Abasto Magazine January / February 2026 ENGLISH

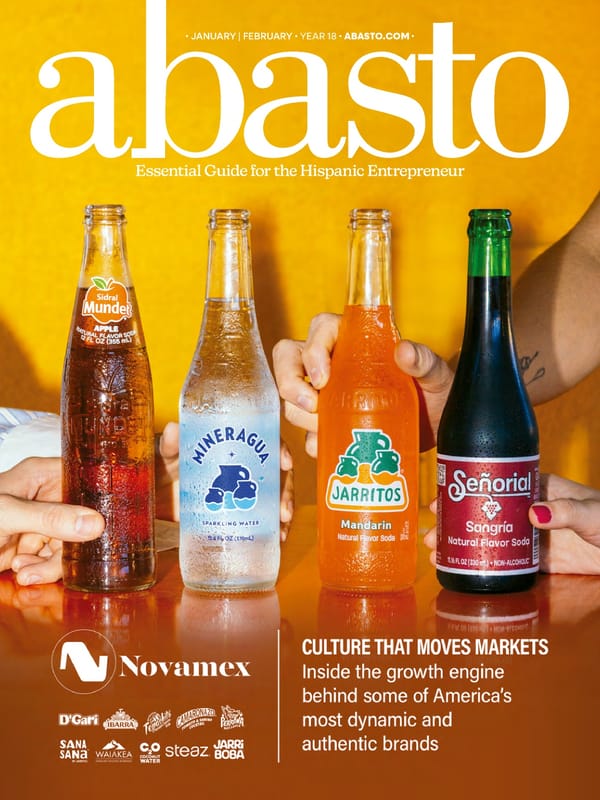

This issue explores the dynamic and authentic brands driving market growth, focusing on Novamex's impact in the beverage industry.

Essential Guide for the Hispanic Entrepreneur JANUARY | FEBRUARY YEAR 18 ABASTO.COM

3 January | February 2026 abasto.com

4 January | February 2026 abasto.com Content JANUARY FEBRUARY 2026 Good business 50. SANE Foods Authentic flavor, guaranteed quality in every product. 52. Adobo for Birria Chef Merito presents the perfect seasoning. Advice 38. Exceptional Year 2026 arrives with force for global trade. 40. Retail Academy Private label as a strategy for stability. Agricultural Industry 44. Global Framework The IFPA launches an initiative that promotes sustainability. 46. In Figures Statistics on the blueberry market in the US. Focus 22. Technology Smart shelving is key to retail profitability. 26. Economy Survey reveals how Latinos rate Trumps economy. Food Industry 54. What 2026 Brings Industry leaders give their forecasts. 58. New Frontiers scar Gonzlez details Vallarta Supermarkets plans. 60. Evolution of tastes Analysis of how stores should operate in 2026. 64. The Next Chapter Interview with the leaders of Northgate Gonzlez Markets. 74. Commitment Sedanos expands its support for the community. Cover 30 54 22 58 38 60 50 52 46

5 January | February 2026 abasto.com

6 January | February 2026 abasto.com EDITORIAL D ear readers and friends of the Abasto family, Happy 2026! We begin this new cycle with renewed energy and the certainty that together we will continue to witness and play a leading role in the evolution of our industry. Each edition of Abasto seeks to offer you valuable information, in-depth analysis, and practical tools so that your businesses can continue to grow and adapt to market changes. In this issue, we highlight several arti- cles that reflect the trends and challenges that will mark 2026. On page 54, you will find forecasts from industry leaders, who- se statements were obtained exclusively by our star journalist Violeta Montes de Oca, who gives us a direct insight into the expectations and strategies for this new year. Also, on page 60, Ron Margu- lis analyzes the evolution of consumer tastes and offers key recommendations for stores to operate effectively in 2026 by better understanding their customers needs. In addition, we reaffirm our commit- ment to staying close to decision-makers. Recent interviews and reports on Vallar- ta Supermarkets, Northgate Gonzalez Market, and the growth of Sedanos in Florida were obtained exclusively by our senior journalist Hernando Ramrez-Santos, showing how we are strengthening ties with market leaders and offering first-hand information that drives decision-making in our industry. In the economic sphere, we present an exclusive Pew Research Center survey that reveals how Latinos perceive the economy under the Trump administra- tion, a key indicator for understanding the context in which our businesses and communities operate. In 2026, at Abasto we remain commi- tted to providing you with content that not only informs but inspires action and smart decisions. Thank you for being part of our great family. May this year be full of opportunities, growth, and shared achievements. With affection and enthusiasm Executive Director Renewed Energy in 2026

7 January | February 2026 abasto.com

8 January | February 2026 abasto.com Colaboradores Gerente General / General Manager Gustavo Calabro gcalabro@abasto.com 336.724.9718 x.204 Diseo Grfico / Graphic Design Orlando Rivera orlando.rivera@abasto.com 336.724.9718 Departamento Editorial / Editorial Department Hernando Ramrez-Santos hramirezsantos@abasto.com 336.724.9718 x.201 Violeta Montes de Oca vmontesdeoca@abasto.com 336.724.9718 x.203 Cuentas Nacionales / National Accounts Eliana Lankerd elankerd@abasto.com 336.724.9718 x.202 Ventas Mxico-Latam / Sales Representative LATAM Marcela Chaves dianac@abasto.com 336.724.9718 x.206 Xochitl Oliva xoliva@abasto.com 713.363.0385 Juan Pablo Madero jpmadero@abasto.com 52.1.333.167. 8502 Administracin & Eventos / Administration & Events Fernanda P. Walker fernanda.pineros@abasto.com 336.724.9718 x.213 Redes Sociales / Social Media Danna Guevara dannag@abasto.com Publicidad / Advertising advertising@abasto.com 336.486.2424 Suscripciones / Subscriptions info@abasto.com Ana Mara Triana Psychologist & Business Consultant. She is Marketing Director of AnaBella Dried Food. Ramn Portilla Founder HumanX Insights. Visionary leader in customer insights. Passionate about CX. Innovator in Insights technology Julio Ibez Retail Executive, International. CEO of Aurora Grocery Group and President of the Hispanic Retail Chamber of Commerce. Diana Leza Sheehan Founder of PDG Insights with over 25 years of experience, she helps brands and retailers make strategic decisions using data. Doreen Colondres Latina chef, tireless traveler, graduate and certified in gastronomy and wines, and owner of the Vitis House school. Ken Ninomiya Omnichannel marketing and e-commerce ex- pert. Award-winning marketing professional, professor, author, and strategist. Ricardo Gaitn Branding specialist. Master in Marketing Mana- gement Universidad San Plablo. Author of the book: 101 useful branding tips Ron Margulis Director de RAM Communications, LLC. He is a journa- list specializing in the food industry. abastomedia abastomagazine abasto abasto Abasto es una revista bimestral de circulacin nacional publicada por Hispanic Marketing Consultants, Inc. P.O. Box 20577 Wins- ton-Salem, NC 27101. Todos los derechos reservados. Prohibida la reproduccin parcial o total de su contenido sin previa autori- zacin del Editor. Abasto investiga la seriedad de sus anunciantes, pero no se hace responsable del contenido de las ofertas. Las opiniones expresadas por los autores y contribuyentes que colaboran en esta revista no son necesariamente compartidas por los editores o representantes de HMC (Hispanic Marketing Consultants) Abasto Media.

10 January | February 2026 abasto.com Starter H-E-B opens three stores H-E-B celebrated the opening of its new locations in Jordan Ranch (Houston) and Rockwall (Dallas-Fort Worth). In addition, Joe Vs Smart Shop officially opened its first store in Irving, Texas. Consumer trends for 2026 KeHE Distributors has released its five macro trends that will define the food and beverage industry in 2026. Back to basics Consumers are opting for simple, minimally processed foods that are connected to real people and places. The power of protein The next wave combines protein with fiber for more satisfying, nutrient-rich meals. Global cravings Sales in the ethnic aisle increased 2.9% in 2024, reaching $9.35 billion, outpacing total supermarket growth. Designing wellness The growing food as medicine mindset is strengthening shoppers connection to brands. The informed shopper Nearly 49% of Americans plan to buy less, and 40% expect to switch to cheaper brands. The Winn-Dixie Company Southeastern Grocers will sell 32 Winn-Dixie stores and eight Harveys Super- markets in Alabama, Georgia, Louisiana, and Mississippi. The company will maintain operations in southern Georgia, including Brunswick, Folkston, Lake Park, St. Simons Island, and Valdosta. The closures and rebranding would take place in early 2026, coinciding with the offi- cial launch of The Winn-Dixie Company. Trends In quotes marks All residents deserve reliable and affordable food options. Illinois food initiative strengthens small businesses, opens stores in food deserts, and stimulates the state economy. Governor Pritzker on the construction of a grocery store in Venice, Illinois. 2407 W Airport Fwy., Irving, Texas. 29711 Jordan Crossing Blvd. Jordan Ranch 1600 E. Interstate 30, at the corner of S. John King Blvd., Rockwall

11 January | February 2026 abasto.com

12 January | February 2026 abasto.com

13 January | February 2026 abasto.com

14 January | February 2026 abasto.com IN THE NEWS A Grand Opening Celebrates Culture and Freshness BY ABASTO S upermercado Nuestra Familia stren- gthened its presence in Kansas with the opening of a new store in Topeka, where hundreds of customers lined up early to explore authentic products and commu- nity-focused services. The opening marked a key step in SpartanNashs strategy to ex- pand its footprint in neighborhoods where Latino culture and flavor play a central role. Located at 2021 SE 29th St., the 50,000-square-foot store offers an expe- rience that blends tradition, fresh ingre- dients and culinary offerings tailored to residents of Highland Crest, Central Hi- ghland Park, Oakland and other neighbor- hoods in southeast Topeka. An Authentic Experience The new Topeka store delivers a traditional market atmosphere designed to highlight freshness, authenticity and convenience. Key features include: Full-service tortilleria. Bakery. Wide selection of Hispanic products across produce, meat, dairy and grocery categories. Extensive assortment of dried chiles and spices. Fresh aguas frescas and horchata prepa- red daily. Fresh-cut fruit and vegetable options. Full-service meat department. Deli offering tamales, enchiladas, rice, beans and hot prepa- red foods. Castillo said the store reflects the cultural identity of the commu- nity it serves. We want to welco- me customers with exceptional service, an outstanding selection of Hispanic products and a place where they can find everything they need, he said. Festive Opening From the moment doors opened, the atmosphere turned festive. A local ma- riachi band, joined by a dance group, set the tone as families enjoyed childrens activities, tastings and giveaways. As the morning progressed, lines grew and aisles filled with shoppers who value having a supermarket that honors their culture. During the ceremony, the SpartanNash team presented a $5,000 donation to Hi- ghland Park High School, reinforcing its commitment to education and communi- ty development. Supermercado Nuestra Familia opens its fifth store Our new store represents the essence of Topekas vibrant Hispanic community, honoring its flavors and traditions. Joaqun Castillo Store director. Continues on page 16

15 January | February 2026 abasto.com

16 January | February 2026 abasto.com Growth Strategy Jay Mahabir, SpartanNash vice president of retail operations, said the Topeka ope- ning underscores the importance of the Supermercado Nuestra Familia banner within the companys portfolio. Our Supermercado Nuestra Familia banner is an essential part of our near- ly 200 stores across 11 states, and we are proud to serve the Topeka community with fresh, authentic food solutions, Ma- habir said. Whether you are looking for specific ingredients or want to try new fla- vors, we invite you to visit our newest store and experience everything it offers. SpartanNash will also open its sixth Su- permercado Nuestra Familia store later this month in Omaha, Nebraska. The loca- tion will feature a compact format focused on everyday convenience. Commitment to Quality and Community Since its founding in 2013, Supermer- cado Nuestra Familia has maintained a clear mission: to deliver quality, convenience and a strong cultural connection. The strong response from the Tope- ka community highlights the banners relevance and reinforces Spartan- Nashs vision of bringing better food experiences to more communities. With the new Topeka location, the company continues to expand its reach while deepening its commit- ment to families who value authentic freshness and traditional flavors. Continuation of page 14 IN THE NEWS

17 January | February 2026 abasto.com

18 January | February 2026 abasto.com Chavez Supermarket Strengthens Presence in the Bay Area The grocery store chain opened its 12th location, revitalizing key Newark commercial corridor BY ABASTO C havez Supermar- kets arrival in Newark marks a new chapter for the Thorn- ton Avenue commercial corridor. The family-ow- ned chain, founded in 1984 by David Chvez, opened its 12th Bay Area store, reinforcing its commit- ment to providing fresh products and ingredients that keep Hispanic culi- nary traditions alive. The building had remai- ned vacant for more than a year following Big Lots clo- sure during the companys bankruptcy. With Chavez Supermarkets opening, the space is now active again, adding energy to a sector where many communities continue to face high vacan- cy rates. The store serves as a clear example of how stra- tegic investments can drive economic revitalization. Boosting the Local Economy Local officials welcomed the return of commercial activity to the building. Deputy Mayor Eve Marie Little highlighted the su- permarkets positive im- pact for residents and bu- sinesses. Speaking to Tri-City Voice , she noted that the chains arrival expands access to fresh products, creates jobs for area fa- milies, and strengthens Newarks economy. She added that the brands re- putation builds confiden- ce in a diverse region with strong demand for cultura- lly significant products. A Store Designed for the Community The new supermarket fea- tures full-service meat and seafood departments, a deli, a bakery with custom cakes, and the traditional Chavez Taquera, offering a menu inspired by au- thentic Mexican flavors. The store also includes a home goods section with essential kitchen tools for Hispanic cooking, such as tortilla presses and molca- jetes, supporting traditio- nal culinary practices. Renovated Space, Stronger Community Chavez Supermarket not only reactivates a vacant space but also provides a gathering point for Newark fami- lies. The company cele- brated the opening with community activities, live music, tastings and giveaways, reinforcing its commitment to the areas cultural identity. Thanks to its strate- gic location, ample par- king and strong brand recognition, the store is well-positioned for sustained growth. With this new location, the city gains expanded ac- cess to fresh products and essential services, while the chain stren- gthens its presence in one of the states most dynamic regions. IN THE NEWS

19 January | February 2026 abasto.com

20 January | February 2026 abasto.com Chevron Announces Leadership Changes Mindy K. West Takes Helm at Murphy USA Murphys Board of Directors announced that Mindy K. West, formerly the Chief Operating Officer, has now assumed the roles of President and Chief Executive Officer (CEO). Ms. West has also joined the companys Board of Directors. Ms. West succeeds Andrew Clyde, who previously served as President and CEO and retired from the Board of Directors on December 31, 2025. Sunoco Finalized Parkland Acquisition Sunoco LP officially closed the ac- quisition of Parkland Corporation on October 31, 2025. This major indus- try transaction, which concluded last quarter, solidified the expansion of the Sunoco enterprise. As part of the deal, Parkland sha- res were delisted from the Toronto Stock Exchange on November 4, 2025. Investors received Common Units of SunocoCorp LLC (SUNC), which successfully began trading on the New York Stock Exchange on No- vember 6, 2025. This completed the public steps of the merger, marking a significant structural shift in the fuel and convenience store sector as we enter the new year. In the fall of 2025, Pilot, the largest travel center network, invested significantly to improve the experience for all drivers. The company focused on physical upgrades, digital enhancements, and expansion of its EV charging network. Pilot completed 14 curb-to-counter re- novations and added 11 new dealer loca- tions across its network since July 2025, expanding convenience for drivers na- tionwide. Digitally, Pilot launched mobile orde- ring in select markets, aiming for nearly 400 locations by year-end, and renamed its app to the Pilot app for better user in- tuition. Pilots Network Enhancements Chevron Corporation an- nounced the appointment of Amit R. Ghai as Contro- ller of Chevron, effective March 1, 2026. Ghai will succeed Alana K. Knowles, in anticipation of her ex- pected retirement from Chevron in April 2026, af- ter 38 years of service. Ghai will lead Chevrons accounting policy, corpo- rate and external finan- cial reporting, internal controls, global business services and digital finan- ce teams. He will report to Eimear Bonner, Chevrons Vice President and Chief Financial Officer. Fact Ghai began his career in the industry in 1996 and joined Chevron in 2004 CONVENIENCE BRIEFS

21 January | February 2026 abasto.com

22 January | February 2026 abasto.com TECHNOLGY FOCUS BY ABASTO R etailers worldwide face a silent enemy eroding their mar- gins: inventory distortion. According to The Revenue Imperative for Modern Retail report by IHL Group, losses from out-of-stock items, overstocking or misplaced merchandise now reach $1.73 trillion annually. The report warns that traditional systems cannot REDEFINES RETAIL PROFITABILITY Global losses from inventory errors top $1.7 trillion annually keep pace with the demands of omnichannel commerce, where lack of accuracy li- mits profitability. The industry is embra- cing a clear solution: smart shelving. Shelf Technology Evolution The smart shelf combines sensors, computer vision, artificial intelligence and hybrid data capture to mo- nitor shelves in real time. What once seemed ex- perimental has become an essential operational tool. The study found that hi- gher-performing retailers prioritize inventory visibi- lity 208% more than lag- gards and are 136% more likely to adopt hybrid data capture systems. Data should prompt every retail executive to rethink their technology roadmap immediately.. IHL Group Key Features of Smart Shelving Continuous shelf monitoring Automatic out-of-stock alerts Planogram optimization Integration with mobile systems Hybrid data capture Omnichannel Increases The Pressure Out-of-stock items remain the biggest headache. When cus- tomers cant find a product, they simply shop elsewhere. IHL reports that the ave- rage consumer abandons a retailer after 2.5 to 3 out-of- stock experiences. The ur- gency is even higher among Prime users: 73% make an immediate purchase at ano- ther store via mobile. Continues on page 24 SMART SHELVING

23 January | February 2026 abasto.com

24 January | February 2026 abasto.com 57% higher customer satisfaction 55% reduction in labor costs 49% improved product availability 38% monetization of data with manufacturers Technological Maturity Drives Adoption After years of trial and error, the sector has rea- ched a tipping point. IHL states that over the past 18 24 months, smart shelving technology has achieved more than 95% accuracy even in complex stores. Today, nearly two-thirds of retailers have imple- mented or plan to adopt these solutions. Top-performing retai- lers are 94% more likely to invest early in new techno- logies. Those adding auto- nomous robots or upgra- ded smart shelves double their chances of leading in sales and profits. A Widening Gap The report identifies a growing divide between leaders and laggards. Hi- gh-performing retailers are increasing tech in- vestments 740% faster Continuation of page 22 Choose leadership. Act now. Execute with discipline. Expected Benefits 40%60% fewer labor hours Faster restocking Availability corrected in minutes, not days Immediate Impact on Efficiency Time to Act IHL concludes with a clear warning: the gap between adopters and those dela- ying smart shelving has reached critical levels. Leading chains are im- plementing the technolo- gy methodically, starting with high-turnover items and expanding to plano- grams, price integrity and data monetization. The competitive advan- tage built through smart shelving grows quarter by quarter. Falling behind is no longer an option. and project 460% higher IT budgets per store. Fixed cameras, mobile solutions and hybrid mo- dels dominate moderniza- tion strategies. Real-World Results: More Sales, More Efficiency Numbers tell the story. A ma- jor European supermarket chain increased availability from 90% to 95%, genera- ting over $4 million in annual profit. A North American pharmacy chain improved availability by only 4.5% but gained $55 million in additio- nal revenue. Retailers that have adop- ted the technology report 40%60% reductions in hours spent on manual inventory audits. Interven- tions now rely on precise AI alerts rather than end- less store rounds. TECHNOLGY FOCUS

25 January | February 2026 abasto.com

26 January | February 2026 abasto.com ECONOMY FOCUS LATINOS RATE TRUMP ADMINISTRATION ECONOMY BY HERNANDO RAMREZ-SANTOS N early a year into Donald Trumps second term, the Latino community in the United States faces a finan- cial climate they consider difficult and unpredicta- ble. Most view the eco- nomy with pessimism. A new report from the Pew Research Center re- flects this sentiment with clear figures: most Latino adults see a strained natio- nal economy, worry about their own finances, and feel the direct impact of ri- sing food prices. According to an October 2025 survey, 78% of Lati- no adults say economic conditions are only fair or poor, while just 22% rate them as good or excellent. Expectations for the fu- ture are also discouraging. Nearly half (49%) believe the economy will worsen in 2026, while only 28% anticipate improvement. Food prices continue to rise, and households feel the pinch every time they enter a grocery store. This sense of strain appears across all ages, income le- vels and geographic areas. The outlook contrasts sharply with Trumps cam- paign promise to streng- then the economy. Food and Housing Costs Drive Anxiety Nothing reflects the Latino economic experience be- tter than food costs. Pews survey shows 81% of Lati- Food prices keep rising, and my paycheck doesnt stretch. Housing costs make it impossible to plan for the future. no adults worry a lot or somewhat about food prices. Families report spen- ding more at supermarkets even when buying less. Many now follow weekly store specials with greater urgency. This concern transcends political lines. Regardless of whether respondents approve of the White Hou- se, they agree that feeding a family now takes a larger share of their paycheck than in past years. This is the reports most unifying economic concern. Two-thirds (67%) say they are very worried about food and essential goods, and 65% express strong concern over housing costs. These issues surpass worries over gas prices (53%) or job avai- lability (50%). Democratic-leaning Lati- nos report the highest levels of concern, but even among Republicans, daily expense anxiety is significant. Many families opera- te on tight margins. Even small increases in food, rent or utilities force them to make trade-offs. 22% Excellent/ Good: 78% Fair/Poor How Latinos Rate the U.S. Economy Continues on page 28

27 January | February 2026 abasto.com

28 January | February 2026 abasto.com Personal Finances Under Pressure Beyond the national eco- nomy, Latinos report per- sonal financial struggles. Nearly two-thirds (63%) rate their financial situation as fair or poor, while just 37% say it is good or excellent. Pews survey highlights widespread difficulty cove- ring basic needs: 35% had trouble paying for food in the past year 30% had difficulty paying rent or mortgage 30% struggled to cover medical care In total, 48% of Latinos re- port difficulty paying at least one of these essential expen- ses, signaling that inflation and stagnant wages continue to affect households. Trump Policies Seen as Harmful Economic dissatisfaction is tied to perceptions of Trumps policies. Sixty-one percent of Latinos say his economic policies have wor- sened conditions, while only 15% believe they improved them. Another 22% say they had little effect. These views align with broader criticism of the administration. About 78% of Latinos consider Trumps policies harmful to Hispanics, up from 69% du- ring his first term. 81% Food prices 65% Housing costs 53% Gas/Energy 50% Job availability Principales preocupaciones econmicas Financial Struggles in the Past Year Continuation of page 26 Looking Ahead: Limited Optimism Despite current challenges, some Latinos remain hopeful about their personal finances. Half expect their house- hold economic situation to improve in 2026, though they anticipate a general decline in the national economy. Optimism is limited because, for many Latino house- holds, the economy is not an abstract national debate. It is a daily calculation: How much will groceries cost this week? or Which bills can I pay before the next payday? 78% rate the economy as poor 61% say Trump policies worsened conditions 67% very concerned about food prices 35% Food 30% Rent/Mortgage 30% Medical care ECONOMY FOCUS

29 January | February 2026 abasto.com

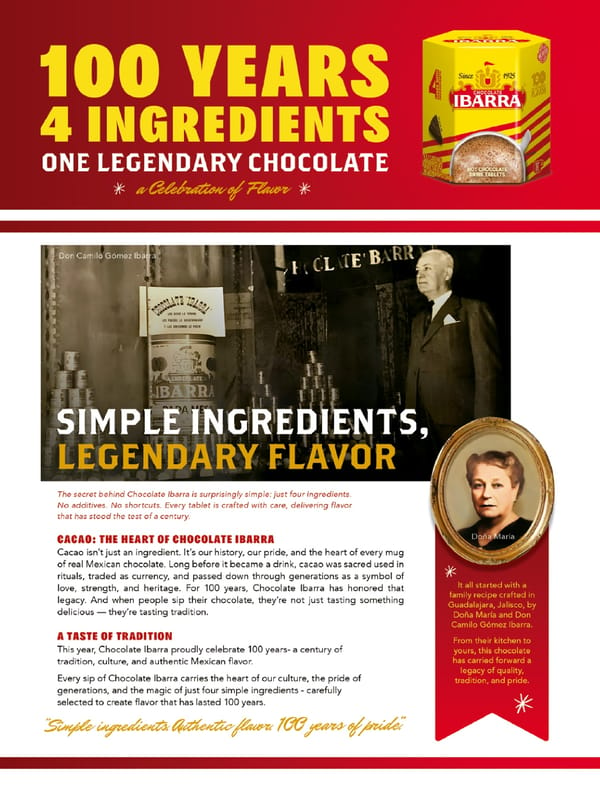

30 Enero | febrero 2026 abasto.com OUR COVER BY ABASTO W hat began as a small team delivering be- loved Mexican sodas like Jarritos, Sidral Mundet and Sangra Seorial to families longing for the flavors of home has grown into a vertically integrated giant. This is the story of how Mexican authenticity conque- red the U.S. market. Four decades later, Novamex stands as a fully vertically integra- ted company, present in more than a dozen beverage and grocery cate- gories, hundreds of SKUs, and tens of thousands of distribution points across the country. NOVAMEX THE CULTURE THAT MOVES MARKETS What began as a small team bringing the flavors of home to nostalgic families is now a vertically integrated giant. This is the story of how Mexican authenticity conquered the U.S. market A Clear and Powerful Mission At the heart of Novamexs evolution is a simple but powerful mission: share Mexican culture and natural products with the world while sta- ying true to authenticity, craftsmans- hip and quality. Guided by the company motto, Stay Unique & Super Good, Nova- mex has built a reputation based on integrity, respect and consistency values reflected in its operations and industry relationships. Few companies in the food and be- verage sector match Novamexs stra- tegic advantage. Its structure spans the entire supply chain, ensuring sta- bility even in turbulent markets: 1. Sourcing raw materials (fruit and cane sugar) 2. Bottling and formulation 3. Import and logistics 4. U.S. storage and distribution This ensures operational stability and reliable supply even in challen- ging market conditions. A Stellar Portfolio Novamex is more than sodas. Its ca- talog includes iconic, culturally roo- ted brands: Carbonated beverages: Jarritos, Sidral Mundet, Sangra Seorial, Mineragua, Tepachito, Sana Sana Wellness and natural: C2O Co- conut Water, Steaz Tea, Waikea Water Pantry and sweets: Chocolate Ibarra, DGari, Salsa La Perrona, Camaronazo

31 January | February 2026 abasto.com Global reach continues to grow; Jarritos alone now sells in more than 40 coun- tries. Authentic Brands Most of its brands originated in Mexico and have been shaped by generations of culinary tradition. That legacy resonates with consumers seeking authentic fla- vors and genuine cultural references. Authenticity remains what sets Novamex apart in a crowded market. Its appeal extends beyond the His- panic segment: Novamex brands are at home on supermarket shelves, in corner stores, convenience shops, food trucks, and restaurants. The secret? Bright colors, hi- gh-quality ingredients like cane su- gar and clean labels, and a vibrant personality that attracts any shopper seeking global inspiration. Diversity in the Portfolio The companys broad and growing portfolio includes: Fruit-flavored sodas Sparkling water and coconut water Organic teas and premium waters Essential Mexican pantry items These categories are thriving, driven by trends toward no-sugar, healthier, and culturally authentic options. Long-term trust has been earned through unwavering authenticity, exceptional quality control, and na- tionwide consistency. Novamexs fully integrated model ensures every stepfrom sourcing fruit and cane sugar formulation to bottling, transportation, and marke- tingaligns with its commitment to freshness and value. Retailers benefit from a partner who not only delivers reliably but also invests heavily in marketing, shopper engagement, shelf execu- tion, and promotional programs that drive measurable demand. Innovation: Looking Ahead Looking forward, Novamex sees significant room for expansion. Flagship brands like Jarritos, Sangra Seorial, Sidral Mundet and Mineragua retain untapped potential in large, competitive beverage categories. At the same time, the company is accelerating innovation: Calorie-free and prebiotic sodas Flavored sparkling waters New can formats, refrigerator packs, and mixed packs Cultural Connection and Future Vision Today, Novamex is firmly positio- ned as a force in U.S. retail. The company strengthens cultural re- levance through advertising, colla- borations, and lifestyle brand part- nerships, creating an emotional connection with consumers. With nearly 40 years of consis- tent growth and a disciplined vi- sion, Novamex is not merely kee- ping pace with changing tastes; it is actively shaping the next era of flavor-driven, culture-inspired con- sumption. KEY FACT:

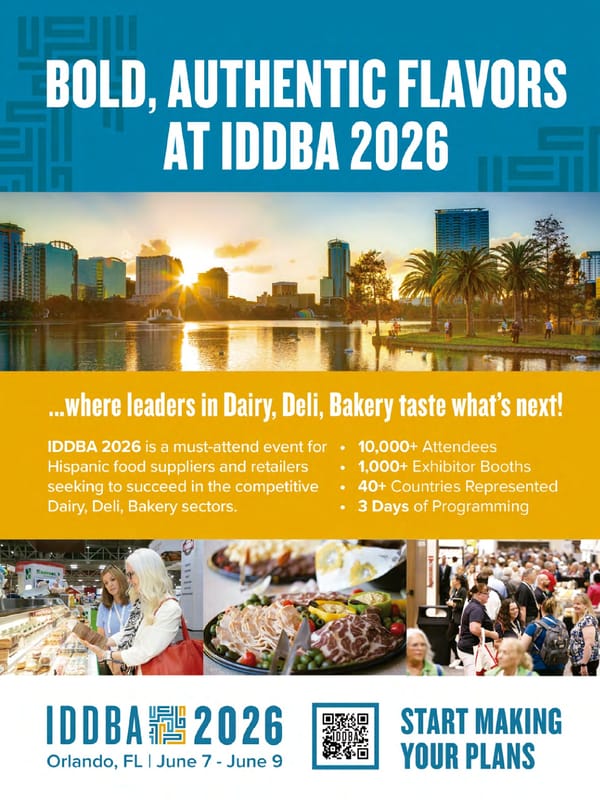

32 January | February 2026 abasto.com Thinking outside the aisle with highest margins, innovation and loyalty BY VIOLETA MONTES DE OCA T he International Dairy Deli Bakery Association (IDDBA) Show provides depth across three essen- tial departments that drive some of the highest margins, innovation, and shopper loyalty in grocery. Ne- vertheless, there are even more reasons to attend this uni- que event in Orlando on June 7-9, 2026. IDDBA fosters un- matched access to senior-level retail leaders, buyers, and influencers who come ready to connect and collaborate. Registration opens mid-January! Lineup for IDDBA 2026 IDDBA 2026 will be introducing a lineup of new and enhan- ced experiences designed to inspire discovery, innovation, and connection across dairy, deli, and bakery. Retail Store Tours. Guided visits to Orlandos top-per- forming grocery stores to spark fresh merchandising and operational ideas. Innovation Showcase Awards. Their first-ever awards spotlighting the most innovative and impactful new pro- ducts shaping the year ahead. Close Up Kitchen with Celebrity Talent. Enhanced meet-and-greets and culinary demos featuring celebrity chefs and personalities, bringing fresh food creativity cen- ter stage. Champions of Change Recognition. An expanded ce- lebration of industry leaders making significant contribu- tions across retail and the fresh food supply chain. Elevated Monday Night Party. A reimagined networking celebration with exhibitor collaboration and products! Join us at IDDBA2026, where our community is Thin- king Outside the Aisleconnecting dairy, deli, and bakery professionals through breakthrough insights, transforma- tive education, and bold collaboration to shape the future of our industry. If youre ready to be part of a more inspired, connected, and future-ready food landscape, this is the one show you cant miss, said David Haaf, CEO and President of International Dairy Deli Bakery Association (IDDBA). Educational and connection program IDDBA 2026 will deliver an educational program built specifically around the real-world challenges facing to- days B2B community. A few of their cant miss venues include the annual Whats in Store Trends presentation, where attendees receive a data-driven look at the forces reshaping dairy, deli, bakery, and fresh foods. IDDBA 2026 includes several dedicated areas designed to spark meaningful connections. One is the New Exhi- bitor Pavilion, which showcases companies exhibiting at IDDBA for the first time. By bringing these emerging brands together in one space, attendees can efficiently discover fresh innovations, explore new partnerships, and maximize their time on the floor. The Career Connection Live programming, built for those looking to start, grow, or pivot their careers within the food industry will present opportunities spanning culinary, R&D, food science, marketing, logistics, and more. Participants can meet industry leaders, explore career paths, engage in internship or recruitment conversations. Its a valuable plat- form for both job seekers and employers. 10,369 attendees 1,011 exhibitors 41 countries represented FOOD INDUSTRY IDDBA 2026 IDDBA 2025 Fresh-forward and future- focused, IDDBA 2026 is where leaders unite to Think Outside the Aisle and ignite the next big thing for dairy, deli, and bakery! David Haaf | CEO and President of IDDBA.

33 January | February 2026 abasto.com

34 Enero | Febrero 2026 abasto.com SHOWCASE CRUNCHY JALAPEOS New! More than 70% of households in this category consume it, seeking no- velty and authentic flavor. Ideal for toppings and as a snack. Include them on your shelves. vilore.com sales@vilore.com (210) 509-9496 QUE LO TIENE TODO UN AO NUEVO The real momentum behind the start of 2026 lies in tradition and flavor. These products offer much more than just food; they are the energy, authentic touch, and cultural connection you need to start off with a bang. By incorporating these vibrant flavors, your start will be authentic, energetic, and a comple- te success! pepito.global sales@pepito.global PEPITO USA Pepito USA offers a delicious variety of flavorful snacks with over 50 years of tradition. From Japanese- style peanuts to corn churros, we combine quality with that homemade touch that connects you to your roots. Enjoy 2026 with Pepito! LA BOTANERA Offers bold Mexican Street Style fla- vor with natural chilies. Dye-free and with a balanced taste that everyone enjoys. La Botanera is the trusted choice for any host. Authentic and vibrant, it enhances every snack with the real flavor and tradition of street food. mega-foods.com (972) 482-7708

35 Enero | Febrero 2026 abasto.com LA MODERNA We are proud to bring authentic Mexican flavor to the United States. Our pasta, made with quality ingredients and a tradition that endures, transforms each dish into an experience full of history and flavor. Authentic Mexican flavor in every bite! lamodernausa.com +1 (817) 506-3535 LAGO DE CHAPALA The 5-oz salsa display comes with three authentic flavors: rbol, Red Habanero, and Poblano & Habanero. Practical and ready to display and sell. sanefoods.com.mx federico.wong@sane.com.mx ADD FLAVOR TO YOUR GATHERINGS IN 2026 For your gatherings and events in the new year 2026, Rancho Los Coyotes snacks are your best option. Add the authentic flavor of the most Mexican snack to all your moments and occasions with Rancho Los Coyotes snacks. We are looking for distributors (210) 500 5412. loscoyotes.mx Botanas Rancho Los Coyotes

LISTTO+ LISTTO+ revives the flavors of home, bringing whole beans and the new and delicious chao mein to your table, which you can prepare with your traditional recipes. Each LISTTO+ product embraces our roots and brings the family together in the kitchen, keeping the taste of home alive no matter the distance. alimentoslistto 36 Enero | Febrero 2026 abasto.com SIGMA FUD Enjoy this New Year with La Chona products and share flavors with your family that unite, pamper, and celebrate the good things to come. Start the year around the table, with moments full of taste and closeness. fudusa.com laChonaUsa LaChonaUS SALSA HUICHOL At Salsa Huichol, were adding flavor to the new year 2026. We appreciate your preference during 2025 and invite you to continue accompanying all your favo- rite dishes with Salsa Huichol in 2026. Follow us and tag us on our social media. #SalsaHuichol #OuterSpiceFlavor #Sal- saHuicholUSA Salsa Huichol USA MOLE DE LA PREFERIDA Enjoy the intense flavors of Oaxacan-style mole, made with a rich blend of chilies, spices, seeds, nuts, and a touch of chocolate. This authentic sauce offers a smoky, earthy, and sweet flavor that brings gourmet tradition to your kitchen. lapreferida.com 1 (800) 621-5422 info@lapreferida.com SHOWCASE

37 January | February 2026 abasto.com

38 January | February 2026 abasto.com ADVICE BY RICARDO GAITN BRAND ANALYST 2026: An Exceptional Year For Global Commerce 2026 is set to be an exceptio- nal year for global trade, driven by the convergence of two major events captu- ring worldwide attention: the FIFA World Cup in the United States, Canada, and Mexico, and the 250th an- niversary of U.S. indepen- dence. Both are expected to generate significant economic momentum through consumption and tourism. A World Cup Beyond Sport The introduction of the 48- team format in the World Cup represents more than a sporting change; it is a business strategy of enor- mous economic scale. Re- venue from broadcasting rights is expected to reach unprecedented levels due to expanded global au- diences, while sponsors- hips gain fertile ground to align brands with the worlds most visible spor- ting event. Celebrating 250 Years Meanwhile, the U.S. ses- quicentennial offers a uni- que platform to reinforce its international image as a leader in democracy, di- versity, and innovation. Hi- gh-profile commemorative and cultural events, along with global collaborations in science, technology, and sustainability, provide an opportunity to strengthen the countrys global lea- dership. In sports, excitement is amplified by more parti- cipating nations and fans eager to experience the World Cup, whether in sta- diums or through media broadcasts. The Lucrative World Cup Business These events translate into assured financial prosperi- ty for FIFA and its member associations, cementing the organization as a ma- jor global economic pla- yer. FIFA President Gianni Infantino has said, Foot- ball is much more than a game... it is a business. Commercially, the 250th anniversary stren- gthens strategic part- nerships with local and international companies, encourages foreign in- vestment, and expands the global reach of U.S. brands, reinforcing the countrys position as a world power both symbo- lically and economically. The FIFA-expanded for- mat also creates opportu- nities for more nations to qualify, making the qua- lifiers more inclusive and competitive and potentia- lly raising the overall stan- dard of global football. In the new format, the group stage features 12 groups of four teams each, with the top two from each group, plus the eight best third-place teams, advan- cing to the round of 16. This structure generates more matches and engagement. A Dual Boost For the U.S. Economy The simultaneous celebra- tion of these two events in the United Statesone sporting, the other histo- rical and culturalwill dominate international attention. They are expec- ted to provide a significant economic boost throu- gh consumer spending, tourism, and marketing, offering brands extensive media visibility and global reach associated with this rare convergence.

39 January | February 2026 abasto.com

40 January | February 2026 abasto.com BY JULIO IBEZ JULIO@JULIOIBANEZ.NET Private Brands as a Strategy for Stability and Loyalty W e are living through one of the most challenging socioecono- mic periods in recent years. Inflation continues to bite, supply chains are still adjusting, operating costs re- main high, and consumers have be- come more selective, multichannel, and extremely price-sensitive. In this scenario, independent retai- lers face two choices: resist or evolve. Evolution inevitably involves stren- gthening private brand strategies as a way to regain margin, deliver real value, and reinforce our identity as Hispanic supermarkets. This is not a new topic in this series, but it is urgent. Today, private brands are no longer a supplementthey have become the heart of a smart as- sortment. A Consumer Who Compares More and Demands Value Shoppers want to save without sa- crificing quality. They know private brands strike that balance and act ac- cordingly. Major chains proved this years ago: Aldi and Lidl built their models almost entirely around pri- vate labels. Walmart, Kroger, Ahold, and Target rapidly expanded their portfolios to meet a more value-dri- ven, rational consumer. Meanwhile, independent retailers are just starting this journey, some- times constrained by scale or bar- gaining power. Even so, the time to move forward is now. Why They Are Essential for Independent Retailers 1 Deliver real savings to custo- mers. In a context where households are budgeting carefully, private brands offer controlled quality at reasonable prices, encouraging repeat visits and strengthening loyalty. 2 Differentiate the independent supermarket. In fresh produce, we already com- pete on quality and service. But in grocery, where competition is fierce, differentiation is harder. A strong private brand provides identity, con- sistency, trust, and exclusivity. 3 Improve inventory and supply control. Private brands allow for more pre- dictable planning, stable agreements with suppliers, and direct control over quality and volumes. Two Clear Paths for Independents 1 Partnerships with established private brands. This route is ideal for rapid progress. It offers high-turnover SKUs, mo- dern packaging, ready certifications, and bargaining power through com- bined volume. It allows immediate competition without development costs. 2 Develop your own private brand. This path takes longer but delivers greater strategic impact. It requires building identity, selecting manufac- turers, designing branding, con- trolling quality and margins, and, Retail Academy if feasible, scaling regionally or nationally. For growth-focused chains, it is the most powerful option. The Challenge: Decide and Act Quickly Hispanic consumers compare, seek price, but also value authen- ticity and connection. Now is the time for stores to: Eliminate SKUs that add no value. Consolidate categories with strategic private brands. Strengthen communication about quality and savings. Leverage strength in fresh pro- duce to build trust in grocery as well. Private brands are more than a productthey are a promise, a lo- yalty tool, and a strategy to navigate uncertain times with stability. As Hispanic retailers, we must offer quality while protecting our communities wallets. Private brands allow us to achieve both. The 20252026 period will distinguish independents who embraced this strategy, winning share, retention, and relevance in their neighborhoods. The time to act is now. ADVICE

41 January | February 2026 abasto.com

FLAVOR FOCUS The Humble Potato: More Than a Basic Ingredient F ried, boiled, roasted, mashed, baked in a tortilla, pie or em- panada, the potato is the friend that never lets you down. This tuber is so glo- bally recognized that the United Nations designated May 30 as International Po- tato Day. It is a tribute to one of the great pillars of global cuisine a food that has eased hunger, nourished families, comforted souls, healed and even stirred emotions. Native to the Andes, the potato has crossed borders, kitchens and generations. In Peru, chefs such as Gas- tn Acurio elevate it to an art form, showcasing varie- ties that tell stories of alti- tude and tradition. In Argentina, Fran- cis Mallmann takes it to the fire like no one else. In Spain, few dispute the power of a well-made tor- tilla or bold patatas me- neas, Rioja-style or bravas. Lemon-roasted potatoes also win hearts in Greece. Potato pie is emotional heritage in Argentina. In Puerto Rico and across the Caribbean, few can resist freshly fried stuffed potatoes or a classic pasteln, just like grandma used to make. Beyond flavor and tradi- tion, the potato deserves recognition for its role in the fight against hunger. It is a resilient crop, requi- res less water than many others and delivers power- ful nutrition with just four ingredients: soil, sun, wa- ter and patience. Celebrating the potato is also celebrating everyones kitchen. BY DOREEN COLONDRES lacocinanomuerde.com Did you know? Spanish Potato Omelet (Tortilla de Patatas) Ingredients 8 eggs 6 yellow potatoes or medium russet potatoes, peeled and thinly sliced 1 white onion, peeled and finely chopped 3/4 cup high-quality extra virgin olive oil 1 garlic clove, finely chopped 1 chili pepper (optional) Salt to taste 20 minutes Directions In a medium skillet over medium-high heat, add the oil, onion, pota- toes, garlic, chili pepper and a pinch of salt. Cook until the potatoes are tender, stirring occasio- nally to ensure even coo- king. Meanwhile, beat the eggs in a bowl with a pinch of salt. When the potatoes are ready, drain them, reserving the oil, and discard the chili pe- pper. Once the potatoes cool slightly, gently fold them with the onions into the eggs, taking care not to break them. In the same skillet, add some of the reserved oil and heat over me- dium-high heat. Pour in the mixture, spreading it evenly. Lower the heat to me- dium-low and cook for 5 to 7 minutes on the first side. Using a flat plate larger than the skillet, flip the tortilla and sli- de it back into the pan. Shape it with a spatula if needed and cook for about 4 more minutes on the other side. Serve warm with fresh bread. 42 Enero | Febrero 2026 abasto.com A medium potato with the skin provides more potassium than a banana and nearly half of the recommended daily intake of vitamin C. From La Cocina No Muerde, by Doreen Colondres

43 January | February 2026 abasto.com

44 January | February 2026 abasto.com AGRICULTURAL INDUSTRY Initiative aims to drive climate action and supply chain accountability BY ABASTO T he International Fresh Produce Asso- ciation announced the development of a global sustainability framework for the produce and floral sectors to address growing environmental, social and economic pressures across the global supply chain. The project was introdu- ced during a planning ses- sion between IFPA leaders and representatives of The Consumer Goods Forum last October. It aims to esta- blish unified standards and practical tools to strengthen sustainability worldwide. A Response to Global Pressures Climate change, evolving consumer expectations and geopolitical tensions have increased the urgency for sustainable practices in agri- culture and distribution. Tamara Muruetagoiena, IFPA vice president of sus- tainability, said the new framework will provide members with reliable in- formation, validated prac- tices and a shared platform for transparency. The framework expands collaboration between IFPA and The Consumer Goods Forum under the Sustainable Supply Chain Initiative, which promotes transparency and respon- sible production. IFPA Launches Global Framework to Advance Sustainability in Produce And Flowers Sustainability is at the heart of what the fresh produce and floral community represents: caring for the planet while growing food and flowers to nourish and delight consumers, Tamara Muruetagoiena. This framework will pro- vide reliable information on sustainable tools and prac- tices, validate their adop- tion and offer a space to share the sectors progress, Muruetagoiena said. Phased Implementation with Global Reach The project will roll out in two main phases over the next year. The first phase, focused on the agricultural sector, will conclude in January 2026 du- ring Fruit Logistica in Berlin. The second phase, centered on the supply chain, will wrap up in July 2026. The official launch of the Global Sustainability Fra- mework for Produce and Flowers is scheduled for Oc- tober 2026 at IFPAs Global Produce and Floral Show. Toward Global Alignment IFPAs long-term goal is to harmonize sustaina- bility standards and pro- mote consistency across regions. With agriculture playing a key role in emis- sions and natural resource use, the framework is de- signed to help companies improve environmental performance without com- promising profitability or food security. The organization expects the effort to become a prac- tical guide for industry leaders, with measurable strategies to cut emissions, conserve resources and en- sure fair labor conditions. Collaboration For a Sustainable Future IFPA emphasized that colla- boration across the supply chain will be essential to achieve meaningful pro- gress. Growers, distributors, exporters and retailers will play active roles in imple- menting the framework. By strengthening global partnerships and sharing knowledge, IFPA aims to build a common foundation for sustainability and social responsibility across one of the worlds most dynamic agricultural sectors. Five Pillars to Advance Sustainability More than 120 members of the IFPA Sustainability Council and a global steering committee participated in developing the framework, ensuring an international perspective. The initiative is built around five priority pillars that will guide future actions: 1 Sustainable packaging 2 Regenerative agriculture 3 Food loss and waste reduction 4 Social responsibility 5 Climate change Each area will include specific goals, tracking me- trics and recommended practices to help growers and distributors assess and communicate progress.

45 January | February 2026 abasto.com

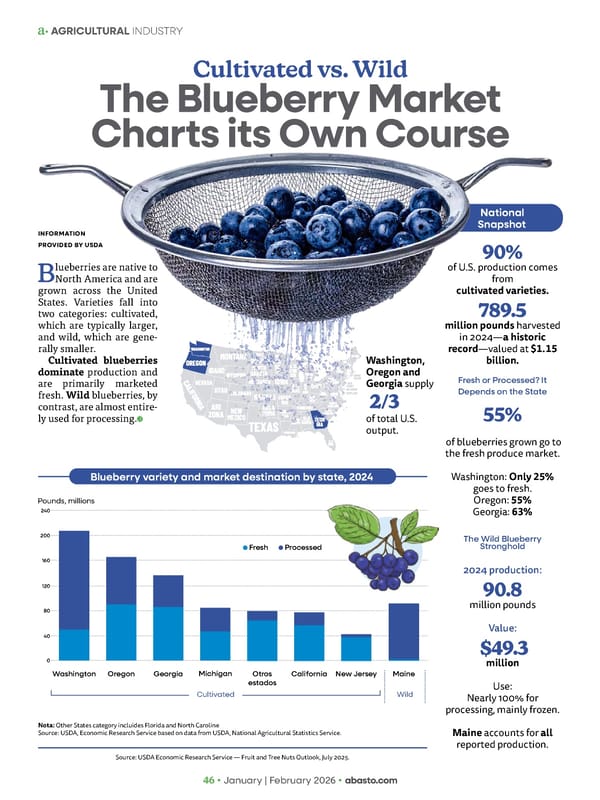

46 January | February 2026 abasto.com National Snapshot Cultivated vs. Wild The Blueberry Market Charts its Own Course INFORMATION PROVIDED BY USDA B lueberries are native to North America and are grown across the United States. Varieties fall into two categories: cultivated, which are typically larger, and wild, which are gene- rally smaller. Cultivated blueberries dominate production and are primarily marketed fresh. Wild blueberries, by contrast, are almost entire- ly used for processing. Source: USDA Economic Research Service Fruit and Tree Nuts Outlook, July 2025. 90% of U.S. production comes from cultivated varieties. 789.5 million pounds harvested in 2024 a historic record valued at $1.15 billion. Fresh or Processed? It Depends on the State 55% of blueberries grown go to the fresh produce market. Washington: Only 25% goes to fresh. Oregon: 55% Georgia: 63% The Wild Blueberry Stronghold 2024 production: 90.8 million pounds Value: $49.3 million Use: Nearly 100% for processing, mainly frozen. Maine accounts for all reported production. Washington, Oregon and Georgia supply 2/3 of total U.S. output. Blueberry variety and market destination by state, 2024 Nota: Other States category incluides Florida and North Caroline Source: USDA, Economic Research Service based on data from USDA, National Agricultural Statistics Service. Cultivated Pounds, millions Wild Washington Oregon Georgia Michigan Otros estados California New Jersey Maine 0 80 200 40 160 120 240 Fresh Processed AGRICULTURAL INDUSTRY

47 January | February 2026 abasto.com

48 January | February 2026 abasto.com BY ABASTO T he Organic Grower Summit named Arnott Duncan, founder of Duncan Family Farms, the 2025 Grower of the Year. The award, sponsored by John Deere, re- cognized his three-decade evolution from a small agritourism operation into an or- ganic agriculture innovator farming 3,850 acres across three states. A discovery that defined a career Duncans path to organic leadership began in the 1990s. While managing a farm stand and petting zoo that welcomed 30,000 chil- dren a year in Goodyear, Arizona, Duncan and his wife, Kathleen, composted daily waste from animals and farm operations. I didnt know it at the time, but it was compost, Duncan said. When they used the pile as fertilizer, he added, It was the most beautiful thing I had ever seen. The colors were vibrant and the texture was incredible. You couldnt see more perfect growth, and the flavor and texture were fantastic. That discovery cemented his commit- ment to soil health and organic production. He fully converted the operation and earned complete organic certification in 1994. Organic Future: Arnott Duncan Drives a New Agricultural Era Duncan Family Farms founder receives 2025 Grower of the Year award Duncan has built a reputation as an innovative leader advancing compost- based soil health. Matt Jungmann | Senior director of events at Farm Progress Community impact beyond the farm Beyond production, Duncan Family Farms donates more than 10,000 pounds of fresh organic produce each week to food banks, partners with schools to provide free organic salad programs and hosts educational days for new farmers. The operation supplies retai- lers including Sprouts Farmers Market and Albertsons/Safeway. Duncan received the award during the 2025 Organic Grower Summit in Monterey, California, an event that brings together growers and industry leaders to examine trends and innovations in organic agriculture. Innovation reshaping the fields Today, Duncan Family Farms operates one of the largest private composting facilities in the Southwest. The company processes 25,000 tons annually from manure, retai- ler food scraps and municipal green waste. Facilities in Arizona, Oregon and New York produce organic leafy greens, microgreens, melons, herbs and specialty vegetables. Duncan has also advanced water con- servation through automated greenhou- ses using Agbotic technology, which cuts water use by 90% compared with tradi- tional methods. The farm integrates cover crops, reduced tillage and laser weeding to achieve organic matter levels above the re- gional average. Arnott Duncan of Duncan Family Farms accepts the award from Greg Christensen of John Deere. AGRICULTURAL INDUSTRY

49 January | February 2026 abasto.com

50 January | February 2026 abasto.com GOOD BUSINESS SANE FOODS: AUTHENTIC FLAVOR AND INTEGRATED QUALITY The vertically integrated Mexican company guarantees flavor, quality, supply, and support for the growth of the category. BY VIOLETA MONTES DE OCA F or three generations, SANE Foods and its Chapala brand have maintai- ned an unwavering commitment to careful processes and authentic recipes. The value that has marked its history is quality with tradition, reflected in stable batches and consistent flavors. Integration, quality, and deep traceability SANE Foods is a vertically integrated com- pany. They grow their own premium chili peppers in Yahualica, Jalisco (with desig- nation of origin) and Chihuahua, and pro- cess everything in their own plant in Cha- pala, Jalisco, Mexico. In addition to their own brand, they offer contract manufacturing and co-ma- nufacturing services for global customers. The main benefit for retailers and distri- With 70 years of experience, total integration, and globally recognized quality, we guarantee authentic flavor, stable supply, and professional support to grow your category. SANE Foods innovation aligns with clear trends: Growing demand for spicy, authentic flavors with defined cultural pro- files. Expansion of categories such as Chili Crisp and Chamoy on international shelves. Consumer preferences for clean ingredients, interesting textures, and products that blend tradition with modernity. SANE Foods responds with differentiated formulations and a real focus on authentic flavor, such as its Chili Crisp with olive oil and crunchy tex- ture (in flavors such as seeds, original, and black garlic), and its Chamoy with a balanced sweet and sour taste and a cleaner, more natural profile. butors is total control of the supply chain, ensuring stability, consistent sensory pro- files, and the ability to develop innovative and reliable products. Traceability is deep and transparent: SANE Foods has detailed information per batch, including exact origin, growing area, harvest date, microbiological analysis, and more. This real competitive advantage offers verifiable quality and facilitates audits. Sustainability and professional support Sustainability is essential to ensuring con- tinuity and efficiency. The company drives continuous process improvements, reflec- ted in savings of nearly 100,000 liters of water since 2021 and ongoing studies to reduce its carbon footprint. SANE Foods is a trusted partner and co-manufacturer of leading sauces in the US, backed by international certifications that guarantee safety, quality, and global compliance, including FSSC 22000, CT- PAT, ISO 9001, and more. Its Distribution Center in Laredo, Texas, streamlines deliveries and market response. Innovation and global trends

51 January | February 2026 abasto.com

52 January | February 2026 abasto.com GOOD BUSINESS BY VIOLETA MONTES DE OCA B irria has transitioned from an authentic, tra- ditional Mexican dish to a massive consumer pheno- menon across the United States. This surge is reflec- ted in over 400% growth in birria menu items, a flavor profile that has expanded beyond Mexican restau- rants and carnicerias into general market locations and fast-food chains. For retailers looking to ca- pitalize on this trend, Chef Merito offers a high-quality and flavor solution with its Adobo para Birria. The adobo is a thick paste where all the chili is Chef Meritos Birria Adobo Fuels Meat Growth extracted and blended with traditional spices to create an authentic marinade, explains Lauren Corugedo. The secret is we dont skip on quality. We use traditio- nal chilies like guajillo, fo- cusing on a smoky, savory flavor, just as you would pre- pare it traditionally. Sales Performance and Loyalty Opportunity The products sales perfor- mance validates its mar- ket power: the Adobo para Birria has quickly become one of Chef Meritos top sellers, a category histori- cally dominated by their carne asada and chicken seasonings. The retail version has held the Best Seller tag on Amazon since its launch over two years ago, quadru- pling sales in comparison to the brands established top-selling products. For the B2B partner (re- tailers and meat depart- ments), this demand trans- lates into predictable sales success, especially in two key applications: Pre-Marinated Meat Trays: The trend of younger generations preferring pre-mari- nated meats is driving demand at the meat counter. Home Preparation: The adobo makes it easy for Hispanic fami- lies to prepare birria for celebrations, especially leveraging convenience trends like crock pots. Chef Merito offers a 22-pound bucket and cases of six 18-ounce jars, ensu- ring partners can meet the rising demand for a flavor that is rapidly becoming a household staple. Birria Takes Center Stage Adobo Flavor Profile: Provides a key flavor base with a perfect harmony of smoki- ness and heat, eleva- ting traditional birria (goat, beef, or lamb). Versatile Use: Ideal for braising, marina- ting, or seasoning for dishes like tacos and consomm. Top Trend: Birria ranked first place on the National Restau- rant Associations 2024 Top 10 Trends Overall. Creative Applications: Beyond traditional stews and tacos, creati- ves have incorporated the spicy, sweet, smoky flavor into sandwiches, nachos, poutines, and pasta. Social Media Po- pularity: Tastewise data identifies tacos, birria tacos, soup, and quesabirria as top ingredients by social share.

53 January | February 2026 abasto.com

54 January | February 2026 abasto.com FOOD INDUSTRY Abasto Media gathered insights from top industry voices to dissect the critical trends shaping the Hispanic market BY VIOLETA MONTES DE OCA T he retail and produce industries are poised for significant change. Abas- to Media interviewed key industry voices about their vision for the next 12 months, analyzing the major forces that will redefine the marketplace and how the Hispanic market can prepare. Will tariffs remain a dominant talking point? Will AI become a standard operational tool across the supply chain? And what regulatory changes will demand immediate attention? According to the Acosta Groups Consumer Predictions for 2026, success hinges on foundational trust: Brands and retailers must commit to transparency and authentic engagement to strengthen consumer loyalty in this ever-changing marketplace. Here is what the key industry voices had to say about the year ahead. KEY INDUSTRY LEADERS SHARE THEIR VISION WHATS NEXT? DANTE GALEAZZI PRESIDENT & CEO TEXAS INTERNATIONAL PRODUCE ASSOCIATION One of the biggest trends will be the indus- trys ongoing work to manage regulatory volatility and trade policy shifts, an issue that defined 2025 and continues into the year ahead. Companies are adapting by building more resilient logistics strate- gies, implementing faster compliance sys- tems, and strengthening communication with buyers who are navigating the same uncertainty. We also anticipate a renewed focus on climate resilience and water availability, issues that increasingly influence production decisions in both the U.S. and Mexico. The continued cultural and economic influence of Hispanic consumers remains a defining force. Their strong preference for fresh, flavorful, and culturally rooted

55 January | February 2026 abasto.com produce items is driving demand for tomatoes, peppers, mangos, avocados, berries, and other staple imports coming through Texas. Their purchasing power will continue shaping retail assortments and promotional strategies in 2026. Retailers and foodservice buyers serving Hispanic consumers should brace for potential fluctuations in availability and pricing, especially for culturally essential items like tomatoes, peppers, and tropical fruits. The coming year will also bring a more data-intensive and technology-enabled supply chain. Growers, importers, and distributors will be increasingly expected to provide real-time visibility, enhanced traceability, and stronger quality assurance. For the Hispanic market, preparation means doubling down on freshness, cultural relevance, and consumer education. Retailers can support their customers by offering bilingual information on origin, handling, and seasonality; highlighting trusted brands and growing regions; and reinforcing the value of produce in everyday meals. If pricing pressures arise, clear communication and thoughtful merchandising can help maintain consumer engagement rather than driving shoppers away from the produce department. DAVID HINOJOSA CHIEF OPERATING OFFICER VALLARTA SUPERMARKETS 1 Accelerated Digital & Omnichannel Expectations: Customers demand faster, more personalized experiences across all channels (online, loyalty, in-store). AI personalization, real-time inventory, and frictionless checkout are now mandatory. For the Hispanic market, this means balancing extreme convenience with maintaining the cultural warmth and authenticity customers value. 2 A Return to Value, Not Lower Quality: Economic pressures will push consumers toward greater value, but unlike previous downturns, they will not compromise on freshness, quality, or cultural relevance. Retailers must focus on culturally significant value: competitive pricing on staples, bulk packs, fresh perishables, and prepared foods. 3 Fresh, Prepared, and Real Food Drives Growth: Shoppers prioritize convenience and health without sacrificing flavor. Authentic prepared foods, fresh bakery, and produce innovation will be major differentiators. For Hispanic grocers, this is a unique growth engine fueled by providing culturally authentic meals and fresh experiences. 4 Supply Chain Resiliency & Cost Discipline: The industry is investing in automation, end-to-end visibility, and data-driven forecasting to manage costs and shrink. Hispanic grocers must modernize distribution, leverage data, and build strategic partnerships to ensure availability and freshness. 5 Expanding Hispanic Influence in Mainstream Retail: The Hispanic consumer continues to shape mass-market trends in flavors, formats, and cultural storytelling. This creates a powerful opportunity for retailers to not just meet demand but to lead the next decade by staying true to culture while embracing innovation. BILL MAYO CEO SAVE A LOT What are the main trends you anticipate for the industry in 2026? Shoppers are increasingly turning to store brands for affordable, high-quality groceries. In tandem, weve seen more interest in cleaner options and expect this demand to grow. Consumers want to feel good about the foods they eat and feed their families. At Save A Lot, were reformulating all of our private label offerings to remove seven artificial dyes. Weve been working with our suppliers to ensure the removal of dyes will not impact or change the overall taste or quality. Customers can feel better about the ingredients in their food without sacrificing affordability. Continues on page 56

56 January | February 2026 abasto.com How will the industry change in the coming year, and what can the Hispanic market do to prepare for these shifts? As costs continue to rise, grocery stores will look for ways to keep costs down. At Save A Lot, weve always been focused on value and quality. With over 50 private brands, we cater to the communities we serve with products our shoppers buy the most. For Hispanic shoppers, staying connected to stores that understand and reflect their preferences will be key. DAVID CUTLER VICE PRESIDENT OF MEDIA RELATIONS AND PUBLIC AFFAIRS NATIONAL GROCERS ASSOCIATION (NGA) As independent grocers look toward 2026, the outlook is realistic yet hopeful. Des- pite navigating thin margins and rising costs in labor, energy, and rent, these local pillars remain vital to the neighborhoods they serve. Navigating Operational & Policy Hurdles Grocers are currently adapting to unique disruptions, such as the cessation of penny production, which requires quick adjustments to cash transactions. More significantly, policy uncertainty regarding SNAPincluding state-level waiver requestshas added complexity to the checkout process. As the primary contact for SNAP participants, independent grocers are prioritizing dignity and clear communication to help customers navigate these evolving rules. The Independent Advantage While national chains focus on scale, independent grocers differentiate themselves through: Local Economic Impact: By employing community members and offering competitive benefits, they ensure dollars circulate back into local schools and businesses. Sourcing & Service: Partnerships with local farmers and bakers provide fresher products, while a focus on personal service over total automation builds lasting shopper trust. Smart Innovation: New technology in inventory and digital engagement is being used to enhance efficiency without losing the human touch. Ultimately, 2026 will be defined by adaptability. Independent grocers are more than retailers; they are essential community partners whose success is measured by connection and commitment rather than just size. KATHY RISCH SVP SHOPPER INSIGHTS AND THOU- GHT LEADERSHIP ACOSTA GROUP The collective of the most trusted retail, marketing and foodservice agencies sha- red four predictions for 2026: Shoppers turn to AI companions; trust slows automation Health gets personal, functional, and transparent Shoppers embrace relevant innovation Consumers demand holistic value from stores to dining 70% of shoppers have used AI tools and features to assist with their shopping journey and in 2026, consumers will begin to depend on intelligent agents to plan, compare, and then complete purchases. 71% of shoppers support stricter rules on artificial ingredients, and 62% believe more regulations are needed for ingredients. This emphasis on proof and accountability underscores the importance of clear communication regarding ingredient sourcing, production processes, and the efficacy of functional benefits. Innovation is having its moment, setting a new bar for brands and retailers in a competitive race to deliver the next big and relevant thing. In 2026, the intentional shopper will demand more more relevance, more experience, and more value. Brands, retailers, and foodservice operators that authentically understand their consumers and double down on curated offerings and seamless technology will turn relevance and experience into total value and loyalty. The most important takeaway for brands and retailers in 2026 is to deeply understand their consumers, so that shoppers can easily find those products that are most relevant to their personal needs - whether with an AI shopping assistant for in-store or online purchases, or creating experiential, immersive retail experiences that deliver value that transcends price. Continuation of page 55 FOOD INDUSTRY

57 January | February 2026 abasto.com

BY HERNANDO RAMREZ-SANTOS C sar Gonzlezs story reflects the spirit that has propelled Vallarta Supermarkets for nearly four deca- des. His career, marked by hard work and discipline, now places him at the helm of the chains most ambitious project: expan- ding beyond California with the opening of its first store in Glendale, Arizona, on January 14, 2026. The Glendale store launches a broader growth plan in Arizona. We plan to open between 10 and 15 stores over the next ten years, said Csar Gonzlez, Glendale store owner and CEO of the Pacoima office, in an interview with Revista Abasto. Vallarta Supermarkets Expands Its Reach: First Arizona Store Drives Expansion From Carts to Executive Leadership Csar is part of the second generation of the founding family. He is the son of Luis Gonzlez, one of five brothers who built the company from a small family dream. Like many of his cousins, he started at the bottom. I began by collecting carts, bagging groceries... sweeping, cleaning ba- throoms. That experience gave him a ground-up understanding of opera- tions and a deep appreciation for the team. He then rotated through multiple departments, learning every operation and understanding the importance of working alongside staff. This journey led to higher-level roles: store director, district manager, category manage- ment lead, and operations director. To- day, he runs the Pacoima office as CEO. For him, this path is not exceptional. It is how the family has taught him to value the business and maintain close ties with employees. Csar Gonzlez leads the chains entry into Glendale and marks the beginning of strategic growth outside California We walked through the Glendale community to speak with suppliers and residents... we saw the potential Csar Gonzlez 58 Enero | Febrero 2026 abasto.com FOOD INDUSTRY

59 January | February 2026 abasto.com A Dream That Crosses Borders The decision to open the first store outsi- de California was deliberate. For years, the Gonzlez family received messages from customers requesting Vallarta stores in other states. Among all requests, Arizona stood out. The idea to explore Phoenix and Glen- dale emerged. During each visit, Csar and his team saw a real opportunity. They also found a growing base of fami- lies from Southern California who already knew and missed the Vallarta experience. That support motivated the decision to enter a new market, but with a solid strategy. The company understands that a single, isolated store is not sustainable long-term, so the plan is to open 10 to 15 locations over the next decade. Prepared for an Evolving Consumer The chain notes constant change in His- panic consumer preferences. Today, Mexi- can, Central and South American families, as well as bicultural generations with dis- tinct habits, coexist. To remain relevant, the team studies sales, monitors trends, and attends conferences. The company is also developing techno- logical solutions to enhance the customer experience. Our team is working hard on omni- channel service, with an app and many more surprises, Gonzlez said. A Message for Arizona Csar recognizes the moments signi- ficance. He knows this opening marks a new stage for the company, combi- ning family tradi- tion with strategic expansion. We are very grateful for the opportunity to serve you and invite you to visit us. I believe that if you havent experienced Vallarta Supermar- kets, its something you havent seen before. With those words, the Hispanic supermarket chain invites Arizona to discover its formu- la: family tradition, service, and an offer tailored to local needs. Arizonas Hispanic community differs from Californias. Csar acknowledges this. Ori- gins, tastes, and traditions vary, especially due to a strong presence of families from So- nora and other northern Mexican regions. The purchasing team studies trends, analyzes data, visits local stores, and speaks with residents to identify specific needs. The goal is to offer products and services that reflect these preferences without losing the Vallarta essence. Training will be key. Store directors and experienced staff will travel from California to transmit the company culture. That identitybuilt on service, respect, and closeness is, according to Csar, the heart of the brand. A Market with Its Own Identity The stores design will reflect the desert personality and local character, aiming for Glendale: The First Home Away from Home Opening Date: January 14, 2026 Address: 5836 W. Camelback Road, Glendale, AZ Store Size: Over 49,000 square feet Key Departments: Sushi bar; fresh-cut fruit bar; guacamole station; prepared foods; tortillera; bakery; grocery and fresh produce sections; specialty depart- ments tailored to the region Estimated Employment: Approximately 200 direct jobs in the community residents to feel it belongs to them rather than being a copy of another city. The opening will feature Vallartas tradi- tional celebration, amplified to highlight the significance of this new chapter.

60 January | February 2026 abasto.com BY RON MARGULIS A s readers of Abasto head into 2026, they are juggling slower spending growth, sharper price and labor pressures, and faster store digitalization all while Hispanic cuisine grows more po- pular than ever. The biggest stories will focus on how re- tailers protect price-sensitive households, modernize merchandising for an omni- channel system, and keep culturally au- thentic experiences alive despite a limited workforce. The Evolution of Tastes in 2026 Personalization and Labor Issues Will Redefine Supermarket Aisles Shifts in Demand and Products After several years of strong performance, spending on Hispanic groceries has leve- led off, even as major supermarkets conti- nue investing in the segment, according to market research firm Numerator. Hispanic households now account for roughly 15% of U.S. consumer spending, but an increasing share of that basket is shifting toward deep-discount and ware- house club channels, driving interest in supermarkets focused on Hispanic sho- ppers. Overall, the Hispanic food market is still expected to grow, fueled by wider adop- tion among non-Hispanic populations and increased interest in authentic regio- nal cuisines. Cross-category product development will expand in 2026, with healthy staples, fusion flavors, and prepared Hispanic meals as busy families seek convenience without sacrificing flavor. Food Safety and Supply Volatility Food safety will take on greater importan- ce as supply chains face multiple pressu- res: Current shortages in agricultural and processing labor, leaving some crops unharvested. Shipping delays. Periodic shortages of fresh produce. Hispanic retailers that rely heavily on fresh fruit, vegetables, meat, and prepared foods will need tighter supplier control, stricter cold chain monitoring, and con- tingency sourcing to prevent disruptions and quality issues. These pressures coincide with growing consumer expectations for transparency regarding origin and nutrition, increasin- gly shaping purchase decisions. Linking store systems with traceability platforms will become essential for chains seeking differentiation in safety and inte- grity within Hispanic communities. Continues on page 62 FOOD INDUSTRY

61 January | February 2026 abasto.com

62 January | February 2026 abasto.com Operators will need to double down on culturally fluent management, bilingual training, and clear promotion pathways The most successful Hispanic food retailers will integrate in-store experiences, including events, tastings, and seasonal or regional Hispanic product bundles. They will offer mobile promotions, creator partnerships, and lo- yalty programs with gamified rewards to encourage repeat visits, celebrate cultural moments, and connect in shoppers preferred language and channels. It promises to be another very busy year! Digital Shelves and In-Store Technology Electronic and digital shelf labels are be- coming one of the most visible tech upgra- des for Hispanic supermarkets, following aggressive rollout by national chains. Retailers are adopting these systems to re- duce labor for weekly price changes, main- tain pricing accuracy between shelves and checkout, and respond quickly with promo- tions to inflation-sensitive shoppers. Beyond price automation, digital labels can provide more detailed information critical for Hispanic food buyers: bilingual descriptions, allergen and key ingredient highlights, and QR codes linking to reci- pes and loyalty offers. Features like pick-to-light and stock- to-light will also reshape store opera- tions, helping staff and pickers locate top Hispanic SKUs quickly for click-and-co- llect and home delivery orders. Workforce Pressures and Opportunities Hispanic workers have demonstrated notable resilience and high labor partici- pation, even as overall U.S. employment growth slows. However, immigration-dri- ven policy measures are reducing the avai- lable workforce in large-scale agriculture and food industries. For Hispanic retailers, this presents a para- dox: a strong, younger front-end workforce, paired with chronic shortages and higher costs upstream, creating risks of stockouts especially in fresh produce and meat. Inside stores, 2026 will bring more ur- gency around retention, skill-building, and flexible scheduling. Retailers will rely on leaner teams to execute highly techno- logical, omnichannel workflows. Marketing, Merchandising, and Loyalty With spending growth stagnant, retailers must increase precision marketing and differentiated merchandising, especially around value. Flyers and displays will need to highli- ght affordable meal solutions. Private-label staples and club-size pac- kaging help multigenerational house- holds stretch budgets without sacrificing cultural identity. Continuation of page 60 FOOD INDUSTRY Action Plan for 2026

63 January | February 2026 abasto.com