Abasto Magazine November/December 2025 ENGLISH

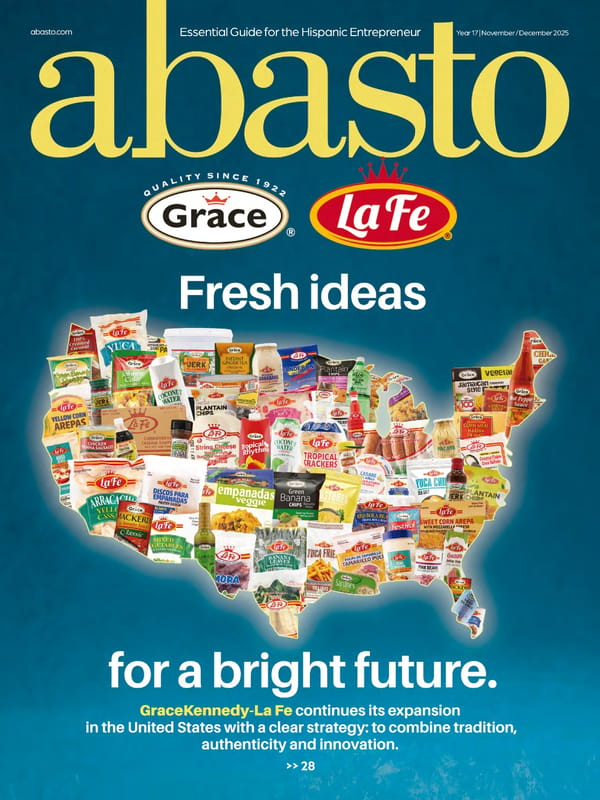

The magazine 'abasto' covers GraceKennedy-La Fe's strategic expansion across the United States, emphasizing tradition, authenticity, and innovation.

abasto.com Year 17 | November / December 2025 >> 28 Essential Guide for the Hispanic Entrepreneur

ABASTO.COM NOVEMBER / DECEMBER 2025�3

4�NOVEMBER / DECEMBER 2025 ABASTO.COM NUESTRA PORTADA COVER ADVICE FOCUS FOOD INDUSTRY AGRICULTURAL INDUSTRY 42 BRIGHTER BITES Te agricultural sector su- pports the fght against food insecurity. 28 BRIGHT FUTURE GraceKennedy/La Fe’s strategy to continue its successful ex- pansion in the US, combining authenticity and innovation in its diverse product line. 20 TECHNOLOGY How artificial intelligence is transforming food safety and traceability. 48 HIGHLIGHTS OF 2025 Leaders in the food and bevera- ge industry ofer their perspec- tives on what they experienced this year. 56 RETAIL EVOLUTION Hispanic marketing, commer- cialization, and consumption trends in 2025. 36 TARIFFS IN 2025 Analysis of the impact of the Trump administration’s trade policy. 24 ECONOMY What lies ahead for the food and beverage sector in 2026, according to Circana. 52 WORK AND VISION How Eladia Ayala turned Te- loloapan Meat Market into a chain of 11 stores. 60 MAKE A DIFFERENCE Tools for succeeding in the holi- day season with AI. 44 FROM FRESH TO FROZEN How the annual potato supply in the US has changed over the last few decades. 40 TRADITIONS AT THE TABLE Te Hispanic heritage in end- of-year celebrations. In This Edition

ABASTO.COM NOVEMBER / DECEMBER 2025�5

EDITORIAL Growth, Vision, and Commitment ecember is here, marking the end of a year that has, once again, reminded us of the in- credible resilience and relent- less dynamism of the Hispanic food and beverage industry in the United States. In this November and December issue, we close out 2025 with a blend of expansive ambition, profound refec- tion, and the community focus that defnes our sector. Te story that crowns our cover is a testa- ment to bold vision and long-term strategy: GraceKennedy La Fe. Tis food giant is no stranger to success, but their plans for a full-scale expansion into the U.S. market mark a signifcant milestone. Teir strategy is not just about distribution, but about cultural immersion, bringing authentic favors to more homes. In the cover story, we explore the mag- nitude of this challenge and the opportunities it creates, not only for the brand but for the diversity of the international aisle in general. It is a clear signal that the demand for Latino products is not a trend, but a fundamental part of the American food landscape. 2025 Retail Review Looking back over the last twelve months, we wanted to capture the essence of what this year has been like for the industry. To do this, we reached out to prominent fgures in the sector—leaders who navigate the complexities of retail and distribution. We asked them: What has been the most signifcant event or trend you have observed in the industry du- ring this closing year of 2025? Teir responses, which you will fnd throughout this issue, are a compendium of wisdom on the evolution of the supply chain, technological innovation, and, above all, the changing relationship be- tween the consumer and their food. A Model for Food Security Finally, we must highlight the importance of food security and civic commitment. On page 12, we shine a spotlight on the capital of Geor- gia, where Atlanta Mayor Andre Dickens has taken a transcendental step. Recognizing the challenge of food deserts, his administration has driven the creation of Atlanta’s frst muni- cipal grocery store. Tis project is a beacon of what can be achieved when local government actively gets involved in fostering the local economy and ensuring access to fresh, healthy food for all its residents. It is a model that other cities should seriously consider. Looking Ahead to 2026 While we celebrate the successes of 2025, this issue also serves as a bridge to 2026. Te expansion plans of GraceKennedy La Fe, the refections of our leaders, and the Atlanta model prepare us for a future where growth, sustainability, and social responsibility go hand in hand. On behalf of the entire Abasto team, we wish you a festive period full of prosperity and a very successful start to the new year. 6�NOVEMBER / DECEMBER 2025 ABASTO.COM

ABASTO.COM NOVEMBER / DECEMBER 2025�7

8�NOVEMBER / DECEMBER 2025 ABASTO.COM Ana María Triana Psychologist & Business Consultant. She is Marketing Director of AnaBella Dried Food. Abasto es una revista bimestral de circulación nacional publicada por Hispanic Marketing Consultants, Inc. P.O. Box 20577 Winston-Salem, NC 27101. Todos los derechos reservados. Prohibida la reproducción parcial o total de su conteni- do sin previa autorización del Editor. Abasto investiga la seriedad de sus anun- ciantes, pero no se hace responsable del contenido de las ofertas. Las opiniones expresadas por los autores y contribuyentes que colaboran en esta revista no son necesariamente compartidas por los editores o representantes de HMC (Hispan- ic Marketing Consultants) Abasto Media. Gerente General / General Manager Gustavo Calabro gcalabro@abasto.com 336.724.9718 x.204 Diseño Gráfico / Graphic Design Orlando Rivera orlando.rivera@abasto.com 336.724.9718 Departamento Editorial / Editorial Department Hernando Ramírez-Santos hramirezsantos@abasto.com 336.724.9718 x.201 Violeta Montes de oca vmontesdeoca@abasto.com 336.724.9718 x.203 Cuentas Nacionales / National Accounts Eliana Lankerd elankerd@abasto.com 336.724.9718 x.202 Administración & Eventos / Administration & Events Fernanda P. Walker fernanda.pineros@abasto.com 336.724.9718 x.213 Redes Sociales / Social Media Danna Guevara dannag@abasto.com Ventas México-Latam / Sales Representative LATAM Marcela Chaves dianac@abasto.com 336.724.9718 x.206 Xochitl Oliva xoliva@abasto.com • 713.363.0385 Juan Pablo Madero jpmadero@abasto.com • 52.1.333.167. 8502 Publicidad / Advertising advertising@abasto.com 336.486.2424 Suscripciones / Suscriptions info@abasto.com Ramón Portilla Fundador HumanX Insights. Líder visionario en insights del clente. Apasionado de CX. Innovador en tecnología de Insights Jesús Díaz Chef Yisus es un cocinero de fusión. Ha ganado dos Emmys y tiene un nuevo proyecto culinario con Televisa Univision y Vix. Ken Ninomiya Expert in omnichannel marketing and e-commerce. Award- winning marketing professional, professor, author, and strategist. Ricardo Gaitán Branding specialist. Master in Marketing Management Universidad San Plablo. Author of the book: “101 useful branding tips” Mary Coppola Heslep Creative Director of Ten Acre Marketing. Former vice president of marketing for United Fresh Produce Association. Ron Margulis Director de RAM Communications, LLC. He is a journalist specializing in the food industry. Julio Ibáñez Retail Executive, International. CEO of Aurora Grocery Group and President of the Hispanic Retail Chamber of Commerce. ABASTO MEDIA IS ACCREDITED / ACTIVELY INVOLVED WITH THE FOLLOWING ASSOCIATIONS: Collaborators

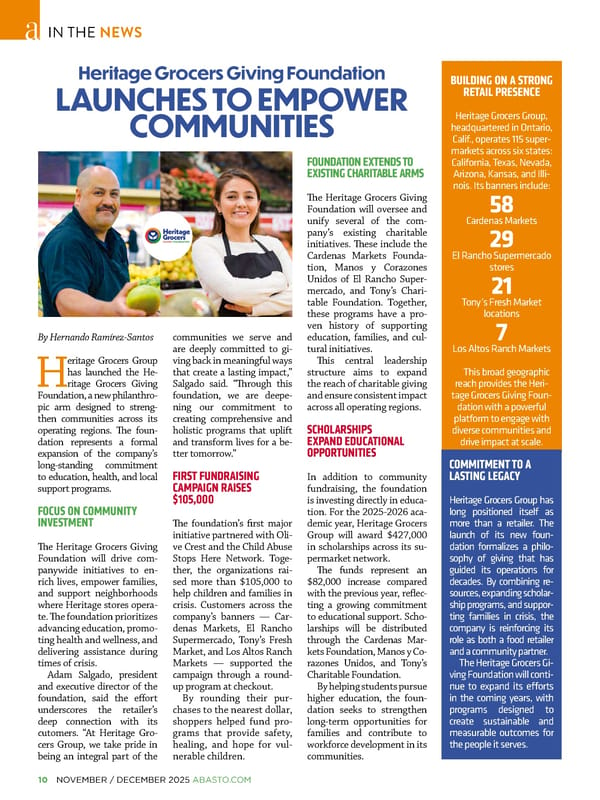

10�NOVEMBER / DECEMBER 2025 ABASTO.COM IN THE NEWS By Hernando Ramírez-Santos H eritage Grocers Group has launched the He- ritage Grocers Giving Foundation, a new philanthro- pic arm designed to streng- then communities across its operating regions. Te foun- dation represents a formal expansion of the company’s long-standing commitment to education, health, and local support programs. FOCUS ON COMMUNITY INVESTMENT Te Heritage Grocers Giving Foundation will drive com- panywide initiatives to en- rich lives, empower families, and support neighborhoods where Heritage stores opera- te. Te foundation prioritizes advancing education, promo- ting health and wellness, and delivering assistance during times of crisis. Adam Salgado, president and executive director of the foundation, said the efort underscores the retailer’s deep connection with its cutomers. “At Heritage Gro- cers Group, we take pride in being an integral part of the Heritage Grocers Giving Foundation LAUNCHES TO EMPOWER COMMUNITIES BUILDING ON A STRONG RETAIL PRESENCE Heritage Grocers Group, headquartered in Ontario, Calif., operates 115 super- markets across six states: California, Texas, Nevada, Arizona, Kansas, and Illi- nois. Its banners include: 58 Cardenas Markets 29 El Rancho Supermercado stores 21 Tony’s Fresh Market locations 7 Los Altos Ranch Markets This broad geographic reach provides the Heri- tage Grocers Giving Foun- dation with a powerful platform to engage with diverse communities and drive impact at scale. communities we serve and are deeply committed to gi- ving back in meaningful ways that create a lasting impact,” Salgado said. “Trough this foundation, we are deepe- ning our commitment to creating comprehensive and holistic programs that uplift and transform lives for a be- tter tomorrow.” FIRST FUNDRAISING CAMPAIGN RAISES $105,000 Te foundation’s frst major initiative partnered with Oli- ve Crest and the Child Abuse Stops Here Network. Toge- ther, the organizations rai- sed more than $105,000 to help children and families in crisis. Customers across the company’s banners — Car- denas Markets, El Rancho Supermercado, Tony’s Fresh Market, and Los Altos Ranch Markets — supported the campaign through a round- up program at checkout. By rounding their pur- chases to the nearest dollar, shoppers helped fund pro- grams that provide safety, healing, and hope for vul- nerable children. COMMITMENT TO A LASTING LEGACY Heritage Grocers Group has long positioned itself as more than a retailer. The launch of its new foun- dation formalizes a philo- sophy of giving that has guided its operations for decades. By combining re- sources, expanding scholar- ship programs, and suppor- ting families in crisis, the company is reinforcing its role as both a food retailer and a community partner. The Heritage Grocers Gi- ving Foundation will conti- nue to expand its eforts in the coming years, with programs designed to create sustainable and measurable outcomes for the people it serves. FOUNDATION EXTENDS TO EXISTING CHARITABLE ARMS Te Heritage Grocers Giving Foundation will oversee and unify several of the com- pany’s existing charitable initiatives. Tese include the Cardenas Markets Founda- tion, Manos y Corazones Unidos of El Rancho Super- mercado, and Tony’s Chari- table Foundation. Together, these programs have a pro- ven history of supporting education, families, and cul- tural initiatives. Tis central leadership structure aims to expand the reach of charitable giving and ensure consistent impact across all operating regions. SCHOLARSHIPS EXPAND EDUCATIONAL OPPORTUNITIES In addition to community fundraising, the foundation is investing directly in educa- tion. For the 2025-2026 aca- demic year, Heritage Grocers Group will award $427,000 in scholarships across its su- permarket network. Te funds represent an $82,000 increase compared with the previous year, refec- ting a growing commitment to educational support. Scho- larships will be distributed through the Cardenas Mar- kets Foundation, Manos y Co- razones Unidos, and Tony’s Charitable Foundation. By helping students pursue higher education, the foun- dation seeks to strengthen long-term opportunities for families and contribute to workforce development in its communities.

12�NOVEMBER / DECEMBER 2025 ABASTO.COM By Abasto P ublic-private partner- ship launches Azalea Fresh Market to fght food insecurity and boost the local economy Te frst municipal gro- cery store in Atlanta opened its doors Monday, Septem- ber 8, through a landmark public-private partnership, marking a new model for tackling food insecurity and revitalizing downtown. Azalea Fresh Market wel- comed more than 700 custo- mers on opening day, inside the historic Olympia Building. A PUBLIC-PRIVATE PARTNERSHIP FOR FOOD ACCESS City ofcials, Invest Atlanta, Savi Provisions and the In- dependent Grocers Alliance joined forces to deliver the project. Leaders framed the opening as a turning point in eforts to bring fresh, afor- dable food to underserved neighborhoods. Mayor Andre Dickens said this frst municipal grocery store demonstrates First Municipal Grocery Store Opens in Downtown Atlanta Atlanta’s broader commit- ment to healthy, thriving communities. “Azalea Market—in the heart of Downtown—is a signifcant milestone in en- suring healthy, whole neigh- borhoods; and this is just the beginning,” Dickens said. He added, “this grocery store is not just a place to shop—it is a community hub that will support Geor- gia-grown products and healthier lifestyles.” WHY THE FIRST MUNICIPAL GROCERY STORE IN ATLANTA MATTERS Nearly 14 percent of city residents experience food insecurity. Te new store ad- dresses that gap by providing access to nutritious food in a USDA designated low-inco- me, low-access area. Dr. Eloisa Klementich, pre- sident and CEO of Invest At- lanta, said the project shows how partnerships can stren- gthen both health and the economy with job creation within the community. “Slated to serve more than 5,500 people per mon- th, the estimated economic impact exceeds $6 million annually,” Klementich said. LOCAL TALENT SHAPES AZALEA FRESH MARKET Te design and identity of Azalea Fresh Market grew from collaboration with SCAD students and facul- ty, Cohere, and the Mayor’s Ofce of Cultural Afairs. More than 60 students across 10 programs helped defne the concept, adding creative depth to the city’s frst municipal grocery store. INDEPENDENT GROCERS STEP UP Independent Grocers Alliance CEO John Ross called the store a model for retailers across the nation. “Large chains may bypass these neighbor- hoods, but with the right guidance and resources, independents like Savi can step in to provide ac- cess to fresh, afordable food and become true community anchors,” Ross said. Ofcials said the first municipal grocery store in Atlanta is more than a market—it is an anchor for downtown renewal. Mayor Dickens noted the project is only the beginning of wider food access initiatives. “With Azalea Market, we’ve taken a major step toward healthy, whole neighborhoods,” Dickens said. INSIDE AZALEA FRESH MARKET Te two-level store sells fresh produce, meats, dairy and pantry staples. It also highli- ghts prepared meals, sushi from Atlanta’s High Roller Sushi, and locally roasted co- fee from Dope Cofee. Savi Provisions founder Paul Nair, who operates the market, said the project re- fects a lasting commitment. “Tis initiative cements our role as an Atlanta insti- tution that partners with the community,” Nair said. “We look forward to growing the Azalea Fresh Market brand and working together with stakeholders across the city to make this a truly accessible and homegrown concept.” IN THE NEWS

ABASTO.COM NOVEMBER / DECEMBER 2025�13

14�NOVEMBER / DECEMBER 2025 ABASTO.COM Save A Lot Reopens 27 Midwest Stores COLUMBUS 3434 Cleveland Ave, Columbus, OH 43224 1254 Morse Rd, Columbus, OH 43229 4930 W Broad St, Columbus, OH 43228 DAYTON 1026 Patterson Rd, Dayton, OH 45420 4233 N Main St, Dayton, OH 45405 2152 N Gettysburg Ave, Dayton, OH 45406 TOLEDO 2626 W Laskey Rd, Toledo, OH 43613 657 E Manhattan Blvd, Toledo, OH 43608 1703 Airport Hwy, Toledo, OH 43609 TOLEDO 845 Portland Way N INDIANA 3739 E Washington St, Indianapolis, IN 46201 2930 E 38th St, Indianapolis, IN 46218 8101 Pendleton Pike, Indianapolis, IN 46226 840 Blufton Rd, Fort Wayne, IN 46809 3310 E Paulding Rd, Fort Wayne, IN 46816 25 Broadway Plaza PENNSYLVANIA 2026 Broad St, Erie, PA 16503 2209 W 12th St, Erie, PA 16505 ABOUT SAVE A LOT Founded in 1977, Save A Lot is the largest independently owned and operated value focused grocery store chain in the U.S., with approximately 700 stores in 30 sta- tes. True to its mission of being a home- town grocer, Save A Lot strives to provide unmatched quality and value to local fami- lies. Customers enjoy savings compared to traditional grocery stores on great tasting, high quality private label brands, national brand products, USDA-inspected meat, farm-fresh fruits and vegetables, and other non-food items. By Violeta Montes de Oca S ave A Lot, one of the largest value-focused grocery chains in the U.S., recently celebrated the return of the Save A Lot brand in 27 stores across Indiana, Ohio, and Pen- nsylvania, after the stores had been im- properly re-branded in 2024. Working to re-establish both high operational and fnancial standards, the stores once again ofer local customers Save A Lot’s outstanding value on an assortment of fresh, afordable, healthy foods, along with 50+ high-quality, award-winning private label brands. Troughout July and August, the stores hosted grand reopening events including special giveaways and sale pricing on popular items. To demons- trate its commitment to the commu- nity, Save A Lot donated $15,500 to regional charities. “We’re delighted to reintroduce Save A Lot to these mar- kets and support the community,” said Bill Mayo, Save A Lot Chief Executive Ofcer. “Save A Lot is committed to provide high quality food and outstan- ding value to our customers.” Save A Lot believes all neighbor- hoods should have access to fresh, high quality food options. Stores fo- cus on ofering everyday low prices on great tasting, high quality private label brands as well as national brand products, USDA-inspected meat cut fresh in store, farm-fresh fruits and vegetables, and other non-food items. THE SAVE A LOT STORES THAT HAVE REOPENED INCLUDE: OHIO 3333 Manchester Rd, Akron, OH 44319 1400 S Arlington St, Akron, OH 44306 25 W Miller Ave, Akron, OH 44301 530 E Tallmadge Ave, Akron, OH 44310 1375 Copley Rd, Akron, OH 44320 544 Canton Rd, Akron, OH 44312 205 N Wooster Rd, Barberton, OH 44203 204 High St, Wadsworth, OH 44281 8005 State St, Garrettsville, OH IN THE NEWS

ABASTO.COM NOVEMBER / DECEMBER 2025�15

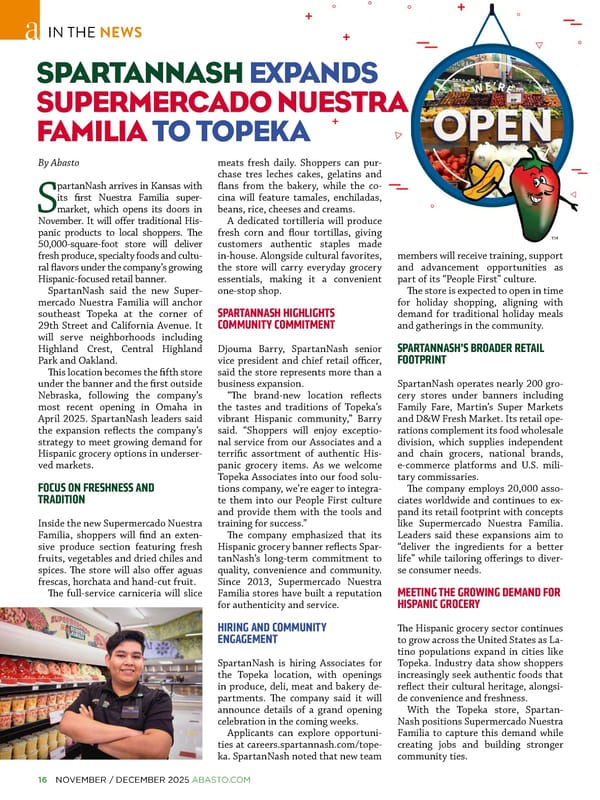

16�NOVEMBER / DECEMBER 2025 ABASTO.COM By Abasto S partanNash arrives in Kansas with its frst Nuestra Familia super- market, which opens its doors in November. It will ofer traditional His- panic products to local shoppers. Te 50,000-square-foot store will deliver fresh produce, specialty foods and cultu- ral favors under the company’s growing Hispanic-focused retail banner. SpartanNash said the new Super- mercado Nuestra Familia will anchor southeast Topeka at the corner of 29th Street and California Avenue. It will serve neighborhoods including Highland Crest, Central Highland Park and Oakland. Tis location becomes the ffth store under the banner and the frst outside Nebraska, following the company’s most recent opening in Omaha in April 2025. SpartanNash leaders said the expansion refects the company’s strategy to meet growing demand for Hispanic grocery options in underser- ved markets. FOCUS ON FRESHNESS AND TRADITION Inside the new Supermercado Nuestra Familia, shoppers will fnd an exten- sive produce section featuring fresh fruits, vegetables and dried chiles and spices. Te store will also ofer aguas frescas, horchata and hand-cut fruit. Te full-service carniceria will slice SPARTANNASH EXPANDS SUPERMERCADO NUESTRA FAMILIA TO TOPEKA meats fresh daily. Shoppers can pur- chase tres leches cakes, gelatins and fans from the bakery, while the co- cina will feature tamales, enchiladas, beans, rice, cheeses and creams. A dedicated tortilleria will produce fresh corn and four tortillas, giving customers authentic staples made in-house. Alongside cultural favorites, the store will carry everyday grocery essentials, making it a convenient one-stop shop. SPARTANNASH HIGHLIGHTS COMMUNITY COMMITMENT Djouma Barry, SpartanNash senior vice president and chief retail ofcer, said the store represents more than a business expansion. “Te brand-new location refects the tastes and traditions of Topeka’s vibrant Hispanic community,” Barry said. “Shoppers will enjoy exceptio- nal service from our Associates and a terrifc assortment of authentic His- panic grocery items. As we welcome Topeka Associates into our food solu- tions company, we’re eager to integra- te them into our People First culture and provide them with the tools and training for success.” Te company emphasized that its Hispanic grocery banner refects Spar- tanNash’s long-term commitment to quality, convenience and community. Since 2013, Supermercado Nuestra Familia stores have built a reputation for authenticity and service. HIRING AND COMMUNITY ENGAGEMENT SpartanNash is hiring Associates for the Topeka location, with openings in produce, deli, meat and bakery de- partments. Te company said it will announce details of a grand opening celebration in the coming weeks. Applicants can explore opportuni- ties at careers.spartannash.com/tope- ka. SpartanNash noted that new team members will receive training, support and advancement opportunities as part of its “People First” culture. Te store is expected to open in time for holiday shopping, aligning with demand for traditional holiday meals and gatherings in the community. SPARTANNASH’S BROADER RETAIL FOOTPRINT SpartanNash operates nearly 200 gro- cery stores under banners including Family Fare, Martin’s Super Markets and D&W Fresh Market. Its retail ope- rations complement its food wholesale division, which supplies independent and chain grocers, national brands, e-commerce platforms and U.S. mili- tary commissaries. Te company employs 20,000 asso- ciates worldwide and continues to ex- pand its retail footprint with concepts like Supermercado Nuestra Familia. Leaders said these expansions aim to “deliver the ingredients for a better life” while tailoring oferings to diver- se consumer needs. MEETING THE GROWING DEMAND FOR HISPANIC GROCERY Te Hispanic grocery sector continues to grow across the United States as La- tino populations expand in cities like Topeka. Industry data show shoppers increasingly seek authentic foods that refect their cultural heritage, alongsi- de convenience and freshness. With the Topeka store, Spartan- Nash positions Supermercado Nuestra Familia to capture this demand while creating jobs and building stronger community ties. IN THE NEWS

ABASTO.COM NOVEMBER / DECEMBER 2025�17

18�NOVEMBER / DECEMBER 2025 ABASTO.COM EG America Raises $597K for American Cancer Society EG America recently completed its “Fuel the Hope for Change” campaign, raising over $597,000 for the Ameri- can Cancer Society. Troughout July, customers at the company’s various brands, including Cumberland Farms, Kwik Shop, and Turkey Hill, were en- couraged to donate at checkout. Te campaign’s success was driven by generous donations from guests and a strong commitment from store employees. EG America further boos- RaceTrac acquired Potbelly Corporation Potbelly Corporation, the popular sandwich shop, has entered into a defnitive merger agreement to be acquired by RaceTrac, Inc., a leading convenience retailer. Te all-cash transaction will see RaceTrac acquire all outstanding shares of Potbelly for $17.12 per share, valuing the deal at approximately $566 million. Tis acquisition brings together two well-known brands in a strategic move that expands RaceTrac’s portfolio. Te merger is anticipated to close in the fourth quarter of 2025, pending regu- latory approvals and standard closing conditions. Tis deal marks a signif- cant development for both compa- nies, with Potbelly joining one of the largest privately held companies in the U.S. Pilot, GM, and EVgo open over 200 fast charging locations Pilot Company, General Motors, and EVgo have teamed up to open over 200 fast-charging locations across nearly 40 states, providing drivers with access to almost 850 new EV fast-charging stalls. Te partnership aims to build critical charging infras- tructure along major travel routes, enabling more convenient and reliable EV travel nationwide. Tis expansion addresses charging gaps, particularly in rural areas where infrastructure has been limited. Te network has grown rapidly, adding charging availability in states like Co- lorado, South Carolina, Louisiana, and Wyoming, with signifcant expansion in Texas, Missouri, and Florida. Tis collaboration is designed to support long-distance EV travel by ensuring drivers have consistent, 24/7 access to high-power chargers at Pilot and Flying J travel centers. Love’s reopens travel stop in Seminole, OK Love’s Travel Stops has reopened its newly rebuilt location in Seminole, Oklahoma, following a complete reconstruction. Te updated store, situated of Interstate 40, aims to provide an enhanced experience for all travelers, including professional drivers and RV guests. Te new location features an ex- panded food court with Godfather’s Pizza, Subway, and Love’s Fresh Kit- chen. It also ofers upgraded ameni- ties such as four remodeled showers, larger restrooms, and more parking. For RV travelers, the store now includes seven dedicated RV spa- ces with electric, water, and sewer hookups. Professional drivers will beneft from six diesel bays and 77 truck parking spaces. ted the total by matching contribu- tions from its top-performing stores. According to Russ Colaco, CEO of EG Group, the company is dedicated to su- pporting the fght against cancer. Tis signifcant donation will help the Ame- rican Cancer Society fund critical advo- cacy, research, and patient support pro- grams, providing hope and assistance to those impacted by the disease. CONVENIENCE BRIEFS

ABASTO.COM NOVEMBER / DECEMBER 2025�19

20�NOVEMBER / DECEMBER 2025 ABASTO.COM TECHNOLOGY FOCUS By Hernando Ramírez-Santos A rtifcial intelligence is no longer a distant concept in the food industry, it is rapidly becoming a necessity. Te AI in food safety and quality control market is projected to hit $13.7 billion by 2030, according to new data from BCC Research. Fueled by stricter regulations, consumer de- mand for transparency, and advances in predictive technology, the market is expected to expand at an annual grow- th rate of 30.9% from 2025 to 2030. Tis explosive growth highlights how AI is transforming everything from contamination detection to su- pply chain traceability. By replacing outdated testing and inspection methods with real-time, automated systems, companies gain the ability to prevent crises instead of reacting to them. As food safety cha- llenges mount, AI stands out as a ga- me-changing tool for manufacturers, regulators, and consumers alike. At the same time, the rise of digital tools like machine learning, robotics, and computer vision is accelerating adoption across industries ranging from meat and dairy to packaged foods. Tese technologies not only streamline compliance but also reduce costs and waste, making AI adoption a strategic priority for food producers worldwide. Rising Demand for AI Monitoring Rising foodborne illness outbreaks continue to make safety a priority. Pa- thogens such as Salmonella and E. coli remain persistent threats. To counter them, AI-powered plat- forms analyze lab results, sensor data, and environmental conditions. By identifying contamination early, the- se systems allow food manufacturers to act faster and prevent large-scale recalls. According to BCC Research, more than 60% of AI adoption in food pro- duction now focuses on real-time ins- pection and contamination detection. Tis shift highlights a move away from traditional batch testing toward auto- mated, continuous safety systems. AI Transforms Food Safety and Traceability Continues on page 22

ABASTO.COM NOVEMBER / DECEMBER 2025�21

22�NOVEMBER / DECEMBER 2025 ABASTO.COM As demand for predictive tools grows, food companies increasingly recognize that AI can protect not only consumer health but also brand repu- tation. Tis realization is driving in- vestments in technology at an unpre- cedented pace. Tackling Supply Chain Complexity Te global food supply chain has grown increasingly complex, spanning multiple countries and suppliers. Tis creates more opportunities for fraud, contamination, and weak links. AI pla- tforms improve traceability and track products through every stage of the supply chain. Te report notes that fewer than 30% of manufacturers have fully integrated AI-based traceability systems, sugges- ting strong growth potential. With regu- lators and consumers demanding higher levels of transparency, companies that adopt AI stand to build trust and gain a competitive advantage. Furthermore, supply chain disrup- tions have made efciency a priority. AI-driven systems help pinpoint vul- nerabilities before they result in costly delays or recalls, reinforcing why tra- ceability remains central to long-term industry resilience. Consumer Transparency and Ethi- cal Sourcing Shoppers now expect to know whe- re their food originates and how it was produced. AI helps verify labeling, detect misrepresentation, and ensu- re ethical sourcing. By meeting both consumer expectations and govern- ment regulations, food companies can strengthen loyalty and avoid reputa- tional risks. Industry experts point out that transparency initiatives backed by AI not only improve safety but also help retailers and manufacturers diferen- tiate themselves in a crowded market. Tis heightened demand for honesty in labeling ties directly into sustaina- bility goals, as consumers increasingly choose brands that can prove their envi- ronmental and social responsibility. Predictive Safety and Personalized Nutrition Another critical driver is predictive risk management. AI systems harness historical and real-time data to fag potential equipment failures, spoila- ge risks, and compliance issues before they escalate. Automated quality con- trol reduces waste while maintaining consistent standards. Beyond safety, AI also supports personalized nutrition. By analyzing health data and dietary preferences, AI tools enable tailored food recom- mendations and product develop- ment. Tis approach caters to rising demand for customized, health-cons- cious oferings. Together, these applications show- case how AI improves both safety and consumer experience, giving compa- nies a powerful incentive to accelerate adoption. Emerging Startups Leading Innovation Several startups are gaining traction in the AI in food safety and quality control market. • Clearsense Technologies develops cloud-based predictive platforms that track microbial risks in real time, ofering compliance-ready solutions for manufacturers. • Strayos uses AI-powered compu- ter vision to automate packaging and labeling inspections, reducing errors and improving efciency. • ImpactVision, now part of Apeel Sciences, applies hyperspectral ima- ging to measure freshness and qua- lity in real time across supply chains. Tese innovators demonstrate how partnerships between AI providers and regulatory agencies are blurring the line between compliance and in- novation. Regulatory Pressure Drives Adoption Increasing regulatory scrutiny and frequent food safety incidents are forcing manufacturers to modernize monitoring systems. Governments and agencies are collaborating with te- chnology frms to establish AI-driven compliance platforms that can adapt to evolving standards. Te report emphasizes that regu- latory alignment will be key to global adoption, especially as new frameworks for digital food safety oversight emerge. Tis regulatory momentum ensures that AI adoption will not only be op- tional but, in many cases, essential for companies seeking to operate interna- tionally. ...Continuation of page 20 Challenges and Opportunities While AI adoption is rising, cha- llenges remain. High investment costs and the skills gap in data science slow implementation. Many food companies struggle to adapt their workforce to AI-driven processes. However, the opportunities ou- tweigh these barriers. Enhanced pathogen detection, stronger su- pply chain visibility, and advanced predictive tools position AI as a central pillar of food industry mo- dernization. With these advantages, com- panies that act early will secure a long-term lead over competitors hesitant to embrace change.

ABASTO.COM NOVEMBER / DECEMBER 2025�23

ECONOMY FOCUS By Hernando Ramírez-Santos C ircana’s latest Food and Beverage Out- look projects steady but modest growth for 2026, as value, health, and shifting demographics sha- pe consumer behavior. In its Circana Compass insights, the frm confrms 2025 global retail food and beverage performance alig- ns with earlier forecasts. U.S. dollar sales are on track to rise 3.2% this year, fue- led by a 3% price/mix in- crease and modest volume gains of 0.2%. shift from trading down to trading up in the year’s se- cond half as economic con- ditions improve, especially in Australia. 2026 U.S. OUTLOOK: PRICES UP, VOLUMES TIGHT Circana notes that com- pounded infation has pus- hed average U.S. food and beverage prices up 34% over the past fve years. For 2026, the frm forecasts price/mix growth of 3% to 5%, supported by ongoing cost pressures, competitive pricing strategies, and tar- geted promotions. Volume growth, however, is expected to remain na- rrow, between -1% and 1%. Consumers are embracing more value-driven and mul- tifunctional eating habits, which could hold back unit growth despite overall sales increases. As a result, U.S. dollar sales are projected to rise 3% to 5% in 2026, demons- trating continued sector resilience even as shoppers remain cautious. WHAT LIES AHEAD FOR THE FOOD AND BEVERAGE INDUSTRY IN 2026 ACCORDING TO CIRCANA 24�NOVEMBER / DECEMBER 2025 ABASTO.COM Rising cocoa and cofee costs have pushed up cer- tain retail prices, but overall food price growth remains moderate. Retail volumes continue to inch upward, though more slowly than in 2024. In the EMEA region, food and beverage sales are ex- pected to climb 4% in value for the year. Private-label brands now account for 41% of sales, even with fewer promotions. APAC’s market has grown 3.7% in value through mid- year, with unit gains of 1.4%. Circana expects a Continues on page 26

ABASTO.COM NOVEMBER / DECEMBER 2025�25

CONSUMERS REDEFINE VALUE Sally Lyons Wyatt, Circa- na’s global executive vice president and chief advisor, says shifting behaviors de- mand a new approach from brands. Circana’s data reveals that value has become increa- singly personalized. Mass merchants, club stores, and value retailers continue to attract budget-conscious shoppers, while e-commer- ce gains momentum thanks to innovations from the bi- ggest players in retail. Consumers are prioritizing in-home food and beverage spending while redefning ‘value’ with an emphasis on convenience and functionality. Te CPG industry must strategically identify ways to stimulate demand and remain proftable. Sally Lyons Wyatt / Circana’s global executive vice president and chief advisor DATA-DRIVEN GUIDANCE FOR A COMPETITIVE MARKET Circana emphasizes that understanding the inter- play of value, health, and demographics is critical for navigating the next phase of market evolution. With modest sales grow- th expected through 2026, companies that can leve- rage data insights to meet changing consumer expec- tations will be better posi- tioned to capture market share. ...Continuation of page 24 DEMOGRAPHIC SHIFTS IMPACT DEMAND Circana’s outlook also iden- tifes demographic changes as a signifcant factor in shaping category perfor- mance. Tighter budgets among low-income and Hispanic households are afecting spending patter- ns, while declining birth ra- tes and slower immigration growth could dampen de- mand in certain categories over time. Retailers and manufac- turers will need to adapt product portfolios and mar- keting strategies to refect these population shifts, par- ticularly in urban markets where growth is slowing. HEALTH AND WELLNESS GAIN INFLUENCE Health-conscious purcha- sing patterns are reshaping the food and beverage sec- tor. Many consumers are adopting higher-protein diets, cutting back on alco- hol and snacks, and seeking premium products with functional, health-driven ingredients. Tis wellness-driven shift presents opportunities for brands to align products with evolving nutritional preferences, particularly as more shoppers look for foods that support active lifestyles and long-term we- ll-being. 26�NOVEMBER / DECEMBER 2025 ABASTO.COM ECONOMY FOCUS

ABASTO.COM NOVEMBER / DECEMBER 2025�27

28�NOVEMBER / DECEMBER 2025 ABASTO.COM Innovation with authentic roots GraceKennedy-La Fe Authenticity and Innovation for a Brighter Future By Hernando Ramírez-Santos G raceKennedy-La Fe continues its expansion in the United States with a clear strategy: combi- ning tradition, authenticity, and innovation to strengthen its leadership in the multicultural mar- ket. Te company, with more than a century of history, is consolidating its presence in key catego- ries such as frozen foods, snacks, and beverages, driving sustained growth across all its channels. GraceKennedy-La Fe’s new portfolio stands out for its focus on products that make life easier for modern consumers wi- thout sacrifcing favor or cultural heritage. Recent additions include empa- nadas, churros, tequeños, and ready-to-serve frozen solutions designed to ofer convenience and authentic favor at home. Te company also expan- ded its lines of snacks and cookies in convenient pac- kaging, seeking to reach new channels and satis- fy consumers who value quick, quality options. Response to new trends Today’s consumers seek authenticity and quality, but also convenience and trust in brands Each GraceKennedy-La Fe launch refects a deep understanding of the trends shaping consump- tion in the United States. Convenience and prac- ticality are essential for a public that lives in a hurry; culinary variety responds to the interest in authentic favors; health and wellness are addressed with natural ingredients and balanced portions; and multicultu- ral inclusion reafrms the company’s commitment to gastronomic diversity. Connecting with Hispanic and mainstream consumers La Fe maintains a dual strategy: strengthening its bond with Hispanic consu- mers—both traditional and younger generations—and attracting Anglo audiences seeking authentic favors. To do so, it adapts univer- sal favors with a Hispanic touch, expands its digital presence, and strengthens visibility at national points of sale. Tis combination allows both La Fe and Grace to be recognized as quality brands in all segments of the U.S. market. Modernizing without losing tradition One of GraceKennedy Foods USA’s great successes is mo- dernizing traditional products without altering their essence. More practical packaging, por- tions adapted to modern lifes- tyles, and healthier options are part of the brand’s evolution. The ready-to-eat snack lines are a blend of tradition, con- venience, and wellness that define today’s Hispanic consu- mer. The company has stren- gthened its feedback system, combining market research, sensory panels, and sales data analysis to anticipate trends and adjust its launches. Hispanic supermarkets, pillars of growth Hispanic supermarkets play an essential role in Grace- Kennedy-La Fe’s strategy. Tese channels allow the company to strengthen its ties with multicultural com- munities and maintain the brand’s cultural relevance. At the same time, its presence in major national chains pro- vides visibility and volume, positioning the company as a reliable and competitive supplier in the food and be- verage sector. GraceKennedy Foods USA Sales Team. OUR COVER

ABASTO.COM NOVEMBER / DECEMBER 2025�29 Growth by category Te categories with the most signifcant potential for ex- pansion include frozen foods, snacks, and beverages, espe- cially products such as frozen cassava and plantains, vege- tables, tequeños, and churros. It is also driving the growth of its beverage portfolio with exotic juices such as passion fruit, soursop, and pear, stren- gthening its appeal in the mul- ticultural market. According to data from GraceKennedy Foods USA, the company is recording double-digit an- nual growth and more than 20 multi-category launches each year, consolidating its position in the industry. A legacy that drives the future Multicultural development as a competitive advantage Multiculturalism is not only part of the company’s DNA, but also guides its innovation strategy. Each product is desig- ned to resonate with diverse consumers, ofering authentic Strategy and leadership: Alberto Young’s footprint at GraceKennedy Foods USA Geographic expansion and strategic alliances With roots in the Northeast, Southeast, and Mid-Atlan- tic regions, GraceKennedy Foods USA is expanding into Chicago, Texas, and Califor- nia, markets where the mul- ticultural population drives demand. Growth has been made possible by alliances with Walmart and Kroger, which ensure stronger national distribution. Tese partner- ships reinforce the ability to respond quickly to demand and maintain product avai- lability in all communities. F rom his beginnings as a sales manager in Belize, Alberto Young learned that success is built on disci- pline, purpose, and a pas- sion for service. Today, as general sales manager for the northeastern United States at GraceKennedy Foods USA, he leads with the same determination that has carried him throu- gh more than 20 years with the group. “I’ve always liked sales and commercial manage- ment. My father was also a well-known salesman. Like father, like son,” he says with a smile that re- veals pride and gratitude. His story is that of a pro- fessional who knew how to transform opportunity into a career and efort into re- sults. A CAREER MARKED BY GROWTH His relationship with Gra- ceKennedy began in 2001, when he contacted the company to distribute some of its products in Be- lize. In 2004, he ofcially joi- ned the team, convinced that international expe- rience would be key to his development. Since then, he has held key positions: general manager and di- rector of GraceKennedy Belize, director of business development, and head of the Atlanta Food Division. In 2015, he led the crea- tion of the distribution network in that city, a fun- damental step in the ex- pansion of GraceKennedy Foods USA. EDUCATION, LEADERSHIP, AND MOTIVATION Graduating with honors and as the top student in his class at the University of the West Indies, Young completed a Master’s in Business Administration that strengthened his stra- tegic vision. My team inspires me. I am motivated to help them achieve their goals and constantly innovate. BUILDING THE FUTURE OF THE NORTHEAST Among his priorities are expanding the GraceKen- nedy and La Fe brands, improving sales processes, and developing new busi- ness channels. His goal is clear: to po- sition the company as the number one distributor of multi-ethnic foods in the northeast of the coun- try. With vision and com- mitment, Alberto Young embodies the values of growth, diversity, and ex- cellence that distinguish GraceKennedy Foods USA. Channel and distribution strategy GraceKennedy Foods USA operates with a mixed distri- bution structure: DSD (direct store delivery) from its cen- ters in New Jersey, Florida, and Atlanta, and partners- hips with regional distribu- tors in the South, Midwest, and West Coast. experiences that transcend borders and generations. With a strong distribution network, strategic alliances, and a vision focused on au- thenticity, GraceKennedy Foods USA and its La Fe brand are moving toward 2026 to expand, diversify, and strengthen their leader- ship in the U.S. market. With more than 100 years of history, GraceKennedy has made diversity the engi- ne of its growth. It celebra- tes an open and inclusive corporate culture, refected in its multicultural team and its commitment to re- presenting the rich culinary diversity of its consumers. Tis human and strategic approach has set GraceKen- nedy Foods USA apart from its competitors.

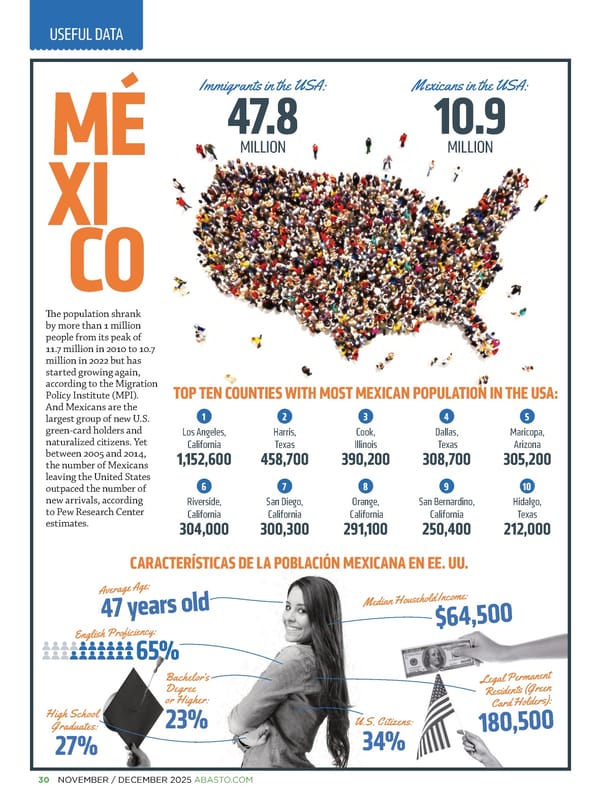

30�NOVEMBER / DECEMBER 2025 ABASTO.COM TOP TEN COUNTIES WITH MOST MEXICAN POPULATION IN THE USA: CARACTERÍSTICAS DE LA POBLACIÓN MEXICANA EN EE. UU. Te population shrank by more than 1 million people from its peak of 11.7 million in 2010 to 10.7 million in 2022 but has started growing again, according to the Migration Policy Institute (MPI). And Mexicans are the largest group of new U.S. green-card holders and naturalized citizens. Yet between 2005 and 2014, the number of Mexicans leaving the United States outpaced the number of new arrivals, according to Pew Research Center estimates. Immigrants in the USA: 47.8 MILLION Mexicans in the USA: 10.9 MILLION Los Angeles, California 1,152,600 Riverside, California 304,000 Dallas, Texas 308,700 San Bernardino, California 250,400 Cook, Illinois 390,200 Orange, California 291,100 Harris, Texas 458,700 San Diego, California 300,300 Maricopa, Arizona 305,200 Hidalgo, Texas 212,000 1 6 4 9 3 8 2 7 5 10 Bachelor’s Degree or Higher: 23% 47 years old 180,500 $64,500 USEFUL DATA Average Age: ������������������� Median Household Income: Legal Permanent Residents (Green Card Holders): U.S. Citizens: 34% High School Graduates: 27% 65%

ABASTO.COM NOVEMBER / DECEMBER 2025�31

32�NOVEMBER / DECEMBER 2025 ABASTO.COM Lago de Chapala Ready to sell! Te 5 oz Lago de Chapala hot sauce display comes fully assembled with three authentic favors: Árbol, Red Habanero, and Poblano & Habanero. Convenient and ready to display: just remove the cover and place it in your sales area. CHAPALAHOTSAUCE.COM/ES La Moderna Happy holidays! During this special time of year, we wish you togetherness and unforgettable moments. With La Moderna®, create unique and special memories around the table. May this season be flled with favor, love, and celebration. Tank you for choosing us! WWW.LAMODERNAUSA.COM | +1 (817) 506-3535 PEPITO USA Pepito USA ofers a delicious variety of favorful snacks, with more than 50 years of tradition. From Japanese-style peanuts to corn churros, we combine quality with that homemade touch that con- nects you to your roots. Tis December, Pepito is the place to be! FIND OUT MORE AT HTTPS://PEPITO.GLOBAL | E-MAIL: SALES@PEPITO.GLOBAL Product showcase SHOWCASE

ABASTO.COM NOVEMBER / DECEMBER 2025�33 Add Huichol to your Thanksgiving At Salsa Huichol, we bring a dash of favor to your Tanks- giving celebration. We appreciate your preference in 2025 and invite you to continue enjoying your favorite dishes with Salsa Huichol. Follow us and tag us on our social networks. #SalsaHui- chol #OuterSpiceFlavor #SalsaHuicholHotSauce SALSA HUICHOL HOT SAUCE La Chona Enjoy this Day of the Dead with La Chona products. Celebrate our traditions with favors that honor our roots. Share recipes rich in history and favor with your family. Make this season a delicious tribute to remember those we love most! BAR-S FOODS – A SIGMA COMPANY LACHONAUSA LA CHONAUS Vilore Jumex Celebrates the Day of the Dead with a Limited Edition Can-Bottle! In honor of Mexico’s rich traditions, Jumex presents a vibrant design that captures the spirit of joy and remem- brance. Te collectible can-bottle fuses art and favor, inviting everyone to celebrate the sweetness of life while paying tribute to those we love and cherish most. VILORE FOODS - WWW.VILORE.COM (210) 509-9496 | SALES@VILORE.COM

34�NOVEMBER / DECEMBER 2025 ABASTO.COM Mole de La Preferida Enjoy the intense favors of Oaxa- can-style mole, made with a rich blend of chilies, spices, seeds, nuts, and a touch of chocolate. Tis authentic sauce ofers a smoky, earthy, and sweet favor that brings gourmet tradition to your kitchen. WWW.LAPREFERIDA.COM 1 (800) 621-5422 | INFO@LAPREFERIDA.COM Happy Holidays from Los Coyotes Tis Tanksgiving and holiday season, enjoy and share the favor of Botanas Rancho Los Coyotes with your family. Give your friends and family the authentic, homemade taste of the most Mexican snacks. Tere’s nothing more homemade and delicious than Botanas Rancho Los Coyotes. BOTANAS RANCHO LOS COYOTES Mega Chili Powder Introducing Mega Chili Powder, the bold new twist you’ve been waiting for! Te latest addition to the Mega Toppings family, home of Chamoy Mega, the #1 chamoy in Mexico and the US, adds a unique spicy and tangy kick to fruits, snacks, drinks, or any craving that needs an extra burst of favor. MEGA FOODS | WWW.MEGA-FOODS.COM| 972 482 708

ABASTO.COM NOVEMBER / DECEMBER 2025�35

36�NOVEMBER / DECEMBER 2025 ABASTO.COM Tariffs in 2025 market owners to review their cost structures and supply chains. Due to the sector’s tight proft margins, it is difcult for them to absorb the additional costs, forcing them to pass these higher costs on to con- sumers in the fnal prices they pay. 3. Companies in sectors dependent on cheap imported inputs, such as textiles and footwear, are sufering price in- creases (clothing up to 35%, footwear 37%), afecting competitiveness and the purchasing power of buyers. 4. Global supply chains are broken, for- cing many companies to seek trade alternatives outside the United Sta- tes or to invest in more expensive do- mestic production processes. 5. Government revenue from tarifs has increased signifcantly, but at the cost of high prices for consu- mers and businesses, leading to market distortions and a loss of overall economic efciency. ECONOMIC CONSEQUENCES According to studies, tarifs could rai- se inflation in the US by up to 1.7 per- centage points, resulting in an average loss of more than $2,300 per US hou- sehold, particularly afecting lower-in- come households. The OECD warns that tarifs have reduced economic growth in the US, with a 16% downward revision to the growth forecast for 2025. The Inter- national Monetary Fund (IMF) lowe- red its economic growth projection to 2.8% in 2025, down from 3.3% the previous year, and warned that risks to the global economy are trending downward. These data predict that growth will be even weaker in 2026. Taking the- se statistics into account, the drastic increase in tarifs imposed by the US is having a negative impact on trade throughout the world. At the same time, it is reducing eco- nomic growth, increasing inflation, and deteriorating conditions for busi- ness sectors dependent on imported inputs, afecting both consumers and producers. A trade policy that is unfavorable for everyone By Ricardo Gaitán T he tarifs imposed by Presi- dent Donald Trump on April 2, 2025, which he called “Li- beration Day,” raised trade barriers and had a signifcant impact on busi- nesses around the world, triggering a chain reaction: tarif retaliation, cost increases for importers, logistical dis- ruptions, and a widespread collapse in international trade. Te so-called “Liberation Day” co- rresponds to Trump’s announcement of a national emergency in the Uni- ted States, a measure that revoked a 30-year-old regulation under the World Trade Organization (WTO), the body responsible for regulating inter- national trade. Te US trade policy implemented substantially modifes the main objec- tive of the WTO, which is to promote global welfare by ensuring predictable, efcient, and free trade fows. In particular, it is characterized by the imposition of tarifs on virtually all imports into the United States, an unprecedented action since 1929. At that time, the application of high ta- rifs had a signifcant impact on the Great Depression; today, this measure has caused notable transformations in the context of international trade. BUSINESS AND SECTORAL CONSEQUENCES 1. In the US, while some manufacturing sectors beneft from tarif protec- tion, others such as agriculture and construction face contractions of 2.9% due to the rising cost of im- ported inputs and tarif retaliation by China and other countries. 2. For grocery retailers, tarifs act as a factor pushing up food infation, directly afecting consumers’ pur- chasing power and forcing super- USEFUL ADVICE

ABASTO.COM NOVEMBER / DECEMBER 2025�37

38�NOVEMBER / DECEMBER 2025 ABASTO.COM By Julio Ibáñez / julio@julioibanez.net T he end-of-year sales season—Tanksgiving, Black Fri- day, Christmas—is once again a key moment for our Hispanic supermarkets. But 2025 is not like 2020 or 2022. Today, the challenges and opportunities have changed: moderate but persistent infation, more informed and deman- ding consumers, and a market in which omnichannel retailing is no longer an option but an obligation. A DIFFERENT CONSUMER DEMANDS A DIFFERENT STRATEGY After years of social and economic change, our customers are not only looking for competitive prices; they are also looking for proximity, authenticity, and convenience. Hispanic house- holds, which already represent one of the main drivers of retail growth in the United States, are planning their purchases in advance and mixing physical and digital channels. Shopping carts are no longer flled the same way as before: today there is less impulse buying and more comparison shopping. For our stores, this means reviewing every category and every linear foot of shelf space. It’s time to leave behind the “it’s always been done this way” mentality and dare to refne our assortments, prioritize high-turnover products, and re- vamp our store presentations. SMART PURCHASING AND LOGISTICS WITHOUT SURPRISES In previous years, the container crisis and the shortage of drivers complicated the supply chain. Although the situation has stabilized, it is not wise to be complacent. International purchases must be fnalized in advance and sources diversi- fed—taking advantage of regional alliances and local produ- cers—to avoid stock shortages in the fnal stretch of the year. In addition, planning promotions with real data—by product family, average ticket, and expected margin—will help measu- re results and negotiate better with suppliers. Cooperatives and purchasing centers continue to be a great resource for securing “assortment funds” and complementing the ofer without overloading inventories. OMNICHANNEL: THE BIG COMPETITIVE DIFFERENCE In this campaign, online service must be ironclad. Whether it’s an app, website, or phone, ensuring availability and timely de- livery is key to building loyalty. Every order fulflled on time and in the right way is a repeat CHRISTMAS IN HISPANIC RETAIL: PREPARE, DIFFERENTIATE, AND BUILD LOYALTY Retail Academy USEFUL ADVICE COMMITMENT TO THE COMMUNITY As Hispanic retailers, we have a social duty to our commu- nities. This season is perfect for strengthening that rela- tionship: outreach initiatives, support for local producers, solidarity programs, and bilingual messages that reflect our culture. The word “closeness” should be our banner. PREPARE FOR A HISTORIC YEAR-END With operational discipline, smart assortments, advance logistics, and excellent customer service, our supermar- kets will achieve one of their best Christmas campaigns in the last decade. We must view this campaign as a major evaluation test that our customers will subject us to, and if the result is positive, we will obtain the most precious thing: loyalty. Now is the time to diferentiate ourselves. Happy holidays and happy sales! customer who will recommend you. And every improvement in delivery times is an advantage over larger, but less agile, competitors. Let’s not forget that the experience is also built inside the store: clear aisles, impeccable cleanliness, shopping carts in good condition, and cashiers trained to say goodbye with a smile and thank customers for their purchase. Tese are small details, but they multiply the perception of value.

ABASTO.COM NOVEMBER / DECEMBER 2025�39

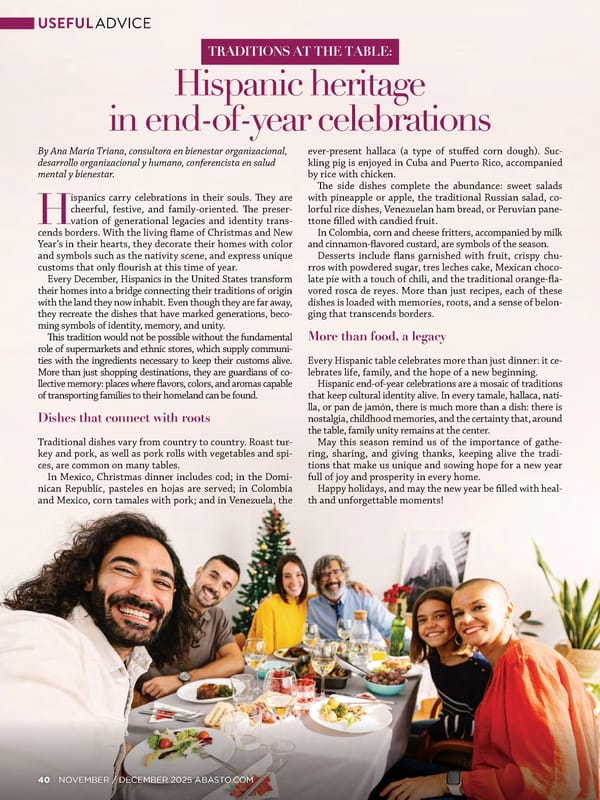

40�NOVEMBER / DECEMBER 2025 ABASTO.COM By Ana María Triana, consultora en bienestar organizacional, desarrollo organizacional y humano, conferencista en salud mental y bienestar. H ispanics carry celebrations in their souls. Tey are cheerful, festive, and family-oriented. Te preser- vation of generational legacies and identity trans- cends borders. With the living fame of Christmas and New Year’s in their hearts, they decorate their homes with color and symbols such as the nativity scene, and express unique customs that only fourish at this time of year. Every December, Hispanics in the United States transform their homes into a bridge connecting their traditions of origin with the land they now inhabit. Even though they are far away, they recreate the dishes that have marked generations, beco- ming symbols of identity, memory, and unity. Tis tradition would not be possible without the fundamental role of supermarkets and ethnic stores, which supply communi- ties with the ingredients necessary to keep their customs alive. More than just shopping destinations, they are guardians of co- llective memory: places where favors, colors, and aromas capable of transporting families to their homeland can be found. Dishes that connect with roots Traditional dishes vary from country to country. Roast tur- key and pork, as well as pork rolls with vegetables and spi- ces, are common on many tables. In Mexico, Christmas dinner includes cod; in the Domi- nican Republic, pasteles en hojas are served; in Colombia and Mexico, corn tamales with pork; and in Venezuela, the ever-present hallaca (a type of stufed corn dough). Suc- kling pig is enjoyed in Cuba and Puerto Rico, accompanied by rice with chicken. Te side dishes complete the abundance: sweet salads with pineapple or apple, the traditional Russian salad, co- lorful rice dishes, Venezuelan ham bread, or Peruvian pane- ttone flled with candied fruit. In Colombia, corn and cheese fritters, accompanied by milk and cinnamon-favored custard, are symbols of the season. Desserts include fans garnished with fruit, crispy chu- rros with powdered sugar, tres leches cake, Mexican choco- late pie with a touch of chili, and the traditional orange-fa- vored rosca de reyes. More than just recipes, each of these dishes is loaded with memories, roots, and a sense of belon- ging that transcends borders. More than food, a legacy Every Hispanic table celebrates more than just dinner: it ce- lebrates life, family, and the hope of a new beginning. Hispanic end-of-year celebrations are a mosaic of traditions that keep cultural identity alive. In every tamale, hallaca, nati- lla, or pan de jamón, there is much more than a dish: there is nostalgia, childhood memories, and the certainty that, around the table, family unity remains at the center. May this season remind us of the importance of gathe- ring, sharing, and giving thanks, keeping alive the tradi- tions that make us unique and sowing hope for a new year full of joy and prosperity in every home. Happy holidays, and may the new year be flled with heal- th and unforgettable moments! Hispanic heritage in end-of-year celebrations TRADITIONS AT THE TABLE: 40�NOVEMBER / DECEMBER 2025 ABASTO.COM USEFUL ADVICE

ABASTO.COM NOVEMBER / DECEMBER 2025�41

42�NOVEMBER / DECEMBER 2025 ABASTO.COM AGRICULTURAL FOCUS By Abasto B righter Bites, a nonproft organiza- tion that distributes fresh produce and nutrition education to families, held its frst event in Bakersfeld with the support of Grim- mway Farms as a presen- ting partner. Te gathering brought together more than 100 guests and raised $85,000 to strengthen eforts against food insecurity in Kern County, California. Te Community Unites Around Fresh Food Te event highlighted the local and national part- nerships that drive Brigh- ter Bites’ work. Leaders in agriculture, health, and education came together to discuss solutions that build healthier futures through access to food. “Tis event is a powerful reminder of what we can achieve when the commu- nity and the agricultural in- dustry come together,” said Rich Dachman, executive director of Brighter Bites. “Every contribution helps us deliver nutritious food to the children who need it most. It’s not just about food, it’s about giving them the foundation to grow, learn, and thrive.” FOOD INSECURITY AMID AGRICULTURAL ABUNDANCE Although Kern County is one of the nation’s leading agricultural producers, one in fve children faces food insecurity, which afects their learning and health. Brighter Bites launched its program in Bakersfeld in April 2022 to respond to this urgent problem. Te organization distribu- tes 20 pounds of fresh pro- duce each week to families in underserved elementary schools. It also provides nu- trition education that encou- rages healthier habits. Currently, the program in Bakersfeld reaches more than 5,000 children, fa- milies, and teachers in six schools. LOCAL LEADERS SUPPORT THE INITIATIVE Community ofcials prai- sed Brighter Bites’ impact on expanding access to food and education. José Quintero, director of the Fairfax School Dis- trict Community Resource Center, highlighted the im- portance of the program. “Te Brighter Bites initia- tive is the perfect addition to the Community Resour- ce Center,” Quintero said. “Families can access fresh produce while participating in English classes, mobile health clinics, nutrition edu- cation, and more to support our community better.” PARTNERSHIPS THAT STRENGTHEN EXPANSION Health systems, farmers, foundations, and local bu- sinesses have supported Brighter Bites’ growth. Grimmway Farms, a pre- senting partner, undersco- red the importance of wor- king together against food insecurity. “We are thrilled to see such support for Brighter Bites in Kern County,” said Dana Brennan, vice presi- dent of Grimmway Farms. “Food insecurity is a real challenge in our commu- nity, and Brighter Bites ofers a proven solution: delivering fresh produce, nutrition education, and a healthier future for local families.” A PROVEN MODEL Brighter Bites operates under a three-component model: weekly distribution of fruits and vegetables, hands-on nutrition educa- tion, and exposure to reci- pes that promote healthier choices. The goal is to pre- vent obesity and promote long-term wellness in chil- dren and families. Since its founding in 2012, has distributed more than 65 million pounds of fresh produce and millions of nu- trition education materials. Today, it serves more than one million people, inclu- ding teachers, in 13 markets across the United States. Its reach includes Austin, Dallas, Houston, New York, Philadelphia, Phoenix, San Diego, San Antonio, Was- hington, D.C., and Bakers- field. For Brighter Bites, the celebration in Bakersfield was not only about raising funds but also about stren- gthening community en- gagement. Dachman em- phasized the importance of local support in maintai- ning momentum. “We are deeply grateful to everyone who supported this event and joined our mission,” Da- chman said. “Together, we can create healthier futures for children in Bakersfield and beyond.” The Agricultural Sector Supports the Fight Against Food Insecurity

ABASTO.COM NOVEMBER / DECEMBER 2025�43

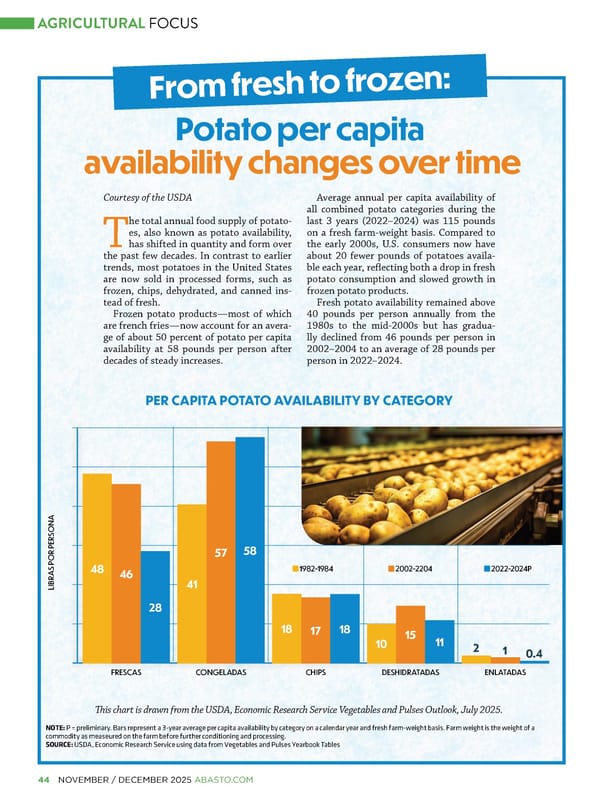

44�NOVEMBER / DECEMBER 2025 ABASTO.COM Courtesy of the USDA T he total annual food supply of potato- es, also known as potato availability, has shifted in quantity and form over the past few decades. In contrast to earlier trends, most potatoes in the United States are now sold in processed forms, such as frozen, chips, dehydrated, and canned ins- tead of fresh. Frozen potato products—most of which are french fries—now account for an avera- ge of about 50 percent of potato per capita availability at 58 pounds per person after decades of steady increases. Average annual per capita availability of all combined potato categories during the last 3 years (2022–2024) was 115 pounds on a fresh farm-weight basis. Compared to the early 2000s, U.S. consumers now have about 20 fewer pounds of potatoes availa- ble each year, refecting both a drop in fresh potato consumption and slowed growth in frozen potato products. Fresh potato availability remained above 40 pounds per person annually from the 1980s to the mid-2000s but has gradua- lly declined from 46 pounds per person in 2002–2004 to an average of 28 pounds per person in 2022–2024. From fresh to frozen: Tis chart is drawn from the USDA, Economic Research Service Vegetables and Pulses Outlook, July 2025. NOTE: P = preliminary. Bars represent a 3-year average per capita availability by category on a calendar year and fresh farm-weight basis. Farm weight is the weight of a commodity as measeured on the farm before further conditioning and processing. SOURCE: USDA, Economic Research Service using data from Vegetables and Pulses Yearbook Tables PER CAPITA POTATO AVAILABILITY BY CATEGORY FRESCAS CONGELADAS CHIPS DESHIDRATADAS ENLATADAS LIBRAS POR PERSONA 48 46 28 41 57 58 18 17 18 10 15 11 2 1 0.4 1982-1984 2002-2204 2022-2024P Potato per capita availability changes over time AGRICULTURAL FOCUS

ABASTO.COM NOVEMBER / DECEMBER 2025�45

46�NOVEMBER / DECEMBER 2025 ABASTO.COM AGRICULTURAL FOCUS Alliance Seeks to Promote Sustainable Agricultural Methods in the Dairy Industry Conservancy’s dairy program. “By putting farmers at the center and collaborating with industry leaders, this initiative can make dairy production part of the climate solution.” Independent experts will validate the results of the pilot program. AHOLD DELHAIZE USA EXPANDS ITS AGRICULTURAL PROJECTS For Ahold Delhaize USA, this is its four- th project focused on agricultural land under its sustainability commitments. Te initiative complements previous partnerships in regenerative agriculture. “As we work toward a healthier pla- net, this pilot program gives us ano- ther way to reduce emissions across the value chain,” said Kendrick Repko, Vice President of Health and Sustaina- bility at Ahold Delhaize USA. With this partnership, the company is expanding its infuence in promo- ting sustainable dairy practices. DANONE’S REGENERATIVE APPROACH Danone North America considers this efort part of its Impact Journey pro- gram, which invests in large-scale re- generative agriculture. “At Danone, we know we can’t do it alone,” said Jessie Copeland, head of Regenerative Agriculture at Danone North America. “Collaborating with farmers and strategic partners allows us to create resilient systems that be- neft farms, communities, and the en- vironment.” In the United States, Danone opera- tes 13 plants across 10 states, emplo- ying 5,000 people and collaborating with over 50 farms. SCALING SOLUTIONS FOR THE FUTURE The collaboration reflects a growing trend in the food industry: adopting sustainable agriculture practices in the dairy sector to ad- dress climate change. By pooling expertise and resources, Ahold Delhaize USA, Danone, and The Nature Conservancy aim to deve- lop replicable models that extend beyond the yogurt chain. With independent validation and financial strategies, the part- ners aim to demonstrate that sus- tainability can be both profitable and environmentally beneficial. The dairy initiative demonstra- tes how major players in retail, manufacturing, and conserva- tion can collaborate to reduce emissions, enhance agricultural resilience, and meet the growing demand for climate-responsible products. By Abasto A hold Delhaize USA, Danone North America, and Te Nature Conservancy announced a joint initiative to promote sustainable agri- cultural practices in the dairy sector and reduce methane emissions in the supply chain. Te pilot project aims to imple- ment agricultural methods that redu- ce emissions, improve efciency, and enhance resilience in dairy operations supplying yogurt products. REDUCING METHANE WITH SUSTAINABLE METHODS Te goal is to reduce methane emis- sions on dairy farms over the next fve years. Danone yogurts sold under Ahold Delhaize USA brands—Food Lion, Giant Food, Te GIANT Com- pany, Hannaford, and Stop & Shop— will be included in the plan. Farming partners will adopt techni- ques such as manure separation, com- post turners, spreaders, and irrigation tools. Tese practices improve ef- ciency and reduce the environmental impact of dairy production. THE ROLE OF THE NATURE CONSERVANCY Te Nature Conservancy will provide te- chnical assistance and support to ensu- re the long-term adoption of sustaina- ble methods. NatureVest’s division will develop fnancial mechanisms to scale solutions in the agri-food sector. “Te project represents a bold step toward decarbonizing milk,” said Ali- sha Staggs, director of Te Nature

ABASTO.COM NOVEMBER / DECEMBER 2025�47

48�NOVEMBER / DECEMBER 2025 ABASTO.COM By Violeta Montes de Oca his year has been a land- mark year for the food and beverage industry. Some of the most re- levant news that took place this year included the gradual elimination of artifcial colorants, SNAP restrictions on “junk” food, and tarifs on imported food and beverages. Mintel’s “US Food Retail Market Report 2025” states that the U.S. food retail market, valued at over $900 bi- llion in 2025, has grown signifcantly since 2019, with an anticipated in- crease of more than 4% for 2025. Historically, grow- th has been driven by price sensitivity, with consumers switching to private brands and online shopping. Eco- nomic factors like ta- riffs and inflation have influenced buying be- haviors, leading to bulk purchases and price comparison. Abasto Media inter- viewed four industry leaders to get their pers- pectives on the most signifcant changes of the year. Read their full res- ponses in the digital version of the magazine. take home delicious, nu- tritious, and afordable food every week. As customers are more willing to try store brands, we have the opportunity to win them over with our more than 50 award-win- ning private label brands. NEWS THAT AFFECTED THE HISPANIC MARKET Like many consumers, the Hispanic market has had to contend with con- tinuous price pressures. We believe that the com- bination of great everyday value and assortment can help them get what they need within their budget. Reaching out to com- munities to foster loyalty within the Hispanic com- munity, by addressing their unique and localized needs, is a crucial part of our growth strategy. BILL MAYO CEO AT SAVE A LOT THE GREAT CHALLENGE AND MEGA OPPORTUNITY Customers continue to face economic challen- ges and are still looking for ways to maximize every dollar they have to spend. It is important to ofer value and qua- lity that allows them to Continues on page 50 FOOD INDUSTRY HIGHLIGHTS OF HIGHLIGHTS OF

ABASTO.COM NOVEMBER / DECEMBER 2025�49

50�NOVEMBER / DECEMBER 2025 ABASTO.COM DANTE L. GALEAZZI PRESIDENT OF THE TEXAS INTERNATIONAL PRODUCE ASSOCIATION THE GREAT CHALLENGE AND MEGA OPPORTUNITY Te challenges were the incredible amount of change and uncertainty surrounding internatio- nal trade. Tese have led to confusion and increa- sed costs across supply chains. Additionally, the United States, Mexico, and even Canada repor- ted signifcant levels of drought, especially in areas with production agriculture. Te biggest oppor- tunity is the chance to participate in the MAHA (Making Ameri- ca Healthier Again) con- versation about how the next generation in this country defnes the con- cept of “healthy.” Te industry needs to be in- volved and ensure that fruits and vegetables are a signifcant part of the agenda. ...Continuation of page 48 NEWS THAT AFFECTED THE HISPANIC MARKET Te withdrawal of the Tomato Suspension Agreement. Tomato importers are now res- ponsible for paying a 17% tarif on tomatoes coming from Mexico. At the industry level, we are coming out of the summer months. Tat means domestic tomato volumes will decline, and early Mexi- can growers will have decided whether to con- tinue planting. As No- vember and December approach, the industry will see the impact. DAVID CUTLER VICE PRESIDENT OF MEDIA RELATIONS AND PUBLIC AFFAIRS AT THE NATIONAL GROCERS ASSOCIATION (NGA) THE GREAT CHALLENGE AND MEGA OPPORTUNITY Te grocery store indus- try faced one of its most unpredictable years. Te constant changing mar- ket dynamics—driven by global trade and supply chain uncertainties, evol- ving consumer habits, and ongoing consolida- tion in the supermar- ket sector—created real pressure on independent operators. For local, fa- mily-owned grocers, adapting to these exter- nal forces required both innovation and a resilient approach. At the same time, the- se challenges created new opportunities for inde- pendent retailers to do what they do best: perso- nally connect with their communities. NEWS THAT AFFECTED THE HISPANIC MARKET One of the most impac- tful regulatory develop- ments in 2025 was the proposed delay in refri- gerant regulations that would have cost over a million dollars per store to implement and com- ply with before the 2026 deadline. For many in- dependent and Hispa- nic-owned grocers, the Environmental Protec- tion Agency (EPA) propo- sal, if approved, will pro- vide much-needed time to plan and budget for equipment upgrades wi- thout jeopardizing their operations.

ABASTO.COM NOVEMBER / DECEMBER 2025�51

52�NOVEMBER / DECEMBER 2025 ABASTO.COM By Hernando Ramírez-Santos E ladia Ayala doesn’t just run her business from an ofce. Te owner of Teloloapan Meat Market and Telemarket, a chain of 11 Hispanic supermarkets in Houston, still spends part of her time kneading the dough for the tortillas that are always sold fresh in her stores. Her story is that of an immigrant who tur- ned hard work into a family business with more than 240 employees. ROOTS IN GUERRERO Ayala was born in Ixcapu- zalco, Guerrero, the eldest of nine siblings. From an early age, she learned the value of commerce from her mother. In her village, they sold tamales, tacos, and bu- ñuelos, and in exchange re- ceived basic products such as eggs, corn, and beans. Tat early training prepared her for the challenges that would come. Her initial intention was to study pastry ma- king, but the costs pre- vented her from doing so. In 1989, she emigrated to California to follow her sister. Tere, she worked in sewing and then moved to Florida to work picking lemons, while selling ta- males in the markets on Sundays. Tat combina- tion of sacrifce and creati- vity was the beginning of her journey as a merchant in the United States. Eladia Ayala Behind Teloloapan Meat Market THE WORK AND VISION FIRST STEPS IN HOUSTON When she moved to Hous- ton, Texas, Ayala got a job at Antonio’s Latin Market, where she learned cooking, butchery, cashiering, and fruit and vegetable handling. She was only 19 years old and al- ready had experience in all the trades of a store. In addition, she continued to prepare tamales, chilies, and cheeses that she sold on the street. Shortly there- after, with a driver’s license and a van, she began selling fruit, bread, and tortillas as a street vendor. In 1991, pregnant with her first daughter, she was advised to open her own business. With $10,000 in savings and $50,000 in financing for equipment, she and her children’s father opened their first 1,500-square-foot store on Aldine Bender Road. Continues on page 54 FOOD INDUSTRY

ABASTO.COM NOVEMBER / DECEMBER 2025�53

VOCATION FOR SERVICE For Ayala, success was ba- sed on cuxstomer service. From the beginning, she set out to ofer quality and attentive service. She remembers baking warm bread at the request of the workers who visited her small store. “What I love is ser- ving people,” she says. Tat philosophy, coupled with discipline and de- dication, cemented the growth of Teloloapan Meat Market. Today, as she kneads four in her tortilla plant, she insists that her children learn to do the work frst before taking on management responsibilities. EXPANSION WITH A FAMILY VISION Growth was possible thanks to opportunities she knew how to capitali- ze on. Eladia bought some stores from business ow- ners who could not con- tinue. Others were born after identifying strategic locations. Ayala says that instinct and confdence in the quality of his pro- ducts are key to choosing locations. Store number 11, the most recent, came about spontaneously. “I saw a sign that said ‘for rent’ and felt it was the right place,” he says. Tat deci- sion resulted in another successful branch. Te family plays a cen- tral role in the company. His three daughters stu- died business, adverti- sing, and administration, and today they are active partners. One of his sons works in logistics with his own warehouse, and the other in the oil industry. “Tey had the school of life and then the profes- sional school,” says Aya- la. Tat combination of practical experience and academic training has been decisive in consoli- dating the chain. With his daughters as partners, they decided to create a new type of store with a name that better refected the diversity of their customers and the new generations. Now the newer stores are ca- lled Telomarket. “We changed the colors of the new stores because Teloloapan has the colors of the Mexican fag, so for Telomarket we cho- se other colors, more eye-catching, showing innovation,” Ayala said. A BUSINESS WITH A PURPOSE Teloloapan Meat Mar- ket and Telomarket cu- rrently employ 240 peo- ple. Ayala spends time reassuring his workers, especially in the face of the political and econo- mic uncertainty faced by immigrants. “I tell them (the emplo- yees) not to worry, that everything will be okay. Tere is always a solution,” she says. Tis closeness to her team has strengthe- ned the sense of commu- nity within the company. In addition, customers have shown loyalty des- pite the difculties. Al- though some avoid the most dangerous times of day, they fnd ways to stock up in the after- noons and evenings. For Ayala, the community’s trust is a pillar of his suc- cess. INNOVATION AND THE FUTURE Te grocery chain is also committed to innovation. Ayala’s daughters partici- pate in conferences and stay current with new te- chnologies and manage- ment systems. According to Ayala, this collective efort ensures that Telo- loapan does not fall be- hind the competition. Te future, she says, is in the hands of the next generation. Her children are setting even more ambitious goals. “If you, without an education and without English, achieved so much, we have to do much more,” they tell her. Te vision is clear: to expand the company into a chain of dozens of stores, further strengthening its Hispa- nic presence in Houston. ...Continuation of page 52 AN EXAMPLE OF PERSEVERANCE Eladia Ayala’s story embodies the perse- verance of a woman who never gave up in the face of obsta- cles. From tamales in a Florida market to a chain of establi- shed supermarkets, her journey reflects discipline, vision, and commitment to the community. Today, as she con- tinues to knead flour for tortilla production and manage the ope- ration of 11 stores, she maintains the same energy that led her to become an en- trepreneur more than three decades ago. For her, the secret is simple: work with passion, take care of your people, and ne- ver miss an opportu- nity. “Opportunities come along, and when they do, you have to seize them,” says Ayala. Her story reveals that behind every store, every tortilla, and every satisfied customer, there is a woman who has transformed hard work into a lasting family and business legacy. 54�NOVEMBER / DECEMBER 2025 ABASTO.COM

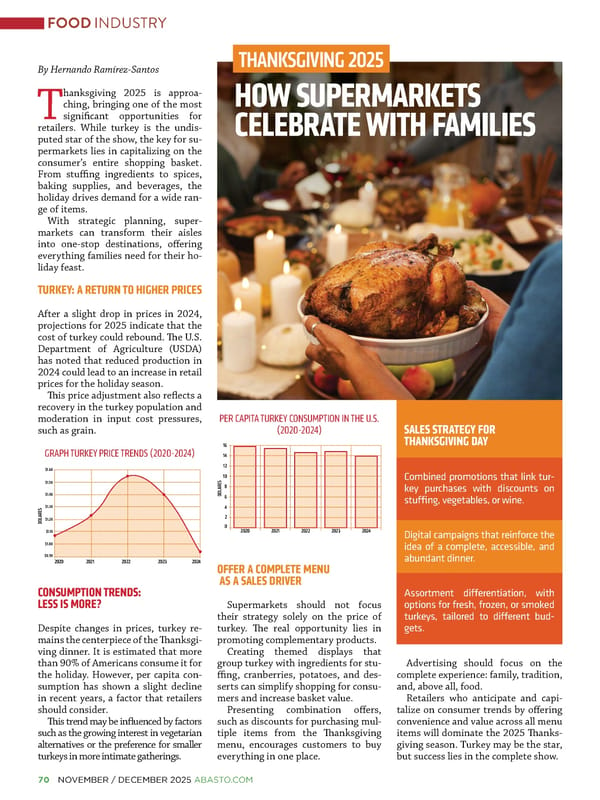

ABASTO.COM NOVEMBER / DECEMBER 2025�55