA warned that cuts to SNAP would jeopardize these critical food access points and destabilize local economies. “SNAP is more than an anti-hunger program; it is an economic engine that supports local businesses, strengthens communities, and helps neighbors in tough times,” Johnson said. For indepen- dent grocers, protecting SNAP means protecting communities, small busines- ses, and the families that depend on both. Independent grocers stand ready to work with lawmakers to preserve an efficient, fair, and sustainable SNAP program” Johnson added / NGA Vice President of Government Relations The NGA said it supports reforms that improve the program’s efficiency, but insists that core funding that guarantees access to food should not be cut. 32 JULY / AUGUST 2025 ABASTO.COM

ABASTO.COM JULY / AUGUST 2025 33

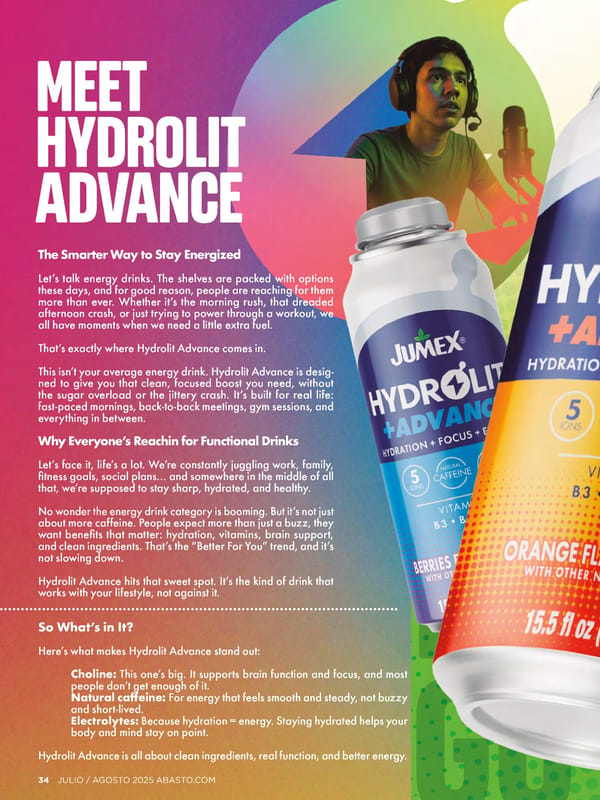

The Smarter Way to Stay Energized Let’s talk energy drinks. The shelves are packed with options these days, and for good reason, people are reaching for them more than ever. Whether it’s the morning rush, that dreaded afternoon crash, or just trying to power through a workout, we all have moments when we need a little extra fuel. That’s exactly where Hydrolit Advance comes in. This isn’t your average energy drink. Hydrolit Advance is desig- ned to give you that clean, focused boost you need, without the sugar overload or the jittery crash. It’s built for real life: fast-paced mornings, back-to-back meetings, gym sessions, and everything in between. Why Everyone’s Reachin for Functional Drinks Let’s face it, life’s a lot. We’re constantly juggling work, family, fitness goals, social plans… and somewhere in the middle of all that, we’re supposed to stay sharp, hydrated, and healthy. No wonder the energy drink category is booming. But it’s not just about more caffeine. People expect more than just a buzz, they want benefits that matter: hydration, vitamins, brain support, and clean ingredients. That’s the “Better For You” trend, and it’s not slowing down. Hydrolit Advance hits that sweet spot. It’s the kind of drink that works with your lifestyle, not against it. MEET HYDROLIT ADVANCE So What’s in It? Here’s what makes Hydrolit Advance stand out: Choline: This one’s big. It supports brain function and focus, and most people don’t get enough of it. Natural caffeine: For energy that feels smooth and steady, not buzzy and short-lived. Electrolytes: Because hydration = energy. Staying hydrated helps your body and mind stay on point. Hydrolit Advance is all about clean ingredients, real function, and better energy. 34 JULIO / AGOSTO 2025 ABASTO.COM

For Our Retail Partners: This One’s a Win If you’re in the retail space, this is the kind of product your customers are already looking for, even if they don’t know it yet. They’re seeking functional drinks that feel healthier, work better, and taste great. Hydrolit Advance checks every box. Here’s what makes it a smart shelf addition: Daily-use potential: It’s not just a once-in-a- while treat. People will reach for it regularly. Cross-category appeal: Great for energy drink fans, fitness lovers, students, and busy professionals. Modern and premium: Eye-catching packa- ging, clean ingredients, and a compelling story. Fits anywhere: Stock it in the cooler, wellness section, gym corner, or grab-and-go area. This is a drink that doesn’t just ride the energy trend, it elevates it. It gives you something different to offer your customers, especially those looking to upgrade from their usual can of caffeine. Give your shoppers a cutting-edge drink and elevate your shelves with this functional, on-trend innovation. Distributed Exclusively by Vilore Foods Hydrolit Advance is proudly distributed in the U.S. exclusively through Vilore Foods, a trusted name in Hispanic and global food & beverage distribution. For sales inquiries or more information, contact: sales@vilore.com 1-877-609-9496 ABASTO.COM JULIO / AGOSTO 2025 35

FOOD INDUSTRY SWEETS & SNACKS EXPO 2025 FINISHED STRONG AT INDIANAPOLIS By Violeta Montes de Oca T he Sweets & Snacks Expo 2025 wrapped up in Indianapolis, leaving an exceptional legacy of success for the confectionery and snacks industries. As atten- dees from across the globe converged on the Indiana Convention Center, the expo solidified its reputation as the premier event of its kind. Building on its previous achievements, the Sweets & Snacks Expo transformed Indianapolis, utilizing over 250,000 square feet of show floor within the Indiana Convention Center. From May 13 to 15, all 11 exhibition halls and three ballrooms were bustling, generating an estimated $13 million in economic impact for the City, said Chris Gahl, Executive Vice President and Chief Marketing Officer of Visit Indy. The enduring partnership with the National Confectioners Association, the host organization, remains central to the event’s focus. Visitors to Indianapolis noted the city’s ongoing revitalization, with $3 billion in new tourism-related cons- truction underway, including the Signia by Hilton and the Convention Center expansion. These projects, set to finish by the end of 2026, will provide even more room for the Sweets & Snacks Expo to expand when it returns to Indy in 2027. 36 JULY / AUGUST 2025 ABASTO.COM

ABASTO.COM JULY / AUGUST 2025 37 Follow us

KEY FEATURES AND ANNOUNCEMENTS The Sweets & Snacks Expo profoundly impacted the confec- tionery and snack communities, both on and off the show floor. Coming to store shelves: The Most Innovative New Product Awards highlighted stdout new consumer products across 12 categories, judged by a panel of retailers from all chan- nels of trade. Best in Show: Belle’s Gourmet Popcorn Matcha Latte Popcorn claimed the top prize. Giving back: The Sweets & Snacks Expo partnered with USO and Give Kids the World Village to donate products to service- members and children in need nationwide. Mark your calendars: The 2026 Sweets & Snacks Expo will be held at the Las Vegas Convention Center from May 19-21, 2026, with a pre-show day on May 18. 38 JULY / AUGUST 2025 ABASTO.COM

ABASTO.COM JULY / AUGUST 2025 39

THE TRADE SHOW IN NUMBERS 1,000+ exhibitors, including over 300 making their debut 14,500 attendees from more tan 85 countries Approximately 5,000 buyers had networking 40 JULY / AUGUST 2025 ABASTO.COM

ABASTO.COM JULY / AUGUST 2025 41

By Abasto Retailers and manufactu- rers across the United States are preparing to highlight innovation in private brand products during the second Private Brands Month, to be held in January 2026. After a strong debut in January of this year, organi- zers are promising an even more ambitious celebration. In the coming months, retailers and suppliers will be launching immer- sive campaigns across all formats, from physical stores to e-commerce plat- forms. The goal is to increase consumer awareness, drive product trials, and foster loyalty to private-label food, beverage, and non-food products. “The first Private Brand Month was a remarkable success with widespread participation,” said Peggy Davies, PLMA president. “This demonstrates the spirit Preparations Begin for Private Brands Month of collaboration and creati- vity that defines the industry. We look forward to even grea- ter participation in 2026.” Digital Tools Available PLMA offers marketing templates, logos, and promotional graphics for participating retai- lers to develop consistent campaigns. Social media content and influencers will target young, value-cons- cious consumers. Private Brand Month coin- cides with other key industry events. PLMA will host its “Store Brands Marketplace” trade show on November 16–18, 2025, in Chicago. The event will showcase thousands of innovative private-label products. There will be food, beverages, wine and spirits, ingredients, international products, personal care, baby, pet and home care items, as well as sustainable packaging and ready-to-eat products. Registration is Now Open For the 2025 Global Produce & Floral Show By Abasto The International Fresh Produce Association (IFPA) announced that registration is now open to attend its 2025 Global Produce & Floral Show, which will take place October 16-18 in Anaheim, California. The next-generation technology, bold ideas, and strategic connections offe- red by the event will drive growth and innovation across the industry. “Each year, the Global Show is intentionally desig- ned to adapt to the needs of the industry, ensuring grea- ter value for our members and the entire fresh produce and floral sector,” said Jim Mastromichalis, Co-Chair of the Global Show Committee. This year's program featu- res high-impact networking receptions. There will be world-class keynote presen- tations—including IFPA CEO Cathy Burns' “State of the Industry” address— and a variety of learning experiences. At the heart of the event is the Expo, a vibrant showcase of innovation and excellence, where a diverse collection of exhibitors showcase the best in produce, floral, and technology solutions from around the world. “The Global Produce & Floral Show is where the global fresh produce and floral community comes together to shape the future of fresh,” said Cathy Burns, CEO of IFPA. “Innovation and connection. Opportunities and possibili- ties. Bold ideas and insights. This is the only event that brings it all together for every segment of the global supply chain.” Registration for exhibitors and visitors is now available on the IFPA website. 42 JULY / AUGUST 2025 ABASTO.COM FOOD INDUSTRY

WHERE FLAVOR MEETS INNOVATION 2,200 top foodservice professionals will make deals in Monterey this July. Will you be one of them? Whether you’re shaping menus, supplying the industry, or innovating solutions, meet future partners and propel your business forward at The Foodservice Conference. JULY 31–AUG 1 MONTEREY, CA Register Now

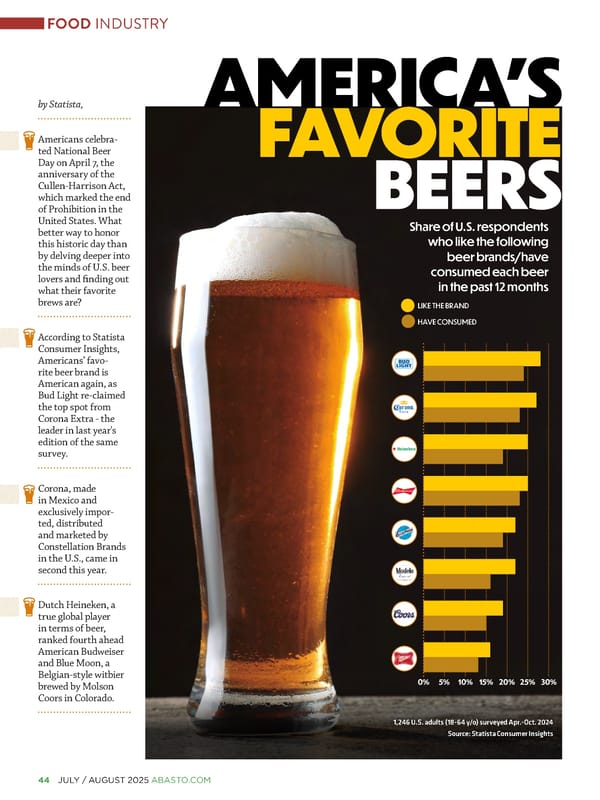

AMERICA’S FOOD INDUSTRY 44 JULY / AUGUST 2025 ABASTO.COM by Statista, Americans celebra- ted National Beer Day on April 7, the anniversary of the Cullen-Harrison Act, which marked the end of Prohibition in the United States. What better way to honor this historic day than by delving deeper into the minds of U.S. beer lovers and finding out what their favorite brews are? According to Statista Consumer Insights, Americans’ favo- rite beer brand is American again, as Bud Light re-claimed the top spot from Corona Extra - the leader in last year's edition of the same survey. Corona, made in Mexico and exclusively impor- ted, distributed and marketed by Constellation Brands in the U.S., came in second this year. Dutch Heineken, a true global player in terms of beer, ranked fourth ahead American Budweiser and Blue Moon, a Belgian-style witbier brewed by Molson Coors in Colorado. FAVORITE BEERS 0% 5% 10% 15% 20% 25% 30% LIKE THE BRAND HAVE CONSUMED Share of U.S. respondents who like the following beer brands/have consumed each beer in the past 12 months 1,246 U.S. adults (18-64 y/o) surveyed Apr.-Oct. 2024 Source: Statista Consumer Insights

ABASTO.COM JULY / AUGUST 2025 45

By Ron Margulis S ummer has always meant cherries to me. From my early days of working at my dad’s supermarket in New Jersey, I looked forward to the first shipment of Bing cherries from the Pacific Northwest, knowing there were a few months of sweet summer goodness ahead. As the summer of 2025 starts getting into full swing and fami- lies gather for outdoor celebrations, there is an equally sweet opportunity for Hispanic food retailers to energize sales and deepen community connections. Seasonal promotions and smart merchandising can trans- form stores into a destination for summer flavors, traditions and memorable experiences. Family Events to Attract Customers Hispanic consumers are known for making grocery shopping a family affair, viewing it as a joyful experience rather than a chore. According to Mintel’s 2022 market report, most Hispanic shoppers take sole responsibility for grocery shopping, but making it a family event opens doors for growth. Summer is the perfect time to host family-oriented events— think grilling demonstrations, salsa-making classes, or cultural festivals in partnership with local chefs and organizations. These gatherings not only boost traffic but also create a welcoming environment that resonates with core values of community and togetherness. Ideas to Create Summer Promotions Cross-merchandising relevant products drives bigger basket sizes and sparks new meal ideas. For example, pairing marina- ted meats with tortillas, salsas and cold beverages like Jarritos creates a one-stop solution for grilling season. Authenticity remains a cornerstone for Hispanic food retai- lers. Shoppers crave genuine flavors and traditional recipes, but they’re also open to culinary innovation. Curate summer promotions around regional specialties— such as Oaxacan cheese for quesadillas or Peruvian aji for marinades—and collaborate with local chefs for in-store tastings or cooking classes. These experiences encourage trial, educate customers and differentiate your store from mainstream competitors. Health-consciousness is on the rise, and summer is an ideal time to spotlight fresh produce, nutritious snacks and better-for-you options. • Retailers need to clearly label healthy products. • Share recipes for lighter summer meals. • Offer tips for incorporating more produce into traditional dishes. Hispanic shoppers, especially millennials, are digitally savvy and increasingly turning to online channels for grocery shopping. Surveys from Circana and others show that Hispanic consu- mers plan to increase their online purchases at a faster pace than non-Hispanics, with a strong focus on convenience and value. Promote exclusive online deals, recipe inspiration and digital coupons through your website, social media and email newslet- ters. Consider offering online ordering and delivery services to capture this growing segment and ensure your digital presence is bilingual and culturally relevant to foster inclusivity. Summer is more than a season—it’s an invitation to cele- brate culture, family and food. By embracing summer seasonal promotions, creative merchandising and authentic engagement, Hispanic food retailers need to turn up the heat and become the heart of their communities. Stay attuned to evolving preferences, leverage digital tools and make every summer occasion an opportunity to connect, delight and grow. And promote cherries more, for me. How Hispanic Food Retailers Can Win the Summer 46 JULY / AUGUST 2025 ABASTO.COM

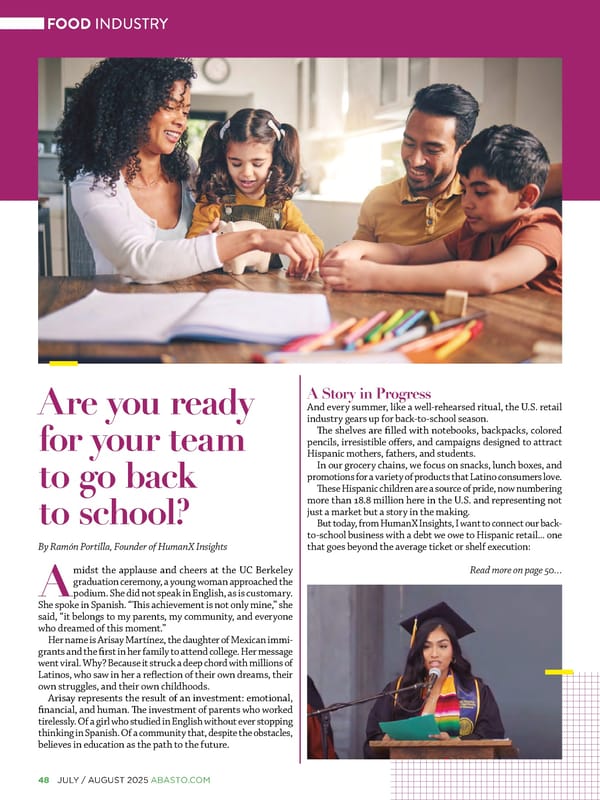

Are you ready for your team to go back to school? By Ramón Portilla, Founder of HumanX Insights A midst the applause and cheers at the UC Berkeley graduation ceremony, a young woman approached the podium. She did not speak in English, as is customary. She spoke in Spanish. “This achievement is not only mine,” she said, “it belongs to my parents, my community, and everyone who dreamed of this moment.” Her name is Arisay Martínez, the daughter of Mexican immi- grants and the first in her family to attend college. Her message went viral. Why? Because it struck a deep chord with millions of Latinos, who saw in her a reflection of their own dreams, their own struggles, and their own childhoods. Arisay represents the result of an investment: emotional, financial, and human. The investment of parents who worked tirelessly. Of a girl who studied in English without ever stopping thinking in Spanish. Of a community that, despite the obstacles, believes in education as the path to the future. A Story in Progress And every summer, like a well-rehearsed ritual, the U.S. retail industry gears up for back-to-school season. The shelves are filled with notebooks, backpacks, colored pencils, irresistible offers, and campaigns designed to attract Hispanic mothers, fathers, and students. In our grocery chains, we focus on snacks, lunch boxes, and promotions for a variety of products that Latino consumers love. These Hispanic children are a source of pride, now numbering more than 18.8 million here in the U.S. and representing not just a market but a story in the making. But today, from HumanX Insights, I want to connect our back- to-school business with a debt we owe to Hispanic retail... one that goes beyond the average ticket or shelf execution: 48 JULIO / AGOSTO 2025 ABASTO.COM Read more on page 50… 48 JULY / AUGUST 2025 ABASTO.COM

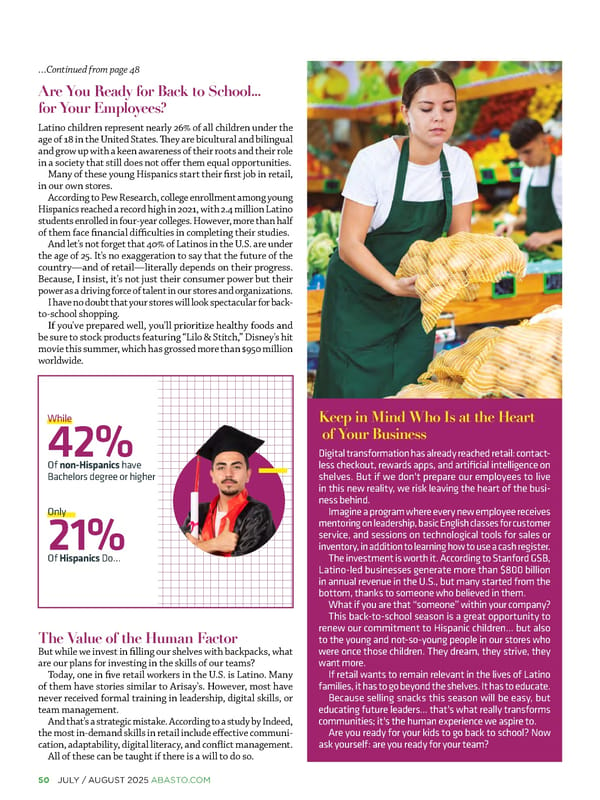

Keep in Mind Who Is at the Heart of Your Business Digital transformation has already reached retail: contact- less checkout, rewards apps, and artificial intelligence on shelves. But if we don't prepare our employees to live in this new reality, we risk leaving the heart of the busi- ness behind. Imagine a program where every new employee receives mentoring on leadership, basic English classes for customer service, and sessions on technological tools for sales or inventory, in addition to learning how to use a cash register. The investment is worth it. According to Stanford GSB, Latino-led businesses generate more than $800 billion in annual revenue in the U.S., but many started from the bottom, thanks to someone who believed in them. What if you are that “someone” within your company? This back-to-school season is a great opportunity to renew our commitment to Hispanic children... but also to the young and not-so-young people in our stores who were once those children. They dream, they strive, they want more. If retail wants to remain relevant in the lives of Latino families, it has to go beyond the shelves. It has to educate. Because selling snacks this season will be easy, but educating future leaders... that's what really transforms communities; it's the human experience we aspire to. Are you ready for your kids to go back to school? Now ask yourself: are you ready for your team? The Value of the Human Factor But while we invest in filling our shelves with backpacks, what are our plans for investing in the skills of our teams? Today, one in five retail workers in the U.S. is Latino. Many of them have stories similar to Arisay's. However, most have never received formal training in leadership, digital skills, or team management. And that's a strategic mistake. According to a study by Indeed, the most in-demand skills in retail include effective communi- cation, adaptability, digital literacy, and conflict management. All of these can be taught if there is a will to do so. …Continued from page 48 While42% Of non-Hispanics have Bachelors degree or higher Only21% Of Hispanics Do… Are You Ready for Back to School... for Your Employees? Latino children represent nearly 26% of all children under the age of 18 in the United States. They are bicultural and bilingual and grow up with a keen awareness of their roots and their role in a society that still does not offer them equal opportunities. Many of these young Hispanics start their first job in retail, in our own stores. According to Pew Research, college enrollment among young Hispanics reached a record high in 2021, with 2.4 million Latino students enrolled in four-year colleges. However, more than half of them face financial difficulties in completing their studies. And let's not forget that 40% of Latinos in the U.S. are under the age of 25. It's no exaggeration to say that the future of the country—and of retail—literally depends on their progress. Because, I insist, it's not just their consumer power but their power as a driving force of talent in our stores and organizations. I have no doubt that your stores will look spectacular for back- to-school shopping. If you've prepared well, you'll prioritize healthy foods and be sure to stock products featuring “Lilo & Stitch,” Disney's hit movie this summer, which has grossed more than $950 million worldwide. 50 JULY / AUGUST 2025 ABASTO.COM

ABASTO.COM JULY / AUGUST 2025 51

By Consumer Reports W hen you’re trying to separate nutrition myths from reality, keep these tips in mind: Check your sources. If you get infor- mation online or from social media, make sure those sources are credible. Find experts who have an RD, an MD, or a PhD in medicine or nutrition and are affiliated with a hospital, university, or reliable agency. Consider the claim. Messages that sound extreme (“Seed oils are toxic!”) or too good to be true (“Cabbage soup melts 5 pounds a day!”) are unlikely to be correct. Dig deeper to fact-check the claim. But some nutrition topics generate more confusion than others, so we asked a few experts to weigh in on some of the most misunderstood foods: Raw Milk: Those in favor of raw milk—milk that hasn’t been pasteu- rized—claim that it contains more nutrients and beneficial bacteria than NUTRITION MYTHS AND MISUNDERSTOOD FOODS the pasteurized version from the store. Others see it differently. “There’s actually no credible evidence that raw milk is better for you or that pasteuri- zation changes the nutritional quality of milk,” says Alison Kane, RD, a registe- red dietitian at Massachusetts General Hospital in Boston. “It’s simply a process of heating the milk for a short time to kill off disease-causing organisms,” like E. coli, listeria, and salmonella. In fact, many experts say that pasteurization is one of the greatest developments in food safety. Seed Oils: These oils—which include canola, grapeseed, sunflower, and soy— are extracted from the seeds of plants. Critics say that their high levels of omega-6 fats raise inflammation in the body and that consuming them can lead to cancer, heart disease, type 2 diabetes, and other illnesses. But the scientific evidence doesn’t support that. “In dozens of studies looking at omega-6s and inflammation, I haven’t seen one that shows an inflam- matory effect, and roughly half are showing anti-inflammatory effects,” Willett says. Plus, we’ve known for deca- des that a higher intake of these oils has contributed significantly to the large decline in deaths from heart disease in the U.S. Green Powders: If you believe the hype, those concoctions of pulverized, freeze-dried fruits, vegetables, and other ingredients have the power to increase your energy, improve your digestion, and boost immunity. “Even though these powders appear packed with nutrients, you’re missing out on the fiber, water content, and the synergistic interactions that take place when we eat nutrients in whole foods,” Kane says. It’s also possible that some of the nutrients are destroyed during processing. And because they’re supplements, manu- facturers generally don’t have to prove to the Food and Drug Administration that they’re safe and effective. Then there’s the price: Some cost close to $100 for a month’s supply. You can buy a lot of deli- cious, filling produce for that. *This is a condensed version of a Consumer Reports article. FOOD INDUSTRY 52 JULY / AUGUST 2025 ABASTO.COM

Empanizador Pooo Empanizador Milanesa Empanizador Mariscos

company’s primary logistics and opera- tions hub, covering ten states from Delaware to Alabama. Local and state officials attended the ribbon-cutting ceremony, along with the company’s executive board, Mexican Consul General in North Carolina, and the fami- lies of founders Dan, Nathaniel, and Phil Calhoun. Purple Crow CEO Rick Calabro prai- sed the city for its skilled workforce and logistical advantages. He said the head- quarters will streamline the company’s supply chain and expand its reach to retailers and foodservice providers in fast-growing Hispanic communities. $50 Million Investment and New Jobs The move represents a $50 million invest- ment in the region and is projected to create 199 new full-time jobs with an average salary of $72,000 by 2028, accor- ding to local media and city development sources. Roles will range from logistics to operations and sales. The redevelopment of the historic Reynolds facility marks a revitalization of an iconic manufacturing site, once central to the city’s tobacco industry, now repurposed for modern food logistics and regional commerce. CELEBRATES ITS SUMMER FOOD SHOW PURPLE CROW OPENS HEADQUARTERS By Hernando Ramírez-Santos H ispanic food distributor Purple Crow officially opened its new headquarters and nearly 1-million- square-foot distribution center on Wednesday, June 11, in the repurposed Reynolds tobacco factory at Whitaker Park. The milestone strengthens the company’s growing Hispanic food distribution network across the eastern United States. A Strategic Move to Support Growth The new facility, located in northeast Winston-Salem, will serve as the Read more on page 56… 54 JULY / AUGUST 2025 ABASTO.COM

Summer! Hot Sauce FOR U.S. SALES: 800-725-7242 13 Bold flavors to make it a ABASTO.COM JULY / AUGUST 2025 55

Summer Food Show Marks New Chapter On Thursday, June 12, Purple Crow hosted its first summer food show at the new facility. The event brought together dozens of Hispanic food brands and hundreds of buyers, distributors, and industry professionals. A Vibrant Showcase of Hispanic Food Products Leading brands like Gamesa, Novamex, Mondelez, and Ricolino showcased their newest offerings. Buyers engaged in one-on-one meetings with suppliers throughout the exhibition floor. Calabro noted the open, collaborative layout of the facility helped facilitate spontaneous deals and deeper business relationships. Attendees praised the event for its energy, inclusiveness, and focus on authentic, high-quality Hispanic food products. The show also emphasized networking, innovation, and cultural connection within the industry. A Leader in Hispanic Food Distribution Purple Crow has grown into a leading Hispanic food distribution company serving more than 2,000 grocery stores and foodservice accounts across the eastern U.S. The company offers a full portfolio of dry, refrigerated, and frozen foods sourced from Mexico, Central America, and domestic producers. Based on its LinkedIn profile, the company operates under a family- and faith-driven mission with a customer promise of “Fresh, Reliable Excellence.” Purple Crow is known for low-order mini- mums and next-day delivery, which make it attractive to independent retailers and neighborhood markets. Community Commitment and Industry Expansion Beyond logistics, Purple Crow continues to foster ties with Hispanic communities. Mexican Consul General Claudia Velasco expressed appreciation for the company’s role in connecting families to cultura- lly relevant products and employment opportunities. The opening event included local leaders and community stakeholders who see Purple Crow’s expansion as a model of how legacy industrial spaces can drive new economic activity. Looking ahead, the company plans to implement automation, expand its supplier base, and develop private-label products. It also aims to host seasonal food shows to strengthen relationships across the supply chain. Purple Crow’s new Winston-Salem headquarters not only deepens its leader- ship in Hispanic food distribution but also affirms its long-term commitment to innovation, cultural relevance, and regional development in one of the fastest- growing consumer sectors in the U.S. 56 JULIO / AGOSTO 2025 ABASTO.COM …Continued from page 54 56 JULY / AUGUST 2025 ABASTO.COM

By Ron Margulis T he 2025 International Dairy Deli Bakery Association (IDDBA) conference brought more than 9,500 attendees and 800-plus exhibi- tors to the Ernest N. Morial Convention Center from June 1–3. The event delive- red actionable insights for Hispanic food retailers aiming to grow in the competi- tive deli, dairy and bakery space. Flavor Trends Shift Toward Bold, Authentic Offerings Panel discussions and product showcases focused on evolving consumer preferen- ces, especially the rising demand for bold and culturally authentic foods. Mexican proteins, cheeses and spicy-sweet combi- nations continue to gain traction among mainstream shoppers. The trend known as “newstalgia”— modern twists on nostalgic favorites—also stood out. This offers Hispanic food retai- lers the chance to reintroduce traditional baked goods with creative flair, merging heritage with innovation. Prepared Foods Lead Deli Growth Prepared foods now generate over half of all deli department sales, surpassing sliced meats and cheeses, according to Hispanic Food Retailers Embrace Innovation at 2025 IDDBA Conference Circana OmniMarket Integrated Fresh. This shift opens doors for culturally relevant grab-and-go options such as tamales, empanadas and Latin-inspired breakfast kits. The breakfast category, in particular, is experiencing double-digit sales growth. IDDBA experts encouraged retailers to offer items like bagel kits paired with chipotle or guava cream cheeses to capture morning traffic. Seasonal Flavors and Emotional Indulgence Drive Sales Retailers can create urgency and deepen emotional engagement by rotating limi- ted-time seasonal offerings. Hispanic flavors like tres leches, dulce de leche and guava continue to resonate, particularly in the dessert and bakery segments. Affordable indulgence remains a powerful motivator for many shoppers. Value-driven treats that tap into cultural memories can help drive repeat visits and build brand loyalty. Technology and AI Solutions Shape Retail Operations Tech integration was a major theme across the IDDBA 2025 show floor. Rich Products debuted an AI-powered recipe platform, giving retailers a tool to customize offerings and streamline operations. Live demonstrations of labor-saving bakery equipment addressed ongoing labor shortages, an issue particularly pressing for independent Hispanic food retailers working with lean teams. 58 JULY / AUGUST 2025 ABASTO.COM

ABASTO.COM JULY / AUGUST 2025 59

60 JULY / AUGUST 2025 ABASTO.COM

ABASTO.COM JULY / AUGUST 2025 61 Atrae al mercado latino con la amplia selección de velas botánicas y religiosas de Velas Hispaniola. Velas Hispaniola is a leading candle maker based in the Dominican Republic, with 20 plus years of experience in the glob- al market. We specialize in producing our own candle brands, and offer private label capabilities for home fragrance and religious candles at scale for worldwide distribution. *Learn more about our fully- customizable options at www.velashispaniola.com. Religious Candles Private-Label Candles Velas Hispaniola Advantages • Shorter Lead Times • Cost Structure • Scalability and Worldwide Distribution • Design and Innovation • Customer Service in Multiple Languages Botanical Candles Buscamos distribuidores, contactar email sales@velashispaniola.com.

By Ron Margulis T he 2025 National Restaurant Association (NRA) Show held May 17–20 at McCormick Place, delivered a sweeping look at the future of foodservice, with more than 2,200 exhibitors and tens of thousands of professionals exploring innovations that will shape the industry in the coming year. For Hispanic food retailers, several emerging trends and tech- nologies highlighted at the show are poised to have a significant impact on operations, menus and customer engagement. While bold flavors remain in demand, Key Trends from the 2025 National Restaurant Association Show 2025 is seeing a shift from simply “spicy” to more complex, layered heat profiles. Trending peppers—including aji chara- pita, goat horn and morita—are being used in creative ways, such as candied chilies, pepper jams and hot honeys. This evolution aligns with the vibrant, spicy traditions of many Hispanic cuisines and presents opportunities for retailers to introduce new products and menu items that resonate with adventurous consu- mers seeking authentic yet innovative experiences. Read more on page 64… 62 JULY / AUGUST 2025 ABASTO.COM

Economic pressures continue to shape consumer behavior, with 72% of diners actively seeking value menu options according to research firm Technomic. Rather than relying solely on discounts, operators are leveraging limited-time offers and creative value propositions to attract and retain customers. Hispanic food retailers can capitalize on this trend by introdu- cing value-driven promotions around popular Hispanic staples or seasonal specialties. Millennials, now entering middle age, are driving demand for health-conscious options, global flavors and adaptable menu formats. Cold brew coffee and well- ness beverages—both trending among this demographic—offer Hispanic retailers a chance to expand beverage programs with Latin-inspired twists, such as horchata cold brew or aguas fres- cas with functional ingredients. Another theme at this year’s show was the rapid adoption of technology across all facets of foodservice. More than 300 companies in the technology pavilion showcased advancements such as AI-powered grill monitoring, smart refrigeration, robotics and next-gene- ration ordering systems6. For Hispanic food retailers, these tools offer pathways to streamline kitchen operations, reduce labor costs and ensure consistency— critical advantages as staffing challenges and tight margins persist. The NRA Show also underscored the importance of networking and collaboration. Special events, live culi- nary demonstrations and expert-led tours provided attendees with firs- thand exposure to trending brands and products. Hispanic food retailers can benefit from these connections by discovering new suppliers, learning best practices and staying ahead of culi- nary trends that influence customer preferences. 64 JULY / AUGUST 2025 ABASTO.COM …Continued from page 62

FOOD INDUSTRY 66 JULY / AUGUST 2025 ABASTO.COM Hispanic Snacks: A Family Affair with A Family Affair with Intense Flavors Intense Flavors Cargill study Emotions drive American snacking By Violeta Montes de Oca C argill recently unvei- led key findings from a new snacking study, highlighting the pervasive role of snacking in American diets, including findings among Hispanics. The study finds that while some consu- mer segments prioritize nutrition in their snacking choices, others are driven by lifestyle and emotio- nal needs. In an exclusive interview for Abasto Media during the Sweet and Snacks Expo 2025 at Indianapolis, Janna Mauck, Senior Marketing Manager for Snacks and Cereal at Cargill, shared Hispanic related insights from a new snacking study. Conducted in November 2024, Cargill surveyed more than 4,400 U.S. consumers—including teens and adults—to uncover the why behind snack choices, not just the what. Zeroing in on the conventional side of snacking, the survey unearthed three core snac- king personas — Guiltless Grazers, Impulse Munchers, and Emotional Snackers. The study, said Mauck, revealed that over 90% of consumers snack at least once daily, and nearly 60% snack two or more times a day. The study delved into what drives these choi- ces, examining a broad spectrum of consumers, from those strictly seeking healthy options to others craving indulgent, traditio- nal snacks. Hispanic Snacking: A Family Affair with Bold Flavors Cargill's research took a deeper dive into specific consumer demographics, including a significant slice on the Hispanic popu- lation. This focused analysis uncovered unique and culturally resonant snacking patterns. A key theme that emer- ged was the family-centric nature of Hispanic snac- king. Unlike some broader consumer segments where individuals might prefer solo or private snacking, for Hispanic consumers, snac- king is frequently a shared, communal experience. "They're going to share more; it's more of a family occasion when they're snacking," Mauck confirmed. This deep emphasis on shared moments aligns strongly with the prevalent fami- ly-oriented values within Hispanic culture. When choosing snacks for these occasions, flavors and textures are paramount, often with a pronounced preference for spicy and culturally inspired options, over-indexing significantly compared to the general population. This "ethnic bold exploration of flavors" showcases a desire for vibrant and authentic taste experiences. Read more on page 68…

ABASTO.COM JULY / AUGUST 2025 67

68 JULY / AUGUST 2025 ABASTO.COM Guiltless Grazers Guiltless Grazers snack all day, snack all day, with no regrets. with no regrets. They view snacking as an integral part of their daily rhythm. Two-thirds graze all day long, and they do so unapologetically. Boredom is a key driver — 80% snack when bored, and flavor matters more than func- tion. Guiltless Grazers don’t let dietary rules dictate their enjoyment. For this segment, snacking is about indulgence and guilt has no place at the table. Impulse Munchers Impulse Munchers satisfy cravings satisfy cravings in the moment in the moment They reach for small indul- gences whenever cravings or boredom strike. But they’re not without remorse for their snacking habits: Nearly eight in ten (78%) admit to feeling snack guilt. Yet, while many aspire to smarter choices, taste typically wins out. Emotional Emotional Snackers Snackers chose comfort chose comfort over calories. over calories. Snacking is emotional therapy for this group, but it’s often done in secret, away from prying eyes. Nine in ten (92%) snack when they’re anxious or stressed, 90% report guilt after overindul- ging and 87% wish they made healthier snack choices. However, despite post-snacking regrets, nutrition is often sidelined to decompress after a hectic day. American Snackers: Three Key Segments Three Key Segments Beyond Indulgence: Purposeful and Sustainable Choices +90% +90% of consumers snack at least once daily While indulgence remains a significant driver across all consumer segments, the Hispanic demographic revealed an interesting layer of complexity. Beyond seeking bold and satisfying flavors, Hispanic consumers also demonstrate a strong preference for snacks that offer a functional purpose. They are actively looking for snacks that can help them increase focus or relieve stress, a desire often asso- ciated with healthier snack choices. Even more notably, the study revealed a heightened awareness and preference for environmentally friendly snacks within the Hispanic demographic. This particu- lar data point over-indexed considerably compared to the general population, highlighting a strong incli- nation towards sustainable consumption. Mauck noted this was an "interesting" finding, indicating that environmental considera- tions play a more prominent role in their snacking deci- sions than in other groups. This suggests a potential …Continued from page 66

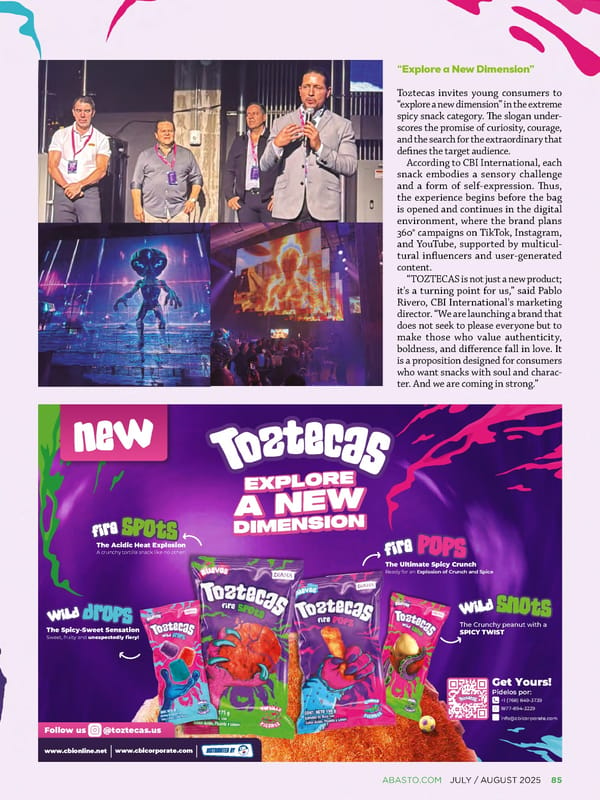

Kit para Micheladas La Fiesta Comienza aquí CS International Services, INC, Phone: 1 800-704-0038 Email: customerservice@csinternationalservices.com www.chipinqueusa.com Join Us: @Chipinque_USA BUSCAMOS DISTRIBUIDORES BUSCAMOS DISTRIBUIDORES BUSCAMOS DISTRIBUIDORES BUSCAMOS DISTRIBUIDORES (787)- 287- 0499 INFO@ACBRANDEXPORTS.COM ACBRANDEXPORTS.COM AECARTAGENA@ACBRANDPR.COM Canned Vegetables IQF Vegetables and Fruits IQF Tubers Vegetables LOOKING FOR DISTRIBUTORS WE ALSO MAKE PRIVATE LABELS & MORE ABASTO.COM JULY / AUGUST 2025 69